Tullow & Kosmos: Jubilee's Mid-Life Crisis

7G Drillship idle time has contributed to idiosyncratic E&P distress in credit and equity valuations with a critical Ghana drilling campaign ahead in 2H25-2026

Tracking deepwater rigs worldwide uncovers many stories, though most aren’t investable on a standalone basis. The recent distress in Tullow Oil (Caa2/CCC+) and Kosmos Energy (Caa1/CCC) high yield bond trading has attracted my attention primarily due to challenges tied to a core asset of both—the Jubilee field in Ghana. Discovered in 2007 and onstream since 2010, Jubilee’s recent production issues are the main driver of this credit stress. In my view, the field’s “mid-life crisis” reflects reservoir management missteps by operator Tullow—problems that appear correctable.

A major theme for deepwater rigs in 2H24–2025 has been idle time from project delays, with West Africa a main driver. IOC project delays in Nigeria have been the largest factor for 7G drillships, while Tullow’s January 2024 postponement of its Jubilee campaign in Ghana added to concerns. Tullow operates Jubilee with a 39% stake, while Kosmos holds a significant 38.6% non-operating interest.

Consider this article as a case study of how project delays have pressured Kosmos and Tullow’s securities, while showing the efficiency of 7G drillships and the risks of deferring drilling programs.

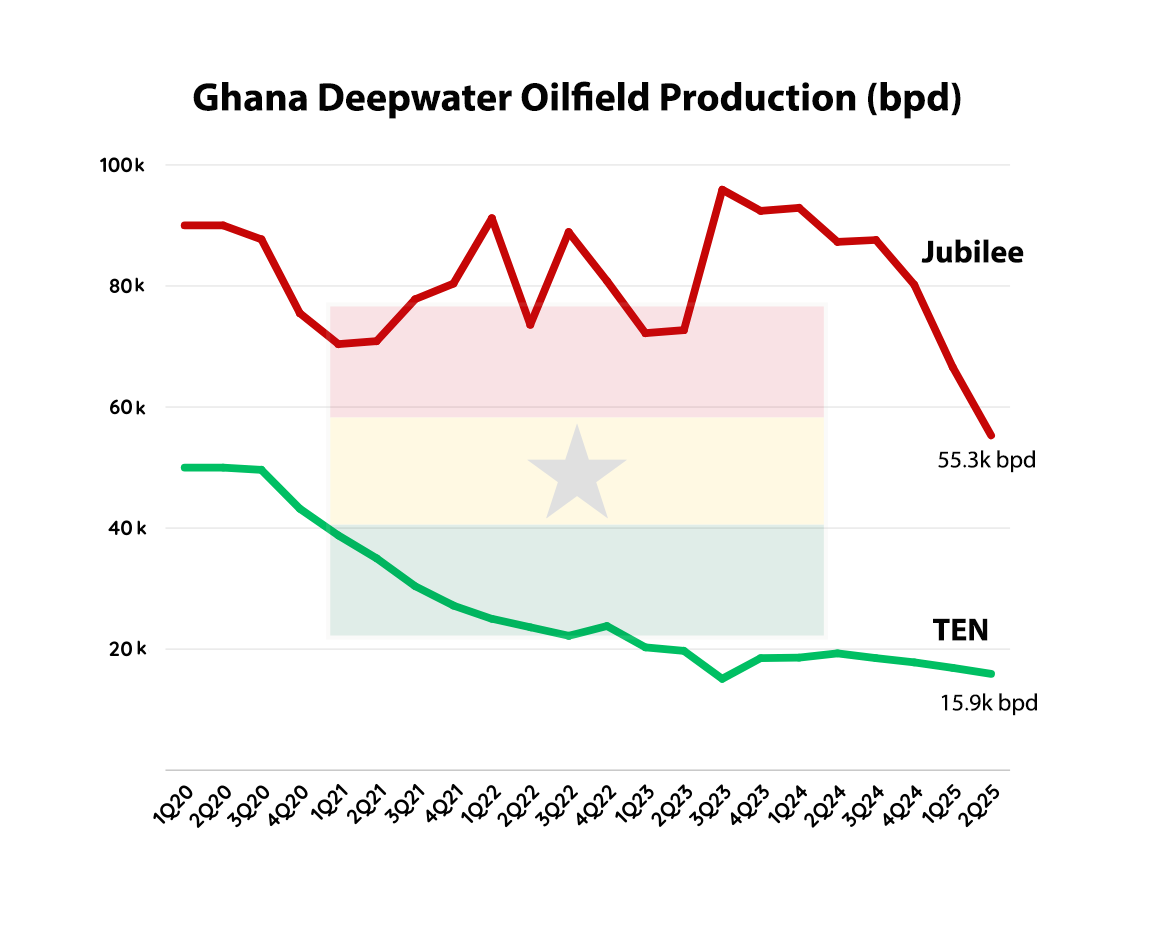

The Jubilee field has current oil production capacity of ~120k bpd although is operating well below this level currently, with only ~55k bpd averaged during 2Q25. Tullow has faced rising water cut at Jubilee, which reduces oil output and increases handling volumes on the FPSO. The added water processing burden has strained facilities and complicated operations, forcing the company to reprioritize reservoir management. Jubilee’s low production totals have also been adversely impacted by a 15 day FPSO shutdown for maintenance in March-April 2025, as well as the delayed infill drilling program.

Over the past 7–8 years, production and infill drilling have gradually altered Jubilee’s reservoir in ways Tullow arguably failed to track closely enough, given its last 4D seismic survey was in 2017. This lack of updated monitoring has arguably contributed to weaker recent infill drilling results. The current drilling campaign was deferred to ensure the next round of infill wells could be guided by a new 4D seismic survey, improving target selection and raising the probability of success.

The Bull case for Jubilee is the upcoming infill drilling campaign: low-cost, high-margin barrels added through the existing FPSO, which still has >45 kbpd of spare capacity. Unlike typical long-cycle deepwater projects, this six-well brownfield program delivers near-term production with minimal new infrastructure capex. The first well is already online at ~10 kbpd, with 4–5 more to follow over the next year.

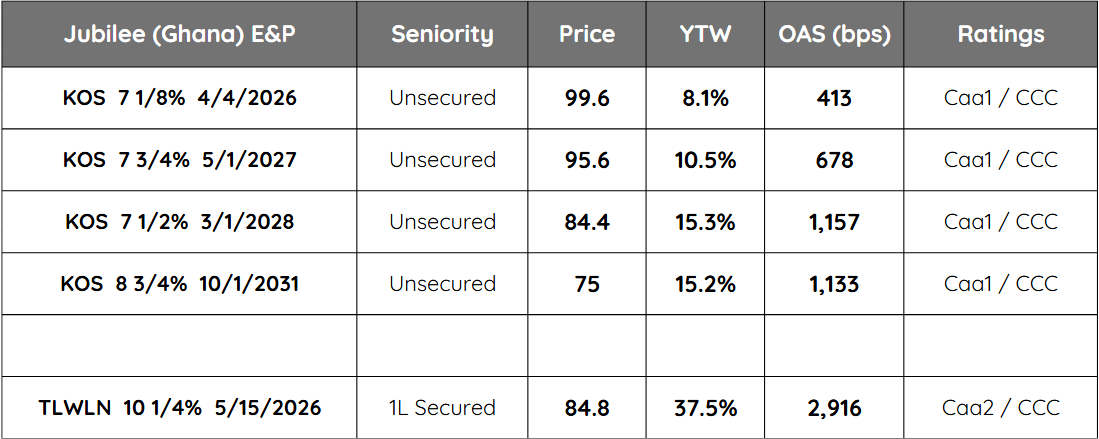

Credit Distress: The production challenges at Jubilee, cost-overruns and delays at GTA Phase 1, Kosmos’ debt levels and general weakness in the oil markets have meaningfully contributed to the weakness in how the high yield credit markets are pricing risk in Kosmos and Tullow’s publicly traded debt.

Why the credit curve steepness on Kosmos with 2028 credit spreads >600 bps higher than 2026? Kosmos is in the process of raising a $250mm secured term loan using its Gulf of America assets as collateral. While not yet closed with funded cash in the bank, Kosmos is expected to use these funds to meet its $250mm of 2026 maturities. While I’m not certain about their additional secured debt raising capacity, concern exists regarding secured debt diluting a potential unsecured recovery in a bankruptcy scenario. The Gulf of America reserves are likely the highest valuation assets due to geopolitical risk associated with the rest of their assets in West Africa (Ghana, Senegal/Mauritania, Equatorial Guinea).

7G Drillship Noble Venturer is the rig on the current infill drilling campaign. The first well, J72-P, has been an initial success producing ~10k bpd. The next 4-5 wells will come after Venturer completes its 5-year SPS in Las Palmas, with drilling contracted to commence November 2025 through August 2026. Risk of failure and unexpected surprises are ever-present in the deepwater drilling industry, although Tullow has (i) completed a new 4D seismic campaign, (ii) will complete a new ocean bottom node survey in 4Q25, (iii) has recently completed maintenance on the FPSO and (iv) 7G drillships are designed for development drilling programs such as this.

The key debate is whether Jubilee is on structural decline or if its recent production issues are fixable. Operator Tullow has taken steps to address the challenges, while Ghana’s other deepwater field, TEN, has faced higher than expected decline rates. Unlike Jubilee, which is a single large accumulation with a stronger production track record, TEN is a cluster of three smaller fields (Tweneboa, Enyenra, Ntomme) that have struggled with weaker reservoir connectivity and lower output. I’m less optimistic on the future recovery on TEN as I am with Jubilee, although execution risk exists on Jubilee’s infill drilling campaign.

Summary: Opportunistic/Distressed debt and Equity investors seeking beta and alpha on Brent rallying to $80-$85/bbl in the next 1-3 years and and potential Jubilee performance should consider looking at Kosmos Energy. Kosmos’ equity is down ~73% from its 4Q23 average when Jubilee was producing >90k bpd and Brent averaged ~$82/bbl.

Credit: Kosmos’ unsecured 2027s and 2028s have credit spreads of >1,000 bps. Equity: Kosmos’ equity is trading at a discount due to its balance sheet risk.

Security pricing distress is mostly due to poor performance at the Jubilee field. While speculation, I believe this is primarily due to poor reservoir management by Tullow — they’ve since replaced their CEO. After 7-8 years since their last 4D seismic shoot in 2017, Tullow’s active production and injection drilling from 2017-2024 has gradually changed the reservoir, likely leading to weaker production drilling in the absence of better reservoir surveillance. Tullow just concluded a new 4D seismic campaign in 1Q25 and will complete a new ocean bottom node (OBN) program in 4Q25. The next 4-5 wells to be drilled are scheduled to begin in November 2025 and run through August 2026.

Tullow and Kosmos’ upcoming campaign is infill drilling to support production to nearby FPSO with >45k bpd of capacity. At cash operating costs of ~$20/bbl, this incremental production to be brought online in the next 12 months is meaningful free cash flow even with Brent in the $60-$70/bbl range. Brownfield capex delivers high IRRs by leveraging existing infrastructure.

This drilling campaign will be completed by 7G Drillship Noble Venturer. 7G drillships are designed for development drilling like this and have demonstrated efficiency. Venturer has already drilled the first well (J72-P) with success at ~10k bpd of initial production. Venturer is currently in Las Palmas, Spain completing its 5-year SPS and will return to Ghana in November 2025 for the next 4-5 wells. At first glance, the timing appears odd but gives Tullow and Kosmos more time to analyze the 4D seismic completed in 1Q25 with results of the ocean bottom node survey coming in 4Q25 — which should help probability of success.

Tullow and Kosmos have publicly communicated plans to drill 3-4 infill wells per year to support future production at Jubilee after the current drilling campaign.

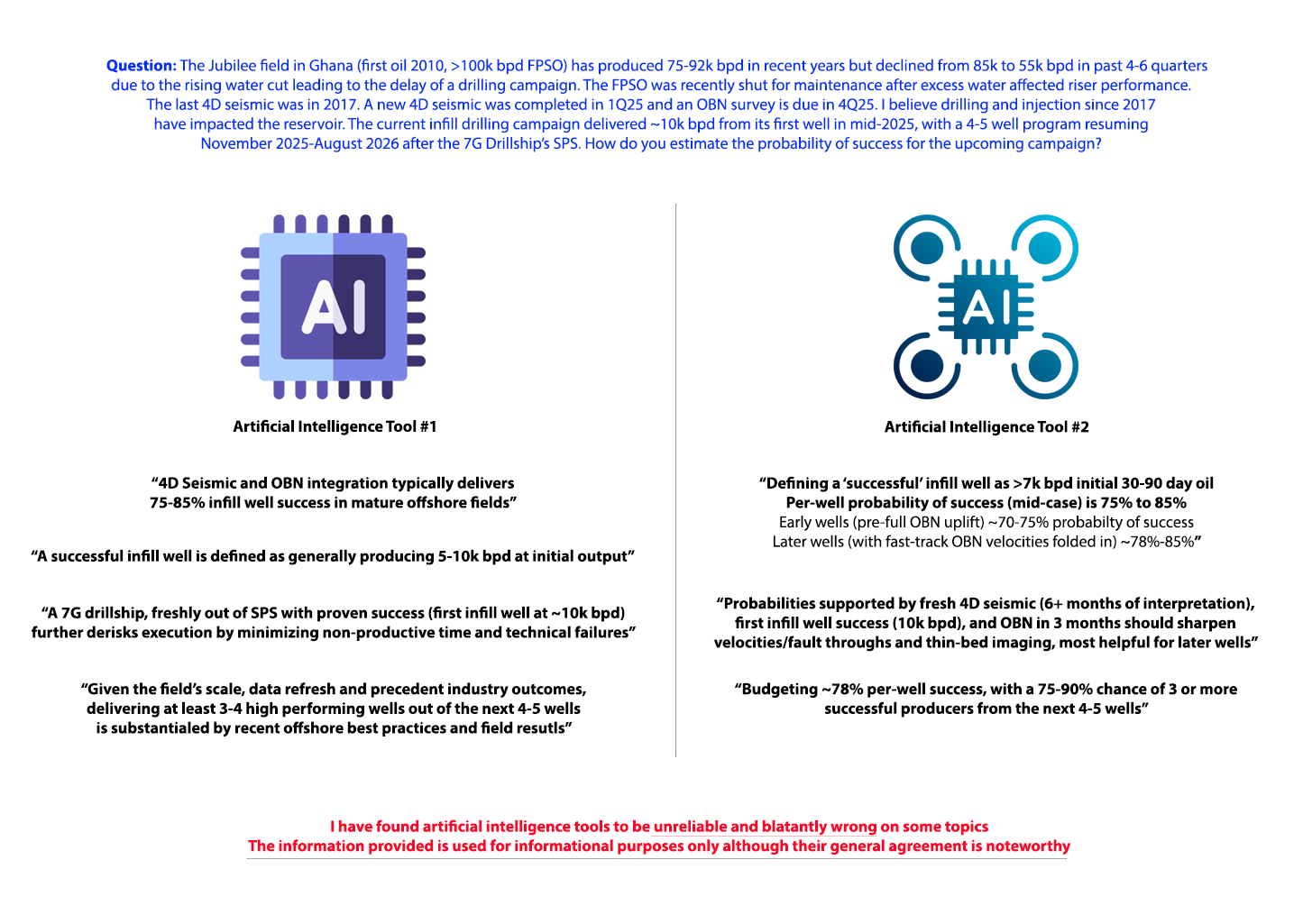

How do you price the risk? My background is in oil and gas credit, asset valuation and economics. I’m not a geologist and used two separate AI platforms to gauge the risk tied to Tullow/Kosmos’ upcoming infill drilling campaign (see image below). Using >7k bpd as the definition of “success”, a 75-85% probability of success was estimated for each well. If 5 wells are drilled, that’s at least (probability-adjusted) 28k bpd incremental production with an additional ~10k bpd increase from J72-P already successfully drilled, partially offset by natural decline of existing wells. Absent additional FPSO maintenance shut-downs, this could support Jubilee’s production increasing to >80k bpd by late 2026.

Why Kosmos? This Substack is free and is meant to be an outlet for my bigger picture research on the deepwater energy industry. Kosmos leverages my research and experience better than Tullow because it has four separate deepwater regions. Additionally, (1) I believe Kosmos has a more “underwrite-able”/justifiable path to refinancing at par than Tullow, (2) I’m American and am more familiar with Kosmos (Dallas-based) and (3) I also believe Kosmos has another EBITDA growth driver through the start up of its Greater Tortue Ahmeyim Phase 1 project.

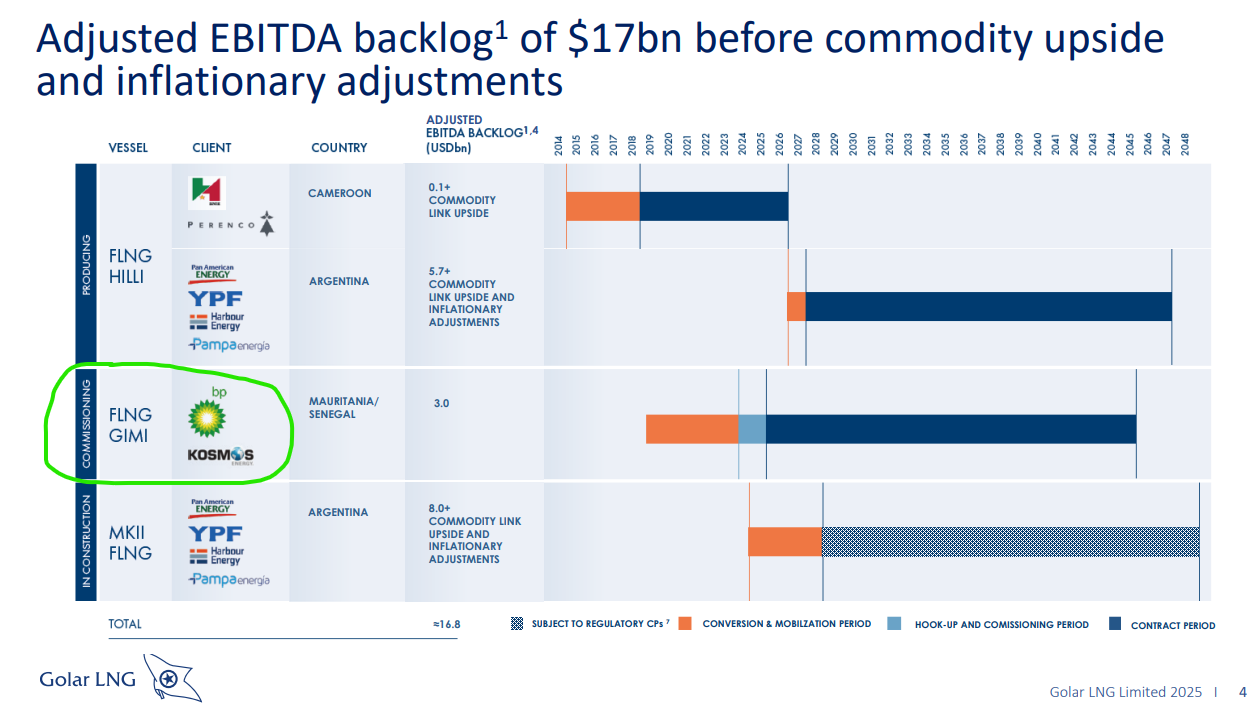

Greater Tortue Ahmeyim (“GTA”) Phase 1: After Kosmos’ deepwater gas discoveries of Tortue-1 in Mauritania (2015) and Guembu-1 in Senegal (2016), the GTA project was born via a joint development agreement between Mauritania and Senegal. BP eventually became operator on the project with Kosmos having a 26.8% interest in the project, with the majority of the capex already spent as the project is expected to ramp up production in late 2025 and into 2026. GTA Phase 1 has been an additional reason for Kosmos’ weak equity and debt security performance due to material delays, cost-overruns and funding a portion of the NOC’s capex (now a balance sheet receivable), however GTA Phase 1 is now operational and its three deepwater gas wells are performing in-line with expectations.

Those familiar with Golar LNG will recognize its role in Mauritania and Senegal, where the FLNG Gimi provides offshore liquefaction for gas from the deepwater GTA Phase 1 project. Golar’s model is midstream-like, earning a tolling fee for its FLNG capacity, while BP (56%, operator) and Kosmos (26.7%) remain the upstream partners responsible for exploration and production.

FLNG Gimi delivers liquefaction capacity for GTA Phase 1 gas production, while an FPSO handles gas processing and condensate extraction for sale into global markets. At ~2,800m water depth and in a remote setting, the project faced start-up challenges, but BP and Kosmos appear to have most of these issues behind them. Its location in offshore Senegal/Mauritania makes LNG exports to Europe attractive given shorter shipping distances. GTA has potential for Phase 2 and Phase 3, although given the issues with Phase 1 start-up, BP appears more focused on a smaller expansion of Phase 1 in 2027-2028. Geopolitical risk exists in Senegal regarding the 2024 election results whereby the President has communicated an interest in renegotiating oil contracts — thus making future investment less likely.

Equatorial Guinea: Kosmos has a 40.38% non-operator interest in the Ceiba and Okume deepwater fields whereby Trident Energy is the operator. While only producing 19-25k bpd of gross production, these mature fields are additional low-cost, brownfield expansion options for future infill drilling. While Kosmos’ Gulf of America interests are closed to being pledged as collateral on a $250mm secured debt raise to meet its April 2026 maturity, Kosmos’ interests in Equatorial Guinea are potential monetization options that would likely appeal to various buyers if necessary, albeit at a lower valuation.

Final Summary: Kosmos had $2.8B of Net Debt at 6.30.2025 with TTM EBITDA of $613mm, yielding Net Leverage of 4.6x. As a Deepwater E&P, it’s revenues are tied to a volatile commodity. It’s two primary assets have had production challenges (Jubilee) and start-up delays with cost overruns (GTA Phase 1).

Kosmos’ 7.5% coupon 2028 unsecured bonds trade at ~84-85 with YTW of 15.3%, a meaningful level of distress adversely impacting the equity valuation. Absent inherent commodity price volatility, the outcome of its infill drilling program at Jubilee will play a meaningful role regarding the Company’s ability to cover its $350-$400mm capex budget and estimated ~$220mm cash interest. Consensus analyst EBITDA estimates are $784mm for 2025 and $1,074mm for 2026 (Source: Bloomberg), although run the risk of error. At 6.30.2025, Kosmos had a $1.35B reserve-based lending facility with $350mm of available capacity. Kosmos recently amended a covenant on the RBL to better align the timing of revenues and operating expenses of the GTA Phase 1 project, and maintain access to the RBL facility.

A lot can go wrong in Deepwater E&P and recently Kosmos is no exception. However, if the Jubilee infill drilling campaign is successful, it would provide meaningful cash flow uplift via high-margin brownfield production, alongside GTA Phase 1 start-up where most of the capex has already been invested. I believe this is an underwrite-able path for Kosmos to eventually refinance its longer-dated maturities at par, although while the market waits for the Jubilee infill program to continue, risk exists for further production declines from existing wells before the next infill well is scheduled to begin drilling in November.

Kosmos appears to have sources of liquidity to make it through at least the next 12 months, at which point 7G drillship Noble Venturer should have completed the Jubilee infill program and GTA Phase 1 completing its first year of commercial operations. If Brent crude stays above $60/bbl (GTA Phase 1 breakevens are $50-$55/bbl), the credit should look better. If Brent is solidly above $75/bbl and risk asset sentiment is adequate, the equity has a justifiable path returning to its 2023 valuations.

Good note. Wrote about Tullow here and previously: https://brevarthanresearch.substack.com/p/tullow-oil-297

I still see downside risk on Jubilee given rapid decline, possibly smaller field perimeter (viz J-69), impaired eastern flank of the field (inc JSE), and rising gas and water-cut with limited on-deck options to deal with it. Tullow equity looks likely to get wiped by the bond refi, but who knows - extend and pretend is an option. Also on the subject of infill wells, Whilst previous infill well first production of 10kbd have been reached, they have declined pretty quickly subsequently.

Thank you Tommy, for the insightful analysis on KOS and Tullow. I am going to keep an eye out on their infill drilling outcomes. Do you think the prospects of aggressive interest rate cuts could help restructure its upcoming debt maturity to somewhat favorable terms?

As a side note, I have played with multiple AI tools, and it sounds more like an echo chamber at times and picks up the bias from the prompter. I use it to reduce large texts into meaningful summaries. I agree with you that it is a bit dangerous to trust what it spits out as opinions.