Semisubmersible rigs (“semisubs”) are generally designed for more harsh environments such as the Norwegian Continental Shelf, whereas drillships most often work in more benign conditions in the Golden Triangle (US GoM, LatAM and West Africa). Many differences exist amongst semisubs, notably including eligibility to work in Norway.

The largest market for semisubs, Norway, was viewed as a mature market during the last newbuild cycle 10+ years ago. Accordingly, fewer newbuild semisub orders were made than drillships which foresaw more growth in Brazil and West Africa at the time. As we head into 2025, the Norwegian semisub market is healthy with strong utilization and recent dayrate prints in the mid-$400k’s to low-$500k’s. Semisub eligibility in Norway is a good club to be in but has premium dues (SPS) every five years. Semisubs without eligibility to work in Norway come in different shapes and sizes but are more likely to be idle and earning discounted dayrates due to weaker option value.

Norway accounts for ~40% of warm semisub supply. Norway’s strict standards for offshore rigs leaves a large amount of semisubs ineligible to work in the country. Brazil is the world’s second largest semisub market although the country’s drilling activities are dominated by drillships. Demand for semisubs is scattered across the globe including Australia, UK, Namibia, Gulf of Mexico, Colombia, India, Indonesia and various others.

The Norwegian Continental Shelf (“NCS”) is a mature market led primarily by steady infrastructure-led E&P capex. Norway’s offshore oil production peaked in 2000-2001 at levels nearly 2x higher than current production (1.78 million bpd in October 2024), although natural gas production doubled has since and is an important source of gas for Europe.

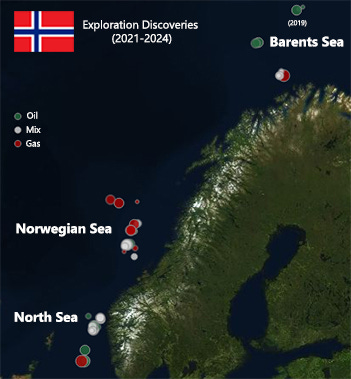

The Norwegian Offshore Directorate published research in 2024 stating Norway’s offshore discoveries over the last 20 years are valued at 3x the costs incurred on a NPV basis. Norway generally does not have headline discoveries, although benefits from a high quantity of smaller discoveries to support lower cost infrastructure-led capex often cited with ~$35/boe breakevens. Exploration drilling is trending positively and is likely to continue in coming years based on Norwegian E&P public commentary.

The Norwegian Continental Shelf (“NCS”) utilizes more than a dozen floating rigs, although drilling in the NCS is predominantly below 500m water depth. Outside of Norway, the vast majority of drillships and semisubs are drilling >1,000m water depth.

Slightly less than half of the warm semisubs in Norway are not capable of drilling in water depths of 1,000 meters. While this would limit their capabilities in most offshore regions, the median water depth of Norway’s exploration wells drilled by semisubs from 2021-2024 was only ~350 meters. COSL has four midwater semisubs operating in the NCS currently, including Pioneer (pictured below). These smaller semisubs generally earn dayrates >$100k less than the larger semisubs although have a place in the NCS market given its relatively shallow water depths.

Transocean, Valaris, Noble and Seadrill receive the most attention in deepwater offshore drilling although are not yet clicking on all cylinders as they mature into a potential long-term growth cycle. Transocean has a good fleet and contract book, although is financially leveraged and does not yet have shareholder returns. Valaris, Noble and Seadrill also have good fleets along with shareholder returns but idle time in 2025-2026 has contributed to near-term earnings momentum concerns.

Odfjell is the least speculative driller in the market. Odfjell’s deepwater semisubs have flexibility work anywhere in the world and are 100% contracted through June 2026 with dayrate appreciation from 2024 levels. The company has repaired its balance sheet and pays dividends with an observable path to growth in 2025 and beyond.

Given strong utilization rates, the Norwegian high spec semisub market is less speculative although has arguably less long-term upside than drillships. If dayrates appreciate further, the market is likely to see a supply response from a stranded newbuild midwater semisub designed for work in Norway.

Unlike most peers, Odfjell did not discharge its debt through bankruptcy during offshore drilling downturn (2015-2022). Over the last three years, Odfjell has paid down $385mm of debt mostly via scheduled principal amortization. Combined with ~30% growth in EBITDA over the same time period, Odfjell’s Debt-to-EBITDA has reduced from >4x to 2.1x at 3Q24. Given Odfjell’s niche focus on harsh environment Semisubs with just 4 owned rigs, Debt-to-EBITDA of 2.1x is not consistent with an investment grade credit rating although their debt leverage is at a healthy level.

After successful deleveraging, Odfjell began paying dividends in 3Q23 with a clear path to a growth in shareholder returns from various sources:

Odfjell’s rigs have a ~20% increase in dayrates contracted in 2025 compared to 2024 levels

Cash flows to debt amortization are expected to gradually transition to shareholder returns

Capex should reduce in 2H25 due to the scheduled completion of the SPS program, although will return in 2029-2030 so may not be best suited for recurring dividend growth

Odfjell is a logical acquirer of assets although has consistently communicated it will be disciplined toward only value accretive opportunities. Acquiring assets also comes with risks tied to those assets’ future performance. Instead of growing the balance sheet with new assets, Odfjell can work towards generating comparatively lower risk, accretive returns to equity by improving the terms and cost of its debt liabilities.

In late December 2024, four exploration wells are underway in Namibia for TotalEnergies, Galp, Chevron and Rhino/Azule (BP and Eni). Two of them are being drilled by semisubs Deepsea Bollsta and Deepsea Mira with the Santorini and Noble Venturer drillships on the other two. Exploration drilling activity in the Orange Basin has been focused on Namibia, although extends into South Africa where exploration drilling likely occurs in the next 12-24 months.

Debate exists regarding semisub and drillship drilling efficacy in Namibia and South Africa. The Orange Basin covers a large area so there is no single answer. Some areas exposed to harsher environments (particularly in winter) may be better suited for semisubs, although higher specification drillships should be capable of most work and have demonstrated success in the region. If/when production drilling begins on Namibia’s discoveries, I expect more drillships to operate in the country although this is partly due to limited availability of capable semisubs. Demand by rig type will depend on where potential developments will be made which is still to be determined.

Northern Ocean owns Deepsea Bollsta and Deepsea Mira, two high specification deepwater semisubs. Northern Ocean recently contracted Bollsta to work in Norway on a multi-year contract for Equinor and TotalEnergies exercised an option to extend Mira by 65 to 93 days after completing the closely followed Tamboti-1X exploration well (still awaiting results). Northern Ocean’s balance sheet has leverage although has made good progress contracting its assets in recent months.

Watch Items and Geopolitics for 2025: (1) Rosebank in the UK, (2) Eastern Canada and (3) the Falkland Islands.

Odfjell’s Deepsea Atlantic is scheduled to begin UK’s Rosebank oil project in 2Q25. If there are any delays tied to politics or court battles, Equinor may use Deepsea Atlantic for work in Norway and potentially crowd out another rig during a potential delay.

Equinor’s Bay du Nord deepwater oil project in Canada has faced delays tied to various factors, including politics. As Justin Trudeau’s influence in Canada is challenged, a new government may emerge more supportive of resource development.

Navitas’ Sea Lion project in the Falkland Islands may be sanctioned in 2025. This project is likely to require a semisub and has been rumored to be a potential landing spot for one of the few stranded newbuild semisubs.

Exploration and appraisal results in Namibia and South Africa will also be important follows in 2025, as well as other exploration activity in the world.

Great stuff! Well researched and organized. You provide big picture context with enough detail for the task at hand. Thanks for making this available!

Great job, Tommy! Lovely and detailed write-up