Rigs, Rates and Recapping 2Q

Thoughts on major Deepwater Drillers, Turkey's Big Surprise, Jackup M&A Heating up, Namibia Conference and the Brunei Bay Indicator

The key focus for 2Q25 deepwater earnings was whether multi-year development drilling projects faced new delays that could add to 2025 idle-time concerns. While guidance shifted slightly—from “2H26 to 2027” in 1Q25 calls to “late 2026 to 2027”—several projects with 2H26 start dates have been awarded in recent months. Overall, the reaffirmation of major project timelines was encouraging and underscores the long-cycle nature of deepwater capex.

Major deepwater projects set to commence drilling in the next 12–18 months generally offer strong economics. Where softness exists could be in shorter-cycle infill drilling, which often waits for higher oil prices before rigs are contracted. Lower prices also tighten IOC and E&P budgets, a familiar headwind for oilfield services. Even so, drillers consistently reinforced expectations that floater utilization will improve into late 2026, translating to reduced idle time, and these comments were further qualified by IOC commentary regarding their capex.

Transocean’s strong contract book shields it from the idle time weighing on peers and supports cash flow generation for further deleveraging. Its highest-value assets are concentrated in stable regions such as the U.S. Gulf and Norway, where lower-cost, infrastructure-led E&P capex generally supports a steady EBITDA base.

While Transocean’s odds of reactivating coldstacked 7G drillships Mylos, Apollo and Athena have materially diminished over the last 18 months, more attention should be focused on its warm fleet that has historically been driving industry dayrates higher. Notably, Proteus and Conqueror roll off contract in May and September 2026. Both are top-tier 7G+ drillships, ranked well within the global top 10, and are likely to to be re-contracted and I believe above recent standard 7G fixtures in the low-$400k range. In Brazil, the outlook for Transocean’s 6G drillships is less clear given Petrobras’ vague tender requirements. However, demand from other IOCs in the region should provide incremental support for utilization.

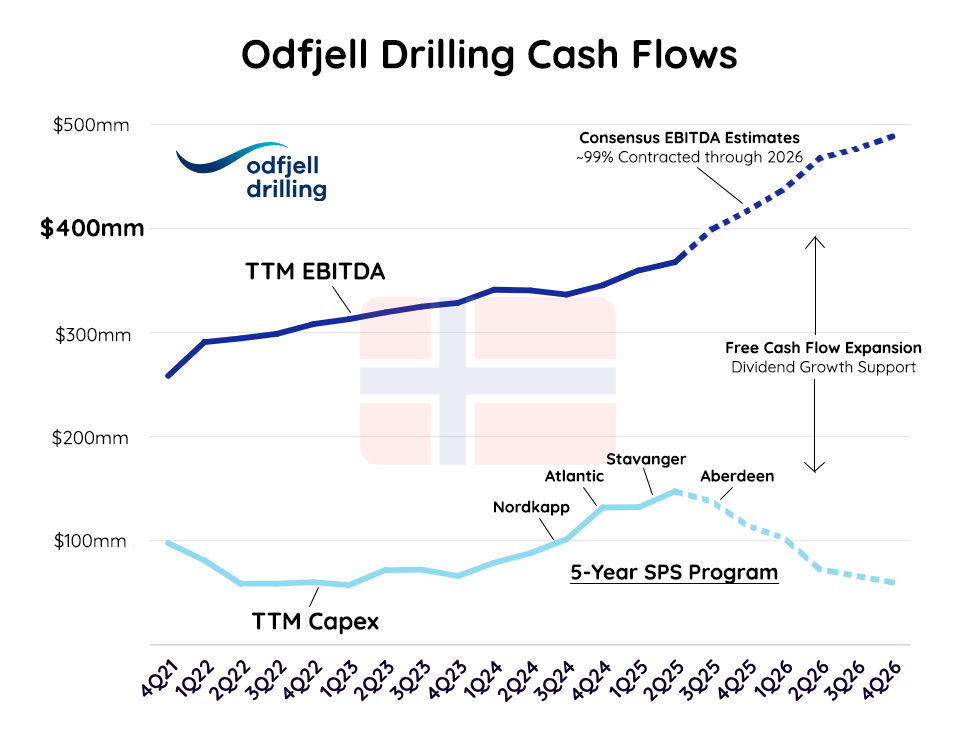

Odfjell Drilling has delivered strong operational and equity performance. Like Transocean today, Odfjell spent 2021–1H23 deleveraging its balance sheet before initiating dividends in 3Q23. Since then, its share price has risen more than 180%. While multiple factors contributed, Odfjell illustrates the bull case for Transocean: once it reaches its leverage target and initiates shareholder returns, equity upside could follow. Transocean has guided to a net leverage goal of ~3.5x, which appears achievable but likely requires another 12–24 months.

Odfjell reported earnings on August 19 and announced a dividend increase supported by strong cash flow growth visibility via (1) nearly 100% utilization through 2026, (2) anticipated contracted dayrate appreciation of ~15% over the next twelve months, (3) completion of the SPS program will reduce capex from $130mm to $45mm-$60mm sustainably for next three years and (4) should be able to reduce debt amortization by $25mm-$50mm annually to free up cash flow for equity returns after successfully deleveraging from 3.3x in 2021 to 1.3x currently.

Odfjell appears expensive on a per-rig basis compared to peers, although its strong cash flows are the basis for its valuation, with a ~8.6% dividend yield (76.90 NOK at Aug. 19, 2025) and visible growth potential from rising contracted dayrates and lower capex. Odfjell communicated confidence in extending its contracts with Aberdeen and Nordkapp into 2027. If an extension is awarded, the company guessed Nordkapp’s dayrate for 2027 to be between $450k and $500k.

Norwegian E&P demand remains resilient, driven by low-breakeven brownfield projects and a favorable tax regime for E&P capex. After Equinor recently extended Deepsea Atlantic firmly into mid-2027, Aker BP noted twice on its 2Q25 call that it is “rig constrained,” suggesting an appetite to extend Deepsea Nordkapp beyond 2026.

Noble: Following the Diamond acquisition in June 2024, Noble has already realized its $100mm annual synergy target—roughly equivalent to the EBITDA of a 7G drillship contracted at dayrates in the high $400ks. In April 2025, Noble secured four multiyear contracts for the Voyager, Valiant, Venturer, and Developer, and more recently extended the Stanley Lafosse with Murphy through August 2027. While these developments strengthen visibility, challenges remain: Voyager and Valiant are without work until late 2026, and the Ocean GreatWhite (UDW semisub) has recently gone idle.

In “Scrap, Baby, Scrap”, I argued Noble could save nearly $100mm in annual *potential* warm stacking costs (if idle) by scrapping various lower tier rigs while having minimal impact on its Net Asset Value. In my opinion, these non-core rigs include Globetrotter I, Globetrotter II, Apex, Endeavor, Reacher or Resolute and *maybe* one of their DSS21 semisubs.

Noble is unlikely to scrap rigs if they believe work can be attained, although these assets are generally not suited for the higher-value work of its 7G fleet. The cost of keeping them warm is limiting share repurchases, suggesting further fleet rationalization ahead—a move equity investors should welcome.

Noble’s operational cash flows in 1H25 were strong and comfortably covered shareholder returns, although will face pressure in the next twelve months due to idle time on core rigs. Consensus estimate for 2026 EBITDA is ~$1.05B and will need to cover capex of ~$450mm, cash interest of ~$160mm and ~$318mm of dividends for its ~7.5% dividend yield – Noble’s bonds do not have principal amortization. Working capital may also be a use of cash when Voyager, Valiant and Developer’s new projects commence in 2H26. Supporting its liquidity, Noble raised ~$105mm in cash via divestments of Highlander, Meltem and Scirocco.

Valaris: After repurchasing $325mm of stock in 2023–2024, Valaris has returned none of the >$100mm in 1H 2025 free cash flow to shareholders, despite $275mm remaining under its $600mm buyback program.

While Valaris’ nine warm (and three cold) 7G drillships are its core strength, ~35% of mid-cycle EBITDA is derived from its jackup fleet, a larger proportion and its peers. Management’s commentary on jackups has more cautious on public calls, reflecting the impact of Saudi Aramco’s suspensions which added >10% of global active supply to the market quickly - a particularly significant hit to benign-environment jackups where Valaris has more exposure than peer Noble. Its two semisubs also face uncertainty with both DPS-1 and MS-1 contracts ending in late 2025.

While the lack of share repurchases have disappointed, Valaris’ sale of jackup Valaris 247 for $108mm is scheduled to close in 2H25 and the press release specifically noted “return of capital to shareholders” as a potential use of cash from sale proceeds. Potential reasons for the lack of share repurchases are hypothesized below:

Valaris, typically more conservative than peers, appears to be holding back on share buybacks amid global macro uncertainty. Valaris has idle time risk on its semisubs in Australia for 2026.

Valaris’ large jackup fleet faces a shallow-water market still unsettled by Saudi Aramco’s suspensions.

Valaris is building cash that could support an M&A deal, though it hasn’t signaled interest publicly. While I have no specific insight, Seadrill is often rumored, and Northern Ocean’s Bollsta and Mira would diversify Valaris’ drillship-heavy fleet.

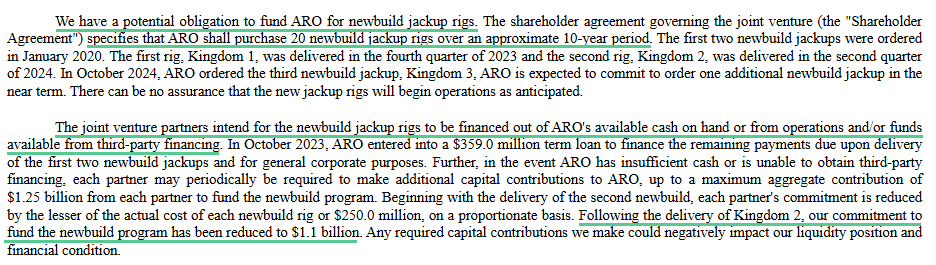

Valaris’ ARO JV faces $1.1B in commitments for newbuild jackups ordered by JV partner Saudi Aramco. These are expected to be funded through the JV’s cash flow or third-party financing, making direct contributions from Valaris unlikely, though the contingent liability remains notable.

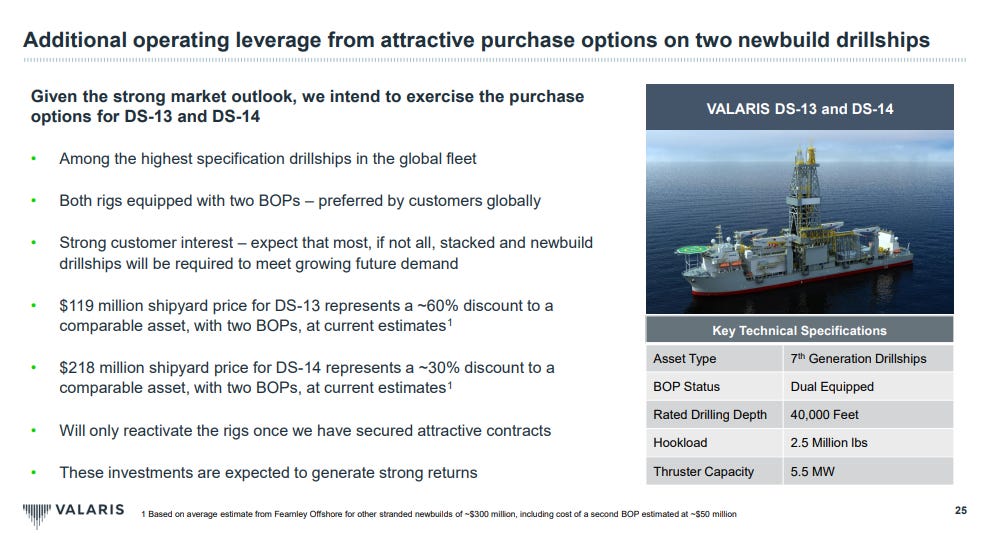

Valaris may have already used much of its discretionary capital with the $337mm purchase of stranded newbuild 7Gs DS-13 and DS-14 in Dec-2023. While attractive buys, both remain uncontracted, cold-stacked in Las Palmas, and each will need ~$100mm of activation capex before working.

Seadrill repurchased $532mm of shares in 2024, funded by (i) the $338mm sale of three jackups and (ii) reducing its cash balance from $697mm at year-end 2023 to $478mm at year-end 2024. Absent asset sale proceeds, no repurchases occurred in 1H25 as operating cash flow was negative before capex. The drag stems from four 7G drillships in Brazil locked into legacy contracts at mid-$200k dayrates through at least November 2025. Looking ahead, Seadrill has secured stronger contracts: Jupiter and Tellus at low-to-mid $400k beginning March and June 2026, respectively. Carina opens in Feb 2026 and is well positioned for new Brazil work, while Saturn remains tied to Equinor’s unusually favorable low-rate options running through 2030.

While Capella will be a key watch for competitive work in SE Asia, in the US Gulf semisub Sevan Louisiana benefits from reduced competition following Noble’s retirement of Globetrotter II, Globetrotter I’s temporary move to the Black Sea, and Valaris scrapping DPS-5. While not competing with top-tier drillships, it now faces less competition for P&A and intervention work.

Namibia hosted its oil and gas conference in Windhoek in mid-August, much of which is available on YouTube. Among frontier deepwater regions, Namibia’s Orange Basin stands out for its significant hydrocarbon potential and the attention it continues to attract. As a true greenfield deepwater oil and gas province, Namibia faces the various challenges of bringing first oil to market. However, the conference reinforced confidence that these complexities are being recognized and proactively addressed, highlighting the country’s professional and thoughtful approach to managing its emerging resources.

Las Palmas and Brunei Bay have long been storage hubs for idle floating rigs awaiting work or upgrades. Las Palmas still hosts Valaris DS-13 and DS-14, the stranded newbuilds acquired by Valaris. Brunei Bay, however, has seen notable progress: the formerly stranded 7G units Dorado and Draco (originally ordered by Seadrill around 2013) were acquired by Turkey’s NOC, TPAO. Both rigs have now departed Brunei Bay and are expected to relocate permanently to the East Mediterranean and Black Sea regions.

The floating rigs remaining in Brunei Bay include Seadrill’s West Capella, Vantage’s Platinum Explorer and Noble’s Deliverer. Vantage’s Platinum Explorer has announced conditional letter of award — the drillship has a history of operating in India and would be a potential destination as the country has growing demand. A few other higher profile projects exist in the region and could be potential fits for Capella and/or Deliverer. Ventura Offshore’s SSV Catarina is currently in Indonesia’s Kutei Basin, a promising region long-term.

“Big Positive Surprise”: On 2Q25 calls, Noble was the only driller to flag TPAO’s purchase of the Dorado and Draco drillships, calling it a “big positive surprise.” The acquisition notes Turkey’s shift from being a major gas importer to a potential producer, with discoveries in the Black Sea and sizable prospects in the East Med. Turkey may also deploy its new 7G units in partnership with recent initiatives in Libya.

Unlike other buyers, TPAO is expected to keep its fleet fully in-house rather than market the rigs globally. This effectively removes ~4% of the world’s 7G drillship supply from open competition; a notable tightening versus prior expectations that the units would be marketed internationally.

Energy Security and Geopolitics: A defining feature of the global deepwater market is that floating rigs are opening up previously untapped reserves in frontier and emerging countries. Turkey is a prime example: it is developing deepwater gas to reduce reliance on imports and could eventually emerge as a regional supplier, enhancing its geopolitical influence depending on the success of future exploration and appraisal. Turkey has also drilled in contested East Mediterranean waters before and could do so again.

Over the next 12–24 months, countries to watch include Turkey, Greece, Cyprus, and Libya—all with promising deepwater gas potential and overlapping maritime claims that carry geopolitical weight.

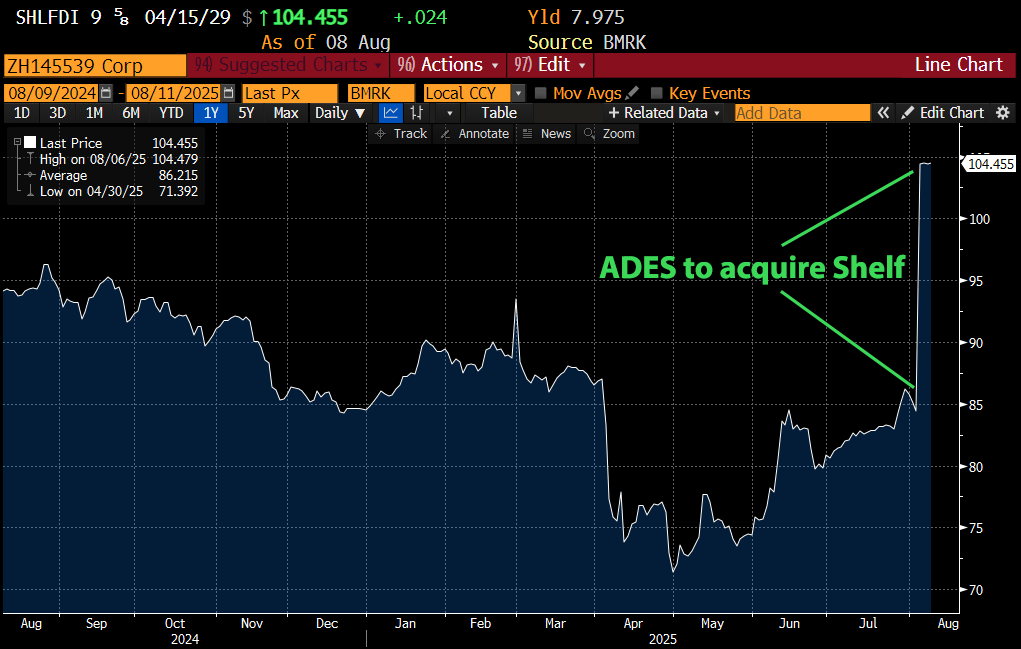

ADES acquires Shelf Drilling

It is unusual for a leveraged company to be acquired when its bonds trade at distressed levels, as a change-of-control provision typically requires the acquirer to repay the debt at par plus a premium. Distressed pricing often signals underlying issues, and buyers generally wait for a restructuring or bankruptcy to acquire assets free of the debt. Nonetheless, ADES announced the acquisition of Shelf Drilling this week, including its $1.3B debt load. ADES’ lower cost of capital gives it the option to refinance Shelf’s bonds at significantly lower rates.

While the 1L SHFLDI 9 5/8% 2029s traded at yield of 16% with a credit spread of ~1,200 basis points, Shelf had adequate liquidity and a decent contract book. I preferred the 1L BORRNO 10% 2028s due to the younger, higher specification jackup rig collateral package. The majority of Shelf’s best jackup rigs were collateral on the Shelf North Sea (SHLFNS) subsidiary bonds, leaving SHFLDI with a comparatively older fleet and meaningful downside recovery risk in a bear case scenario. Congratulations to the SHFLDI longs.

The 1L BORRNO 2028s rallied ~3 points on ADES’ acquisition of Shelf, tightening spreads by roughly 140 bps. Now quoted near 99.5, the bonds offer less pull-to-par from the heavy amortization schedule but still carry a 10% coupon.

More Jackup M&A Potential?

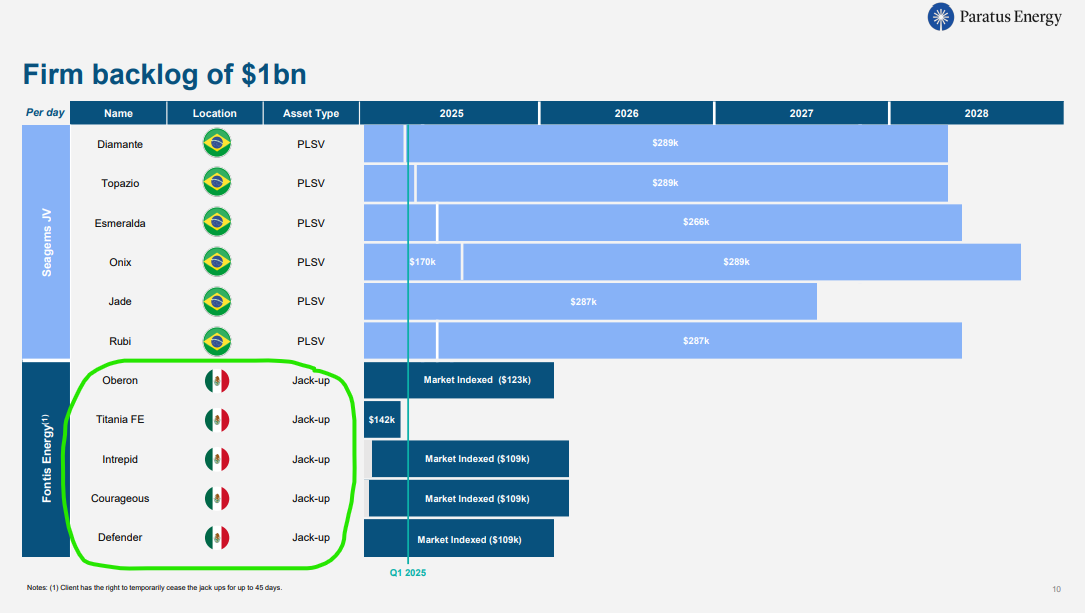

On its 2Q25 call, Borr hinted at the potential of an acquisition funded via the cash proceeds from its $200MM equity raise announced in early July. Based upon public information, a logical acquisition target is Paratus Energy Services’ jackup fleet of five in Mexico. At the Marine Money conference in June, Paratus’ CEO mentioned it would consider selling its jackup fleet. While Mexico has been an area of pain for jackup drillers in 2025, shallow water production is important source of energy production for the country and there should be a fairly resilient source of demand for jackup rigs through the decade.

Borr already has seven jackup rigs in Mexico and an acquisition of Paratus’ five jackups in the country would have a meaningful benefit as it relates to pricing power with less competition for work in 2026-2027.

Two of Paratus’ jackup rigs are the same design as Noble Highlander, which was just sold for $65M, approximately 42% lower than Seadrill’s comparable transaction in 2024 of comparable jackup rigs (Castor, Telesto and Tucana). Without inspecting the rigs or knowing specific capex requirements, I believe $280mm-$300mm is a reasonable price range for this fleet given recent transactions and market dayrates. Subject to Mexican regulatory input regarding market competition, Borr would gain meaningful leverage to a potential recovery in this market although this is entirely speculation based on public info.

Tommy we bask in the garden of your turbulence! Keep it up!

Another great piece, thanks Tommy. Cheers John