Disclaimer: I have no ownership in any securities noted. This is independent analysis. This is not intended to be investment advice, but instead an extension of independent research on deepwater rig supply and demand underwriting to gauge reader interest on credit work.

High yield credits generally sell-off when recession probabilities increase due to expectations of higher leverage via reductions in EBITDA. Oilfield services credits are some of the first to be sold given their exposure to volatile oil prices (especially if B-/Caa1 rated like RIG unsecured), although Transocean is actually projected to increase EBITDA and reduce debt through 2026.

Consensus analyst estimates (as of 4/29/25) are noted below. Net Debt-to-EBITDA estimates are based upon deleveraging via contracted cash flows, primarily through scheduled amortization on RIG’s secured bonds (~$450mm annually).

2024: $1.15B EBITDA, 5.3x Net Debt-to-EBITDA

2025e: $1.32B EBITDA, 4.3x Net Debt-to-EBITDA

2026e: $1.38B EBITDA, 3.8x Net Debt-to-EBITDA

Unlike short-cycle onshore services, deepwater capex is long-cycle. Contracts are often signed >12 months before drilling commencement. Despite recent weakness in oil markets, Transocean is scheduled to begin new multiyear projects from contracts signed in 2023-2024 with strong dayrates ranging from $465k to $530k (detailed later). Transocean appears set to benefit from positive Dayrate Duration from locked in dayrates on multiyear contracts signed in a stronger market. Deepwater capex is generally not as flexible spend as onshore services, meaning risk of contract cancellations is low considering the strategic nature of the IOC’s projects.

Offshore credit has a bad history. The industry understandably makes many PM’s uncomfortable and Moody’s unsecured rating of “Caa1” does not help although I disagree with their rating. I’ve always operated off requiring >10% returns to invest in oilfield services credits considering the downside potential. Regarding downside, a major difference today vs. ten years ago is the newbuild orderbook is essentially zero. About 4 “stranded newbuilds” still exist, although they were ordered >10 years ago. These stranded newbuild 7G drillships may limit upside in dayrate potential but this is nothing like the impending supply of to-be-delivered rigs we saw in 2015-2017. Since then, a lot of the older, less efficient rigs were scrapped to support a healthier supply/demand dynamic.

RIG Secured vs Unsecured

Secured: Transocean has ~$2B of secured bonds with higher specification assets pledged as collateral. These are generally well-structured bonds with Debt Service Reserve Accounts requiring Transocean to set aside liquidity in Restricted Cash a year ahead of debt payments due. This Restricted Cash account had $428mm at 3/31/25. The secured bonds have meaningful amortization schedules to pay debt back at par and support LTV. In my opinion, these have very low risk of impairment and purchases below par have the benefit of semi-annual amortization payments at par from funds via debt service reserve accounts. The 2030s are secured by five different rigs (three 7G+ drillships in US GoM and two HE semisubs in Norway) and are my preference over the single asset bonds due to collateral diversification.

Unsecured: Transocean has different classes of unsecured debt. My focus is on the Sr. Unsecured bonds (2027s, 2029s and 2031s). RIG also has subordinated unsecured bonds. Additionally, RIG has $234mm of convertible notes due December 2025. Read the indentures and complete your own due diligence on the unsecured structures.

The Unsecured 2027s have $655mm due in February 2027. In September 2024, RIG announced the sale of non-core rigs Inspiration and Development Driller III for ~$340mm in cash proceeds. This sale was presumably to support liquidity for maturities, although the sale was cancelled in late ‘24/early ‘25. RIG is seeking remedies although material risk exists the majority of the $340mm is not collected. Partially offsetting these concerns, Transocean announced on its 1Q25 call that it has identified ~$100mm of cost savings in 2025 and another ~$100mm in 2026 that could support maturing debt. Transocean also has ~$500mm of revolver capacity that could be tapped if necessary (DYODD on terms). Further, while limits exist on ability to raise secured debt in the bond market, the majority of their debt payments are on the secured bonds. As they secured debt pays down, it may open ability to raise new secured debt although DYODD on the bond structures. Transocean has unencumbered, valuable rigs it can use as collateral although debt structure terms may influence access to the secured market. DYODD.

By its nature, high yield debt heavily relies upon successful rolling of maturing debt through refinancing. Based on RIG’s current unsecured debt pricing, the high yield market is not currently receptive of refinancing the maturities. However, various multi-year development drilling projects are scheduled to commence in late 2026/2027 (with more to follow — see my articles on Namibia and Mozambique). Based upon commentary from Noble and Transocean’s calls on April 29, 2025, multiple awards are anticipated to be awarded this summer and more later in 2025. This has potential to improve sentiment and debt service capacity, especially if these are multi-year awards as expected. Depending upon capital markets health in 2026, its reasonable to see successful refinancing via the HY unsecured market before the $655mm is due in February 2027. If you expect the S&P 500 to be 4,500 and crude oil persistently in the $50’s through 2026, RIG unsecured may not be for you.

Transocean will likely have paid down an additional ~$500mm of debt by 2Q26. Further, while nothing is guaranteed in oilfield services, Transocean is likely to make progress contracting its geographically diversified fleet in the next year. Why?

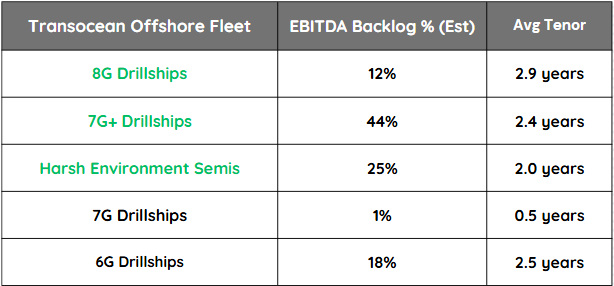

Transocean has a differentiated fleet of high specification deepwater rigs. Approximately 80% of its contracted EBITDA (estimated) is derived from these rigs with an average remaining tenor of ~2.4 years. IOC’s and E&P’s demonstrate a preference for highest spec assets and Transocean’s strong EBITDA backlog is a function of their high quality, differentiated fleet. This is most notable from their 8G Drillships, 7G+ Drillships and Harsh Environment Semisubs (NCS eligible) where their American peers have very limited comparable assets.

8G Drillships: Strong pricing power. Transocean’s 8G Drillships (Titan, Atlas) are among a limited group of three drillships in the world capable of 20k psi completions in the emerging Paleogene play in US GoM. Atlas has earned a firm $635k dayrate (in 2028) and there’s likely upside beyond this longer term.

7G+ Drillships: Before Noble announced on April 29, 2025 it was upgrading two 7G drillships to effectively to 7G+ (hookload), Transocean controlled the 7G+ drillship market in US Gulf of Mexico with seven separate 7G+ drillships. In my opinion, the difference between 7G+ and 7G is not major but is worth a modest dayrate premium and higher utilization.

Harsh Environment Semisubs (NCS eligible): These HE Semis are often referred to as “6G” but these earn 7G type dayrates at better utilization due to short supply and a positive outlook on Norwegian Continental Shelf (NCS) demand. Transocean has seven of these, although after moving two to Australia and one to Romania, only four remain in Norway. Norway has high standards for its offshore drilling rigs and is a high barrier to entry market with strong demand profile through 2030 (at least). Odfjell Drilling is a pure-play on this market, but none of Noble, Valaris and Seadrill have these types of semisubs.

Opinion (DYODD): I believe Transocean’s fleet is industry-leading. It has scale, leading specifications and diversification by capability and geographical reach. While timing of liquidity and access to capital markets is uncertain, I believe the value of the fleet on a through-the-cycle basis comfortably exceeds its outstanding indebtedness. Not my base case, but if capital markets are unhealthy when Transocean needs them and unsecured debt (partially) converts to equity, owning converted equity of a deleveraged company likely has appeal to those constructive on the industry.

Long-Cycle Contracting: Deepwater contract drilling works with long lead times. This is very different from US Shale services that are short-cycle and more flexible capex.

Supporting its projected EBITDA growth, Transocean has various rigs embarking on multiyear contracts at strong dayrates that were announced in 2023-2024:

Invictus ($485k from April ‘25-April ‘28)

Barents ($465k from April ‘25-Sept ‘26)

Conqueror ($530k from Oct ‘25-Sept ‘26)

In addition, Atlas begins $505k dayrate work in May ‘25-Dec’25 with a firm $580k dayrate from April ‘26-Sept ‘26. Further, Thalassa begins $480k from March ‘26-March ‘29. These rigs are all working generally high profile projects, including Barents drilling for Romania’s greenfield Neptun Deep offshore gas project in the Black Sea with additional growth potential in the area (including Bulgaria).

On the negative side, Skyros’ contract with TotalEnergies in Angola ends in September 2025 with likely idle time ahead of it but is a candidate for TotalEnergies’ Kaminho project in Angola after FID in 2024, or perhaps emerging work in Mozambique. Additionally, the Mykonos contract with Petrobras ends in October 2025 although likely finds work again in Brazil but unclear on timing. While Skyros is a “7G” drillship, it’s a lower tier 7G, and like Mykonos, Transocean is not likely to be able to push for rates on it and may instead value utilization on these workhorse rigs similar to its success with Dhirubhai KG1 in India ($347k-$410k through Nov ‘27).

Cash Flows: I recommend you DYODD modeling annual cash flows although consensus analyst estimates expect >$1.3B of EBITDA in 2025 and 2026. Successful execution on revenue efficiency and cost controls will impact ability to achieve these levels, although this EBITDA is generated through in-place, multiyear contracts with generally credit worthy counterparties. Transocean’s annual Net Cash Interest is ~$500mm, Principal Amortization is $450mm-$500mm and Capex is guided below $150mm annually. Working capital fluctuations can be volatile quarter-to-quarter and may be a net use of cash in 2025-2026, although Transocean appears capable of covering its fixed cash uses and paying down debt (Secured) in coming years.

Transocean’s equity does not yet have shareholder returns. The free cash flow from its existing contracts primarily goes to interest and scheduled secured bond amortization. I believe Transocean hopes to enable shareholder returns after further deleveraging through 2026, but until then the bondholders are most the direct beneficiaries of the cash flows from RIG’s industry-leading existing contract book.

Summary Opinion (DYODD): I believe Transocean’s deepwater fleet is industry-leading. It has scale, leading specifications and diversification by capability and geographical reach. While timing of liquidity and access to capital markets is uncertain, I believe the value of the fleet on a through-the-cycle basis comfortably exceeds its outstanding indebtedness. Not my base case, but if capital markets are unhealthy when Transocean needs them and unsecured debt (partially) converts to equity, owning converted equity of a deleveraged company very likely has appeal to those constructive on the industry.

There were rumours that $RIG may acquire $SDRL but as yet noth8ng has happened. Have you heard anymore on this rumour. Or has that takeover been kicked down the road given the sentiment and weaker rates. I’d be interested in your views on this

Great article--thanks! Not gonna sugar coat it: I own a ton of this shit, and for so long that I've learned to live with the danger, especially twice a year, when they ring the dinner bell LOL! We'll just have to see if the Credit Gods finally get the last laugh...