Transocean's Capital Structure

A credit investor's perspective on the recent equity raise

Transocean is a pure-play deepwater driller with a leading fleet by specification and geographic reach—anchored by (i) two 8G drillships with 20k-psi completion capability, (ii) eight ‘7G+’ drillships with 1,400-st hookload, and (iii) seven harsh-environment semisubmersibles qualified for the Norwegian market. Noble, Valaris and Seadrill have good fleets, although none of these competitors currently have any comparable warm rigs. Noble’s Voyager and Venturer drillships are scheduled for “7G+” upgrades via contracts with Shell in April 2025.

On September 24, 2025, Transocean announced an equity offering to raise at least $381mm in cash proceeds at roughly a 16% discount to the price of the equity before the offering. While clearly a debtor-friendly transaction, Transocean has the opportunity to gain material option value for equity via upcoming debt refinancing transactions if they execute in the fixed income capital markets.

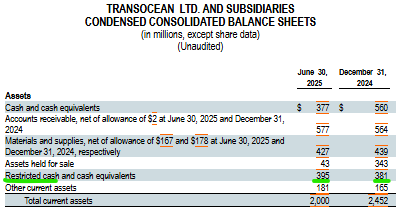

Unlike its peers Noble, Valaris and Seadrill, Transocean never filed for bankruptcy in the downturn of 2015-2021. Accordingly, the company still had ~$6.6B of debt as of 6/30/2025. While avoiding Chapter 11 in a painful downturn is admirable, a debate exists if they would have been better off long-term had they filed because this debt is still constraining equity upside.

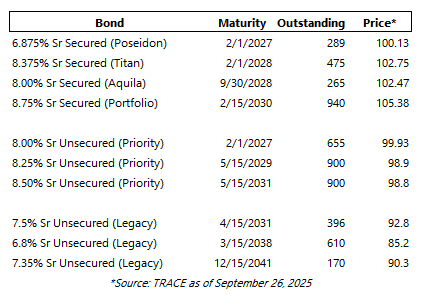

Leverage isn’t just the headline debt balance—the terms determine who holds the option value. In many high-yield and leveraged-loan deals, loose documents let sponsors extract value. Transocean is the opposite: creditor-friendly indentures and structural protections direct most operating cash flow to debt service and tightly limit leakage to equity (dividends/buybacks). In short, creditors—not equity—hold much of the value today.

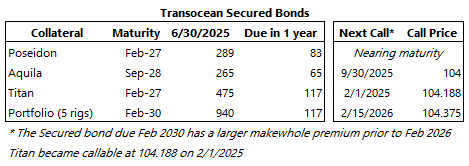

Transocean’s equity has a debt structure problem. It’s not just the amount of leverage, it’s the terms of leverage being (currently) too debtor friendly. All of the cash flows deleveraging is from paying off secured debt. Specifically, Transocean had $502mm of scheduled principal amortization due in the next twelve months from secured bonds and a shipyard loan. RIG’s contracted cash flows support this debt repayment, but if paid as dividends they would translate to ~16% dividend yield based on September 26’s equity market cap of ~$3B.

Under the secured notes indentures, a Debt Service Reserve is required, mostly represented by $395mm of restricted cash as of 6/30/2025 (see below). With legacy unsecured bonds trading at discounts, Transocean would likely prefer to deploy liquidity toward those repurchases rather than secured note debt service. However, the reserve effectively ring-fences cash for secured creditors and limits leakage to unsecured creditors.

The secured debt’s (i) amortization schedule and (ii) Debt Service Reserves are favorable structural features to Transocean’s bond holders which currently limit meaningful option value to the company and its equity investors.

Transocean’s outstanding debt includes other covenants and constraints, but the two most apparent are the ~$500mm of annual amortization and the Debt Service Reserve Account (DSRA). Eliminating these (and related covenants) via a future refinancing would could potentially free trapped cash and reduce mandatory paydowns, creating immediate equity value. Transocean has other structural levers to improve equity value, but for simplicity I’m focusing on these two because they’re the most obvious.

In June 2025, Tidewater (OSV’s) refinanced its bonds, easing indenture terms—looser covenants and lower liquidity floors—freeing capacity for shareholder returns and M&A. With a meaningful amount of debt due in coming years, Transocean will have the opportunity to do the same but needs cooperation and to build favor with debt investors.

In the deepwater rig market, operators still point to 2H26–2027 for most multiyear project starts. Some examples of slippage are likely, but commencements largely appear on track. For Transocean, early 2026 is setting up as pivotal as a large portion of its secured debt becomes callable, and 2027 maturities roll into current liabilities.

I highlighted the appeal for the Secured 2030s in Dayrate Duration (April 2025) and RIG Credit: June 2025 Update, although these are at risk of being called in February 2026. Unlike the other single asset bonds, the Secured 2030s have five collateral rigs in USA and Norway, an 8.75% coupon with 3-year call protection (!) These become callable on February 15, 2025 at 104.375, a redemption price below the current market value ~105.

Credit investors may love the 2030 secureds, but equity holders shouldn’t. Refinancing these notes—and others with similar structures—easily could restore equity option value by loosening more market standard indenture terms. RIG will likely need to pay a call premium above par, but it would be money well spent.

The equity raise was painful, but it appears to be setting up a cash-in refi—injecting new equity to delever and enable a refinancing. In CMBS, the market often sees cash-in refis to back assets lenders disliked (malls, older offices, lower-tier hotels). Deepwater drilling rigs are included in this group. Earmarking proceeds to retire the 2027 notes should read well to high-yield investors when the company returns to market.

With >$6B of debt outstanding, Transocean needs a deep bid to refinance and must persuade many holders in a market where few generalist HY investors still underwrite offshore rigs post-downturn. Large issuers often use fixed-income investor decks; despite its strong technical reputation, Transocean could improve economics by marketing more directly to HY credit buyers.

Deepwater Market Signal or Idiosyncratic to RIG?

When the equity raise was announced, my first question was whether it signaled a defensive outlook or was simply RIG-specific. In September 2024, Transocean announced a ~$340mm sale of the Development Driller III and Inspiration rigs, but the deal collapsed in early 2025. Those foregone proceeds would have addressed the same 2027 maturities now targeted by this week’s $381mm equity raise.

The $340–$400mm cash raise is symbolic against the $395mm of restricted cash on RIG’s 6/30/2025 balance sheet. Most of that balance is the Debt Service Reserve, which ring-fences funds for secured debt service and can’t be used to retire subordinated debt like the 2027 unsecureds. If those terms were removed in a refi, the $381mm equity raise may have been unnecessary. Secured bondholders: you win—now equity wants you to go away.

The US Gulf has been an area of strength for Transocean, although I think the equity raise would not have been done if they had near-term news of a multiyear contract extension in the region on the 7G+ drillship fleet. I’m confident in this fleet’s marketability long-term but the equity raise may signal a project or two they were counting on slipping a couple quarters.

Transocean’s utilization and dayrates have stayed strong partly because it has limited West Africa exposure—the source of much of the ‘white space’ on Noble and Valaris fleet reports. Confidence is improving that projects in Nigeria and Côte d’Ivoire are progressing, which is positive for Transocean, though it has only one rig in the region (Skyros).

Lower crude prices compress IOC operating cash flow, shrinking discretionary budgets for buybacks and growth capex. If IOC’s and E&P’s continue to ‘live within cash flow,’ projects run the risk of delay although cancellation risk appears low. This week, TotalEnergies said it will reduce share repurchases, effectively prioritizing capex—a constructive signal for deepwater rigs given TotalEnergies’ role as a major demand driver. However, it’s unclear which projects are affected or whether rigs have already been assigned. Many IOC’s and E&P’s have yet to provide 2026 capital-budget guidance. Considering deepwater investments are long-cycle and less flexible than short-cycle U.S. shale, deepwater activity may prove more resilient than other land-based services.

RIG: Debt or Equity?

Since the ‘Liberation Day’ bottom in April, Transocean’s equity is up ~54.9% versus ~20% for the 2029 unsecureds. However, equity’s daily-return volatility has been roughly 4× higher, so on a risk-adjusted basis (Sharpe ratio) the debt has outperformed the equity over this period. For income-oriented investors, debt has clear appeal. While unsecured notes offer limited price upside, RIG paper still carries ~450–475 bps of credit spread—attractive in a pricey high-yield market given the company’s recent credit-positive actions.

The Equity bull case casts Transocean as an early-stage Odfjell Drilling: Odfjell is up >210% since Jan-2023 and valued at ~$500mm per rig, driven by dividend growth after successful deleveraging. Odfjell is a niche, Norway-focused player—where Transocean also has exposure but is more geographically diversified. If Transocean is successful reducing mandatory principal amortization on debt, cash can pivot to shareholder returns. However, Transocean has said it will need to get below 3.5x Net Leverage before returning cash, and not all debt amortization will flow to equity immediately. After the equity raise and 2027 note paydown, RIG is 4.0-4.3x Net Leverage, depending on how you treat Restricted Cash.

Summary: RIG equity still trades like a beta play on oil and risk sentiment, while the bonds offer steadier pricing, semiannual income and good credit spreads in a rich HY market. As RIG nears shareholder returns, the stock should trade with less volatility, all else equal. If refinancing shifts more cash flow to equity by loosening creditor-friendly structures, income-oriented investors may see value speculating on shareholder returns before announced they but work is still yet to be done.

What to Follow Next: If Transocean is able to successfully refinance debt and improve structural terms in coming quarters, it will be an important step toward potential shareholder returns. Contract announcements are also obviously important, but the potential debt refinancing will arguably be more impactful long term if successful.

Transocean has two classes of unsecured notes: Priority Guaranteed Notes (PGNs) and Legacy Guaranteed Notes (LGNs). In a downside or restructuring, PGNs should recover more because their guarantees sit closer to operating cash flows. If you don’t expect restructuring, LGNs may offer greater upside. The open question is whether Transocean will refinance the legacy notes or keep them if their terms are less burdensome than the senior secured notes. Do your own indenture diligence.

I have no positions in any securities referenced in this article.

Grateful for all your writings on this space the past few years. Super helpful in spelling it out.

Curious Tommy - Why do you do this? (Says you have no positions) - What are you optimizing for?

This is very helpful and does a great job helping me (a frustrated equity investor in RIG) with some guideposts for timing equity purchases in the future! I am a believer in the cycle so it has been tough to live through all the delays with contracts and dilution