RIG Credit: Deepwater CLO?

A catchy title but very unlikely. Investigating various secured financing options.

In response to questions from Transocean’s Capital Structure, this covers secured debt market options to potentially refinance bonds with heavy amortization schedules and debtor-friendly terms of existing secured debt including (1) Secured High Yield, (2) Term Loan B’s, (3) CLO or CMBS-like structures and others. (This will likely be the last Transocean article for a while)

(1) Secured High Yield Bonds: Transocean’s secured bonds are inefficiently offered to investors: single-asset bonds (Poseidon, Titan and Aquila) amplify idiosyncratic risk and represent over half of RIG’s secured debt. Rolling them into a diversified, multi-rig secured bond would reduce concentration risk and likely ease amortization demands.

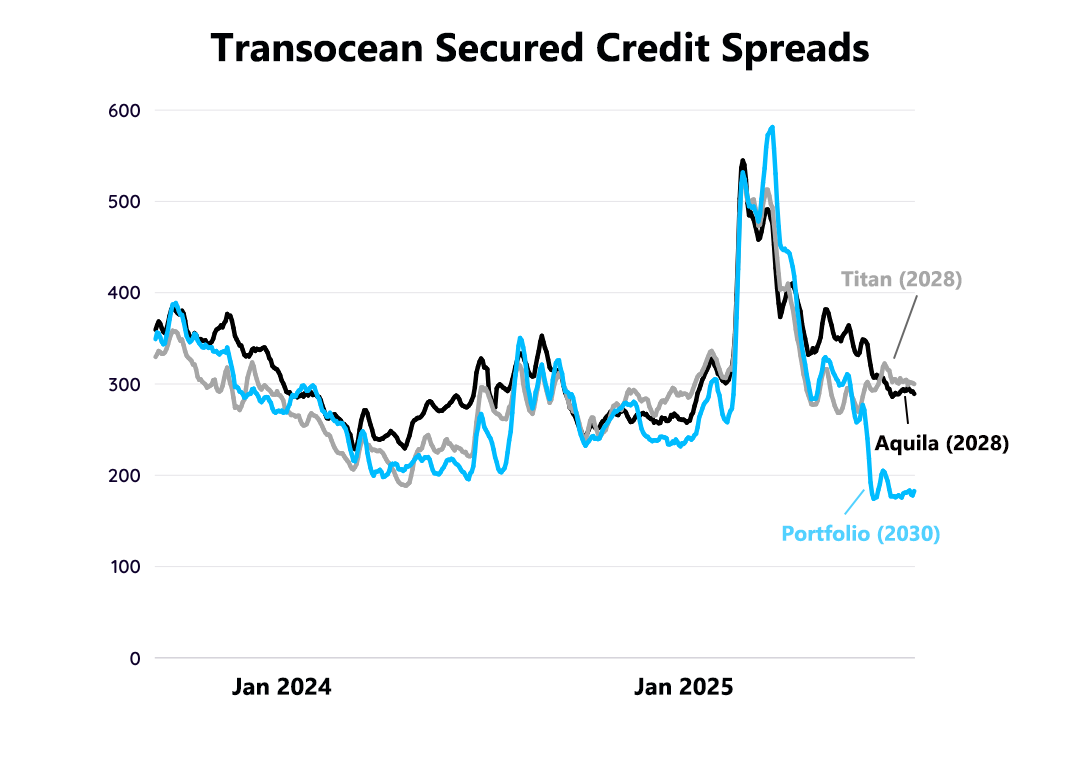

Current trading levels demonstrate investor preference for the diversified Secured 2030s (five collateral rigs) over the single-asset Titan and Aquila bonds. While bond pricing can be choppy, the current market preference is rational and suggests Transocean could win better pricing and terms by consolidating single-asset bonds into a diversified pool.

While info on the $269mm Atlas shipyard loan is limited, the Poseidon, Titan and Aquila secured bonds are now callable. Rolling them into a single, 2030s-style multi-rig secured bond (Pontus/Proteus/Thalassa/Enabler/Encourage) could ease the structure via lighter amortization and reduced debt service reserve/restricted cash.

The collateral rigs are all high specification rigs that competitors do not currently have. At least five rigs securing Transocean’s debt rank comfortably in my global top-10. BP recently exercised a $635k/day option on the 8G Deepwater Atlas (my #2) for 2029–2030, and the 8G Deepwater Titan (my #1) is on Chevron with April 2028 availability. Given scarce 8G supply and leading specs, Titan’s follow-on will command a strong rate.

While secured debt investors with offshore drilling rig collateral may require amortization structures to support Loan-to-Value (LTV) ratios that protect their recoveries, Transocean could also potentially ease this cash flow burden via overcollateralization. In June 2024, Transocean acquired the remaining 67% of the Norge semisubmersible rig it did not already own in a transaction with Hayfin. Transocean conservatively exchanged shares as consideration for the purchase, instead of paying cash. If necessary, adding unencumbered Norge to a multi-rig secured bond would diversify the collateral pool and lower LTV as mitigating factor to support reduced amortization.

Norge is a high-spec, harsh-environment semisub certified for Norway, a designation that typically commands a valuation premium. It also diversifies Transocean’s asset mix: Norge’s demand is anchored in Norway and other harsh-environment markets, whereas drillships like Poseidon and Aquila target benign basins (US Gulf, Brazil, West Africa, etc.). Combining Norway semisubs with 7G+ drillships—as seen in the secured 2030s—yields a balanced package across lower-risk, OECD-weighted geographies debt investors like.

As detailed in the call schedule (above) of Transocean’s secured debt, the Aquila-secured bond’s call protection very rolled off on September 30th and is now eligible to be called at a price of 104, or a 4% premium to par value. While the 2030s are arguably prohibitively expensive to call early, Transocean can now refinance a portion of its secured debt although it is not clear on market receptivity on terms. Considering the secured bonds all trade above par, the investors in these deals may not even want the heavy amortization considering the debt payments are made at par (below the market price).

Separately, Transocean also has a conservatively structured revolving line of credit with covenants, including minimum liquidity ($200mm) and has ten rigs pledged as collateral. In addition to Norge, it appears Transocean also has Norway-eligible semisubs Equinox and Endurance as unencumbered collateral that may also be used in a secured debt offering. RIG may prefer not pledging its crown jewel 8G drillships as collateral (Titan and Atlas) for option value on them long-term.

(2) Term Loan B Market: First-lien, senior secured, floating-rate loans—common in ETFs like SRLN and BKLN—typically carry 7-year tenors, ~1% annual amortization, and largely cov-lite docs. Attractive on paper for Transocean but this market is likely not available to them.

CLOs drive the Term Loan B market—roughly ~70% of demand—and they avoid offshore drillers. Their structures are penalized by CCC concentrations and, especially, defaults, which can trip overcollateralization and/or interest coverage triggers and cut off equity cash flows. Even with wider spreads, CLO structures aren’t built for deep-cyclical risk and without CLO participation, placing a $1–2B TLB would be challenging.

Offshore drillers once tapped the Term Loan B market, but the bankruptcies of Ocean Rig UDW, Seadrill Partners, Pacific Drilling and others left lasting scar tissue with CLO managers. I covered deepwater driller Term Loan B’s for a CLO manager in 2015–2017—it was a bruising stretch.

(3) Deepwater CLO? Very unlikely but I would love it.

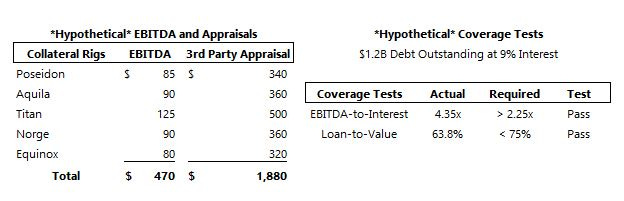

If the secured bond market continues insisting on heavy amortization and other creditor-friendly terms, the ~$70–80B CRE CLO market offers a useful analogue for offshore rigs. In CRE CLOs, pools of transitional/non-stabilized properties are financed on an interest-only basis; amortization is not required unless the pool breaches tests (e.g., interest coverage, overcollateralization), at which point cash is diverted to pay down the senior bonds to support LTV ratios. Borrowers pay up on spread but gain value from the structure’s flexibility.

Deepwater rigs carry risk, but Transocean is asset-heavy with collateral that generates substantial cash flow from predominantly investment-grade customers. As with bank-loan covenants, quarterly trustee-monitored structural tests protect creditors. If a test is breached, excess cash is diverted to amortize debt, delever the structure and protect noteholders.

A key CRE CLO feature is collateral substitution: if a property’s weak performance threatens coverage tests, the borrower may replace it with a stronger asset—so long as the replacement meets defined eligibility criteria and approvals. Applied to rigs, Transocean’s large rig fleet provides a sizable substitution bench, particularly if a few of the 10 rigs currently pledged as collateral to the $510 million revolver are released.

Key drawbacks are ratings and liquidity as the notes would likely be unrated and highly bespoke, limiting secondary-market depth—placing the deal squarely in private credit universe. That said, performance would be transparent, with coverage tests tied to rig-specific, publicly available data.

While unlikely, CLO-style structures offer borrower flexibility that can enhance equity returns. Transocean’s current secured debt is currently not shareholder-friendly. Improvements are likely in the secured high yield market, although if not a structured alternative—akin to CRE CLOs—could deliver the needed flexibility, as the >$70B CRE CLO market demonstrates.

(4) Other Options: Transocean could refinance its secureds with unsecureds, although it would require a deep unsecured bid and appears unlikely. Secured debt sometimes has strings attached to it, making unsecured more preferable although RIG may not be there yet. Sale Leaseback transactions could also be an alternative, although the company’s 10-K notes its secured credit facility places restrictions on these types of transactions.

Summary: I believe Transocean has the capacity to meaningfully improve its flexibility via refinancing transactions, although it will need the high yield credit and oil markets to cooperate.

As Transocean moves toward simplifying its capital structure, it very likely does not want something like a ‘Deepwater CLO’ but this type of financing is designed for borrower flexibility which is what Transocean needs to satisfy its equity investors long-term — its also fun to write about. They can likely achieve better terms via the Secured Bond market where they have an existing investor base.

The simplest way to achieve this appears to be combining its single asset bonds/loans (Poseidon, Titan, Aquila and Atlas) into a diversified collateral bond, and if needed also contributing recently acquired Norge (or another unencumbered rig) to improve LTV via overcollateralization. A lower LTV can justify lower debt amortization payments, offering a path for cash flows to gradually shift from secured debt holders and back toward equity investors after further deleveraging.

Tidewater’s recent equity-friendly refinancing transactions that better enabled share repurchases and M&A optionality offer a template for Transocean. RIG carries more debt because it never filed Chapter 11 so it will be a slower process to return to shareholder distributions, although the company merits credit investor recognition for honoring obligations through a brutal decade.

Transocean has different levels of debt with various covenants that I have not analyzed in depth (DYODD).

Excellent--many thanks!

Great article, Tommy - thanks!