RIG Share Issuance Quick Thoughts

RIG's share issuance is a win for Credit. Disappointing for Equity although could be a step toward eventual shareholder returns by loosening bond terms via upcoming debt refinancing transactions

I have no positions in any securities noted in this article

Transocean announced a $381mm equity raise at a ~16% discount to closing price on September 24, 2025. Sharing quick thoughts as I’m traveling:

RIG’s stock jumped more than 10% Tuesday morning without any clear news catalyst, gave back some gains later in the day, and then rallied again on Wednesday. I noticed on my Twitter feed some of the buying was from technical charts people, as I was unaware of anything fundamental. My initial reaction was as though RIG had just announced two multiyear contracts in the US Gulf at $450k dayrates, but the buying appeared to be more technical in nature (??). RIG took this opportunity to raise equity, selling that rally. Not a great signal to equity investors but debt investors had to be pleased.

RIG has been using shares to pay down convertible notes and also to acquire the Norge semisubmersible rig — they’ve been acting in a debtor friendly way lately. For perspective, RIG has $6B of creditors and an equity valuation ~$3B as of this morning.

Transocean faces roughly $2.5 billion of debt maturities in 2027–2028. While they likely could have refinanced without the recent equity raise, the company still has significant refinancing ahead. This presents an opportunity to improve the structural terms of their debt — eliminating amortization would be a major step forward. The equity raise should also support potential credit rating upgrades (Moody’s still rates the unsecured debt at Caa1) and strengthen Transocean’s position in negotiating better terms.

Transocean’s equity story is constrained by its debt structure. A large share of its capital is tied up in secured bonds that carry about $400 million of scheduled annual amortization. While this is the company’s lowest-cost source of funding and would ideally be the last debt to repay, the bond terms mandate substantial semiannual principal payments — terms that are highly favorable to secured creditors.

If Transocean can eventually redirect the >$400 million in annual principal payments toward dividends, it would equate to a yield of over 12% at today’s equity value. These cash flows are backed by firm contracts on a leading offshore fleet by specification and geographical diversification.

The equity raise is an important step toward loosening bond terms and improving flexibility for future shareholder distributions. The next milestone will be executing refinancing transactions in the debt markets, a process the equity raise should meaningfully support although equity returns are still >12 months away.

Market Signal or Idiosyncratic Transocean Capital structure story?

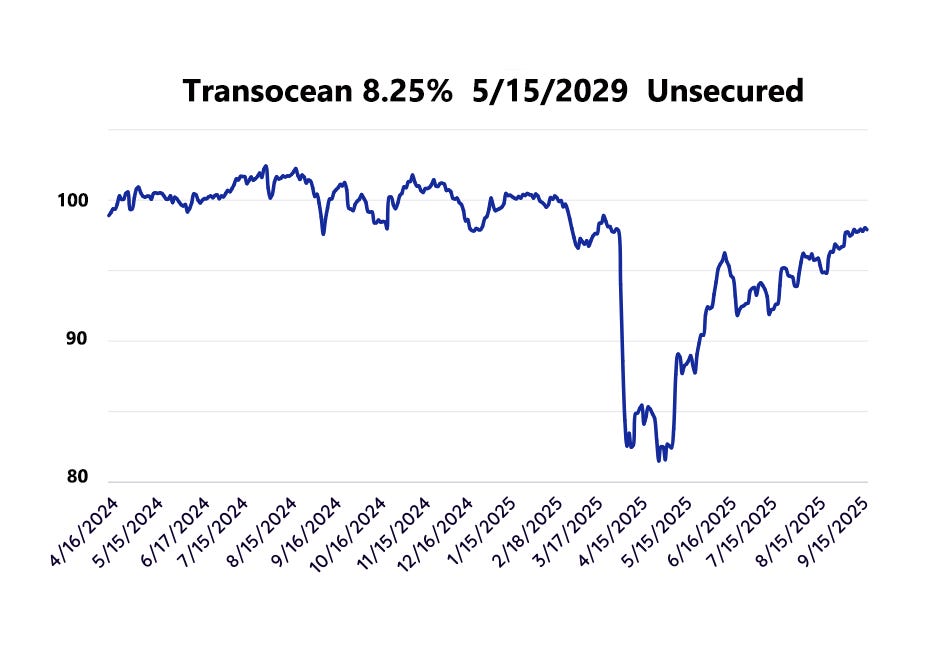

In September 2024, Transocean announced the $340 million sale of the DD3 and Inspiration, but the deal fell through as market conditions weakened. Now, with the current equity raise bringing in $383 million, one can’t help but note the timing. This was covered in RIG Credit: Dayrate Duration.

Unlike Noble, Valaris, and Seadrill, Transocean never went through bankruptcy and still carries legacy debt. At times one might argue they’d have been better off restructuring, but they’ve consistently honored their obligations and treated creditors fairly. It’s now time for creditors to recognize that and support refinancing transactions with less restrictive terms

Unsecured creditors benefit from this equity raise, and their bonds should rally. That could set up a trade: sell into credit strength and buy equity on weakness, if you believe the ~$400 million in annual amortization tied to the secured bonds (Titan, Poseidon, Aquila, Secured 2030s) can be refinanced in upcoming transactions and eventually redirected to shareholders. If achieved, that’s a compelling return story—but likely more than 12 months out.

Borr completed a large equity raise in early July, which equity investors absorbed well given the reduced balance sheet risk. Broader risk assets have also traded strongly since then, but if Transocean can frame a constructive narrative around this raise, it may find similar support although the market’s current constructive risk asset appetite needs to cooperate.

Broader Deepwater Rig Market: As we approach capital budgeting season for the IOCs, some restraint is possible. Any delays could cap dayrate upside by dampening utilization, though that remains to be seen.

Key market item to watch: Petrobras’ Búzios tender. Unlike past tenders with a fixed rig count, Petrobras specified a range of 1–4 multiyear contracts. Outcomes matter: four awards would be excellent for Brazil’s market, three solid, two OK but underwhelming, and one clearly negative. 2-3 rigs awarded Buzios contracts should be good for that market given competing demand from Shell and Equinor. I expect 7G winners to secure dayrates in the upper $300k range—slightly below the recent ~$400k prints but still offering attractive returns. Búzios is a massive deepwater field. Its output adds to global oversupply concerns, but sustaining production requires deepwater rigs. While other tenders are underway globally, the Búzios award will be the headline event to watch

Thanks for all your work and thoughts on this name. I agree with what you are saying but the bigger issue in my opinion is that RIG was very confident on the last call about some new contracts coming through and adding to backlog at attractive rates (especially after losing the work in GOM).. I think the timing of this issue does not bode well for the state of the contracting market. There has been no news on contracts - if that news was coming, my assumption is RIG would have and could have waited to release that before selling stock

Thanks for the update, RIG as well as the entire deepwater sector reminds me of the saying, "The struggle is the glory."