Transocean’s strong contract book has shielded it from 2025–early 2026 industry “white space,” as discussed in Dayrate Duration. As backlog dwindles down, the contract driller appears willing to wait out weaker bids from competitors rather than accept low rates offered to avoid warm stacking. Transocean can remain patient, with larger contract rollovers beginning in 2Q26, aligning well with expected multi-year opportunities beginning in late 2026–2027.

This article reviews my thoughts on contracting opportunities and risks for Proteus (7G+), Mykonos (6G), Skyros (7G) , KG2 (6G) and Equinox (NCS HE Semi).

As discuss in Transocean’s Capital Structure, RIG has room to gain value for its equity via improving its restrictive debt terms, and securing multi-year contracts for rigs coming open next year could strengthen its position to refinance on better pricing and terms when it eventually hits debt capital markets. Transocean’s 7G+ drillship fleet remains highly marketable and could secure multi-year contracts at healthy dayrates—a continuation of a few 10-year fixtures that helped the company avoid bankruptcy during the 2015–2021 downturn.

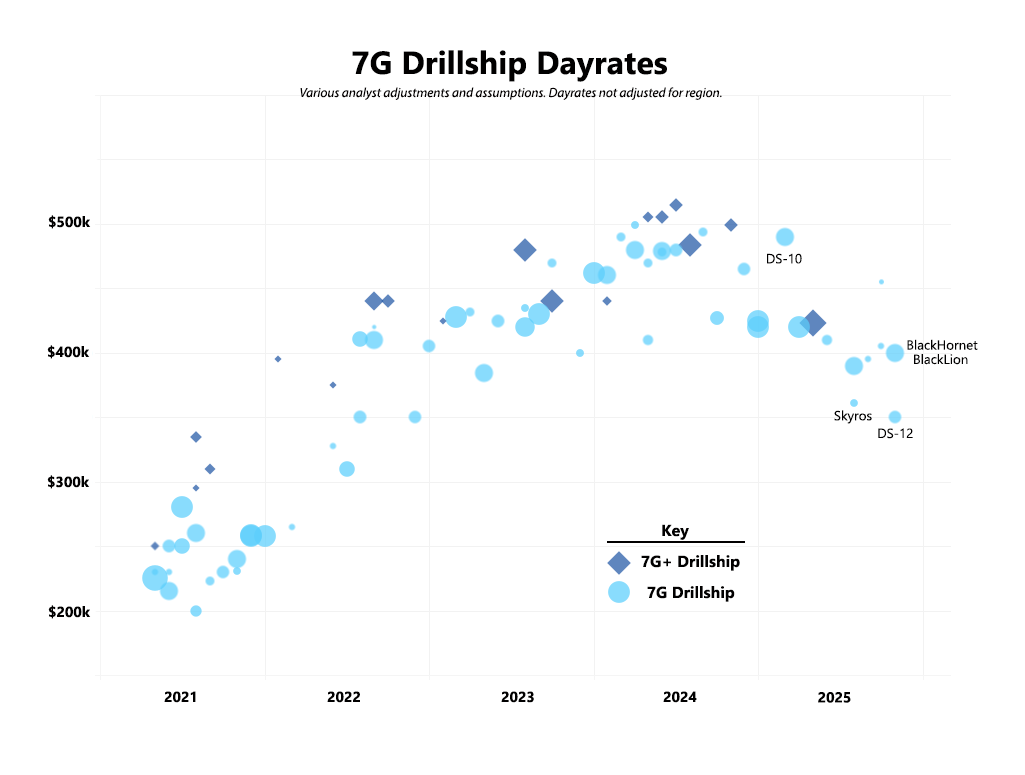

In recent months, 7G drillships have had multiyear contracts announced in the high $300k-to-low $400k range (depending on various adjustments). We have yet to see Transocean announce a 7G+ dayrate in 2025 — is this a sign of prudent price discipline or misjudging the market?

Transocean’s fleet includes eight 7G+ drillships with enhanced 1,400-ton hookload capacity, offering improved deepwater efficiency over standard 7G units (1,250-ton hookload). These rigs led the >$500k/day rate surge in 2024, typically earning a modest premium over standard 7G units. Transocean hasn’t announced any new 7G+ drillship contracts in the past year, leaving price discovery pending, with Proteus (May 2026), Asgard (June 2026), and Conqueror (Sept 2026) set to roll off within the next year.

In April 2025, Noble signed four-year Shell contracts in the U.S. Gulf for the Voyager (2Q26) and Venturer (4Q27), including hookload upgrades to 1,400 tons, elevating both to 7G+ status. As of November 2025, Shell utilizes four 7G+ drillships from Transocean, but Noble’s new deals could displace Proteus (May 2026) and/or Pontus (Oct 2027). To offset risks from newly upgraded rigs, Shell offered incentive-heavy terms that Transocean is unlikely to match. Notably, other IOC’s including, but not limited to, Chevron and BP have meaningful appetites for high spec drillships in the US Gulf.

7G+ Drillships (Proteus, Asgard and Conqueror): Transocean has the industry leading fleet and they are likely to contract Proteus, Asgard and Conqueror at healthy rates on multiyear term, but they run the risk of overplaying their hand in a softer services market. As seen via Noble, there’s not a high barrier-to-entry in the 7G+ drillship upgrades, with Valaris or Seadrill having potential to do the same.

The first half of 2026 will be key for Transocean as it seeks to refinance and ease its restrictive debt terms through new capital market deals. Securing multi-year 7G+ contracts in the U.S. Gulf could reassure lenders and improve financing terms. While Transocean retains pricing power with its fleet, softer oil prices are making IOCs more selective; thus, locking in long-term utilization may add more value via debt capital market execution than chasing marginal dayrate gains.

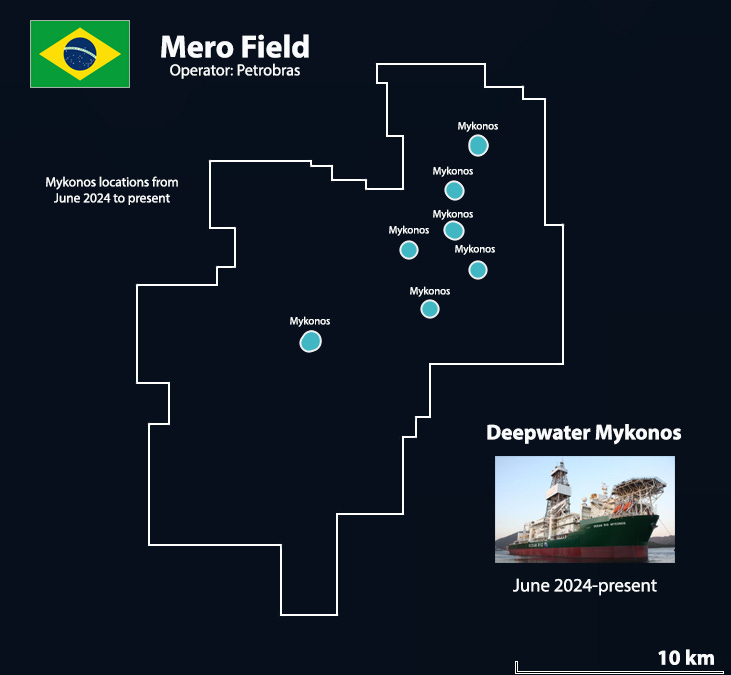

Deepwater Mykonos’ contract with Petrobras is scheduled to conclude in Jan 2026 with a priced option through April 2026. Petrobras currently has at least two tenders outstanding, one for Buzios (likely 3 or 4 rigs) and another for Mero (~1 rig). Mykonos has been working the Mero field in the Santos Basin (~500k bpd production) for at least the last year and a half. While a 6G drillship, Mykonos is MPD-ready and a strong candidate for Petrobras to extend.

Dhirubhai Deepwater KG2 (6G): KG2 has operated in Petrobras’ Campos and Santos basin rig “pool,” moving between fields as needed. While Petrobras’ Búzios tender (3–4 rigs) is nearing award, other rigs appear to be better positioned contenders. Additional opportunities exist in Brazil—Shell’s Orca/Gato do Mato and Equinor’s Bacalhau—though these IOCs typically favor higher-spec units than KG2. KG2’s outlook is uncertain but prolonged idle time seems unlikely. It will likely find work in Brazil, though perhaps with some idle time and rates well below its current $446k/day.

Deepwater Skyros (7G): After finishing TotalEnergies’ Angola campaign, Skyros will move to Côte d’Ivoire for Murphy’s three-well program through March 2026 (priced option for April 2026), after which it faces idle-time risk. With only one BOP, its marketability is limited compared to other 7G’s, although it could return to Angola or other African work at competitive rates.

Shell recently signed an Angola exploration agreement (Reuters)—a logical fit for Skyros given its local experience—though start-up is rumored for 2027. Remaining in Côte d’Ivoire is a possibility but would include idle time as multiyear work for Eni likely won’t begin until early 2027, suggesting Skyros may need to seek interim work elsewhere.

Transocean Equinox: This midwater semisub acquired via the Songa acquisition in 2018 was moved across the globe from Norway all the way to southern Australia. Equinox is firm at $540k through December 2026 and has multiple priced options at $540k dayrates through August 2027, options that may depend on the success of the current Otway Basin exploration campaign.

Summary: Transocean is likely to find multiyear work on its 7G+ drillships (Proteus first availability) and I believe Mykonos is a strong candidate for a likely multiyear extension with Petrobras. Skyros and KG2 have idle time risk and Transocean would likely be wise to bid these two for utilization rather than chasing dayrate, as these rigs face competition for work in a period when IOC and NOC’s are budget-conscious. Transocean has value to gain via execution in the debt markets by showing strong utilization with its lower spec assets. Its unlikely both Skyros and KG2 face extended periods of idle time, but both appear likely to face some idle time which can be a normal occurrence in deepwater contract drilling.

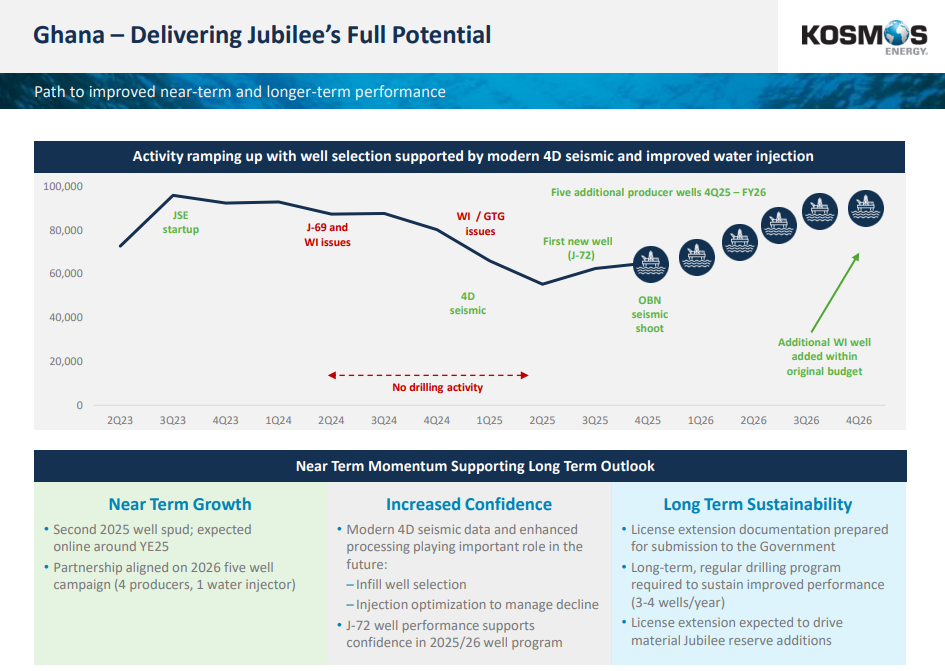

Kosmos: The Jubilee field in Ghana is a source of rig demand that I follow. It has had real challenges with production that I believe are correctable although that is to be determined by the current infill drilling program I previewed here — Tullow & Kosmos: Jubilee’s Mid-Life Crisis. Following Kosmos’ 3Q25 earnings, an update is below:

Along with operator Tullow, Kosmos plans five new infill wells, up from the four previously expected—a modest positive. Following 4D seismic analysis, Tullow/Kosmos have identified targets, each expected to produce 5–10 kbpd. However, with Jubilee’s ~20% annual decline, new wells will offset but not reverse falling output

Jubilee’s gross output rose from 55,300 bpd in 2Q25 to 62,500 bpd in 3Q25. Accounting for decline and the planned five new infill wells, Kosmos could lift production to ~80,000 bpd gross if results are modestly successful. However, Kosmos’ 3Q25 earnings were a reminder that deepwater oil production can be challenging, as it communicated its Winterfell-4 well in the Gulf of America was abandoned due to completion challenges “arising from the collapse of the production casing” — a disappointment after investors anticipated this well to begin producing in 3Q. Noble’s Ocean BlackRhino was the drillship operating this well.

The news on Jubilee was generally OK, although the example of Winterfell is a reminder to never count your chickens before they hatch. The market will be closely following the Jubilee infill drilling campaign now underway.

Kosmos secured a $250 mm loan from Shell (interesting), backed by its U.S. Gulf assets, to address 2026 bond maturities. The company may also raise secured debt against its GTA assets for 2027 maturities, although remains to be seen. Ideally, strong Jubilee performance and Brent in the $70s would support refinancing its 2027–2028 debt.

The question on Jubilee (Ghana) is if the field is structurally challenged, or if recent challenges reflect a “mid-life crisis” that can be corrected via better reservoir management aided by fresh, new 4D and OBN seismic shoots. I tend to believe the latter and better Jubilee production will support refinancing 2027-2028 maturities, although operational risk exists on executing on the drilling program. Kosmos’ E&P assets are mid-tier, to put it politely, although I believe Jubilee’s production problems can be adequately addressed with the current infill drilling campaign.

Thanks Tommy, always very insightful! Kosmos almost mentioned assets sales to manage the deleverahe process and I think GoM is the most likely source of assets.

Would you guess Wintershell-4 well failure was a drilling or a design issue? Maybe it's out of your area of expertise though.

Very informative as always Tommy