Upstream reported a rumor of Foresea and Ventura merger this week. These drillers own about 5% of the global fleet so not that relevant outside of modest positive impacts in the Brazilian market. The Transocean and Seadrill rumor reported by Bloomberg in October gets more fanfare. The two global drillers account for >30% of the modern deepwater rig fleet. On paper its a logical combination but there’s complications to a potential deal and it may never happen. If a deal were to occur, it’d be clearly positive for the deepwater rig market that could use a boost in 2025.

Similar to the Noble/Diamond merger in 2024, any potential deal would be heavily share based. Investors sometimes ask the fundamental question, “Why would Seadrill want Transocean shares?”

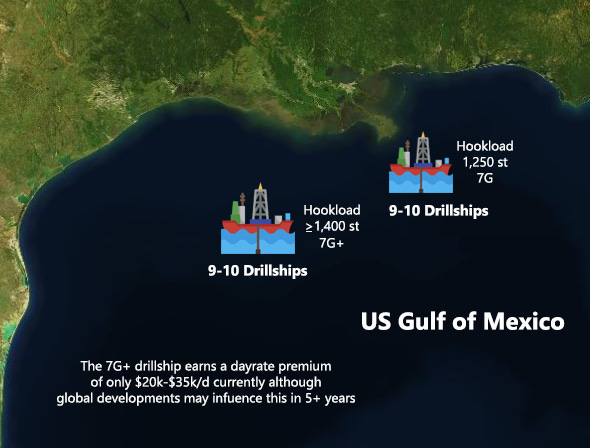

Transocean owns 10 of the highest specification drillships in the world, which includes two 8G drillships with 20k BOP’s (>$600k dayrate market). It also has another seven (7) with 1,400 st hookload operating in U.S. Gulf of Mexico. These are the drillships that printed multiple >$500k dayrates in 2024. The dayrate premium over the standard (yet highly capable) 1,250 st hookload 7G drillship is a modest $20k-$30k/day today, but longer term the 1,400 st hookload may see better demand globally and Transocean owns that market. Seadrill has two quality 7G drillships in US GoM but none with 1,400 st hookload.

Transocean also has three harsh environment semisubs in Norway along with another two in Australia capable of earning a future bid from Norway. Norway is a healthy, stable market with mostly brownfield capex that also sells gas into the European market. Seadrill has no warm semisubs capable of working in Norway.

My Norwegian friends are quick to remind me operating in Norway includes expensive SPS (special periodic survey) every five years, but it’s a stable market with a positive E&P outlook with lower cost infrastructure-led brownfield capex opportunities. Var Energi, Aker BP and Equinor all have projects with breakevens near $35/boe and >20% IRR’s. Odfjell has the top rigs in this market.

US Gulf of Mexico and Norway are mature but lower cost, more stable markets that offer high utilization and market leading dayrates for the highest spec assets. This is what Transocean has in its fleet but Seadrill only has a small taste.

Seadrill’s Share Repurchases

Seadrill has repurchased $431mm of their shares in 2024. Why can’t Seadrill just keep buying back shares? The majority of these repurchases were funded by the sale of three jackup rigs for $338mm (Castor, Telesto and Tecuna). Seadrill’s $81mm of operating cash flow in first nine months of 2024 did not cover its $119mm of capex. Offshore contract drillers can sometimes have lumpy operating cash flows via working capital draws and releases, although Seadrill’s recurring operating cash flows have been constrained by weak legacy dayrates on core 7G drillship assets.

Seadrill is adding cash flows from Auriga and Polaris on 3 year contracts commencing for Petrobras. However, it has recently coldstacked Phoenix, and 6G’s Capella and Gemini are facing competition for work in 2025-2026. The $338mm sale of 3 jackup rigs basically was pulling forward contracted cash flows, so there will be a modest drag on future operating cash flows from that sale.

Legacy 7G Drillship Contracts: Jupiter, Tellus, Saturn and Carina are all 7G drillships that will earn mid-$200k dayrates through at least November 2025 from their legacy long-term contracts. Three of these 7G drillships are likely to be contracted at better dayrates in Petrobras tenders for work in 2026, although Equinor has priced options (ugh) through September 2030 on Saturn’s legacy contract signed in April 2021. Earning strong dayrates on Jupiter, Tellus and Carina contracting opportunities will be important for Seadrill in 2025 to support future share repurchase activity.

Summary: On paper, the rumored Transocean/Seadrill combination that could work for both parties. Both would benefit from meaningful synergies as well as a very diversified fleet. Seadrill gets an obvious fleet upgrade and better contract book with Transocean shares. The shareholder returns would likely stop in the short-term, but Transocean would be getting nearly half a billion of EBITDA along with very low, if any, net debt. This would be deleveraging for Transocean and bring them closer to shareholder returns. A reminder the majority of Seadrill’s shareholder returns in 2024 were due to $338mm asset sale. The question is the valuation of these two companies’ fleets and contract books. I’m sure they have different views on the valuation of their assets, and their balance sheets have some modest quirks that would need to be ironed out.

Deepwater E&P Acreage

E&P’s love to market their assets in big name plays. Growing up in non-IG Oil and Gas credit in USA, I’ve seen a lot mediocre shale E&P’s brag about their Bakken, Permian, Eagle Ford and Marcellus plays. Not all acreage is the same in-basin and debt markets begin pricing these material differences in down markets.

Namibia is not the only deepwater exploration market in the world, but it gets the most headlines. It also has numerous concurrent exploration programs with more to come. These exploration and appraisal wells are seeking the find the best acreage in this potentially prolific basin. There will be surprises along the way, both good and bad. That’s wildcatting. Not everyone can be Harold Hamm.

The Bakken Shale (North Dakota, USA)

The picture above notes varying pressure across the Bakken shale in North Dakota. Go 95 kilometers in any direction away from central McKenzie county and nobody is earning truly accretive returns on shale E&P capex. The distance between Galp’s Mopane discovery and Shell’s acreage (recent write-downs) is approximately 95 kilometers. While still within the Orange Basin, reservoir characteristics can change materially over this large of a distance. That’s why they drill exploration and appraisal wells.

Shell made various comments on its 1Q24, 2Q24 and 3Q24 conference calls regarding a “complex” reservoir on its “challenging acreage” before recently writing down its discoveries in Namibia. Specifically, Shell noted concerns about the mobility of the oil and gas molecules in the reservoir, or low permeability. Shell affirmed the substantial resource size, but its low permeability appears to have played a material role in the recent write-down.

Nearly 100 km to the north, Galp has made more positive comments on its Mopane discoveries’ permeability in PEL 83 specifically noting “high” or “good” permeabilities on three separate press releases (April 21, 2024; Mopane-1A results and Mopane-2A results), as well as direct comments on its 1Q24 and 3Q24 conference calls. Based upon public communication in numerous instances, the permeability challenge related to Shell’s write-down does not appear applicable to Galp’s Mopane discoveries.

Beyond good permeability, Galp’s discoveries have noted “good porosities", “high pressures” as well as low viscosity characteristics with minimum C02 and no H2S concentrations. Galp has only provided a “10B boe or higher” in-place resource estimate and has not guided on recoveries, although its reservoir characteristics appear to be above average based upon the public releases. Galp’s light oil discoveries also come with associated gas that will have its challenges although reinjection appears to be a likely solution in early years of potential development(s). Still more to learn from this active exploration and appraisal program.

That’s the look on Patrick Pouyanne’s face seconds after he described TotalEnergies’ current Tamboti-1X exploration well in Namibia before drilling began in October. Answering an analyst’s question, he called it an “elephant” prospect. “It’s a billion (barrel) target alright,” before stating optimism has its risks in exploration. Results should be available soon. I sense pessimism on Namibia E&P after Shell’s write-down and Chevron’s Kapana-1X miss, but Namibia’s exploration results to date had been unsustainably strong success rate near 80%. There’s no shortage of future exploration targets in the Orange Basin.

It's the Gulf of America now, Tommy 😂

Interesting as always, Tommy!

Coincidentally I was researching Sintana Energy ($SEI) right before reading your post. They have small stakes in PEL 83 (Mopane) and PEL 90 (Kapana-1X) which you both mentioned. As well as PEL 87 (Saturn) and some others.

Have you ever looked at them? The stock has seen a recent drop on the Kapana miss. Although management still seems optimistic. Does that miss materially lower their chances in PEL 90?

Besides that PEL 83 alone could be worth more than their current market cap. 10B of barrels with 30% recovery rate and $2.5 per barrel would be ~$1.2 per share (current price is $0.72). Or do any of these numbers seem too optimistic?

I'm also not sure how long these thing usually take till monetization. Cash burn isn't too bad but opportunity cost could be a factor.

If you have any insights I'd love to hear it.

There was a write-up on VIC for more background: https://www.valueinvestorsclub.com/idea/SINTANA_ENERGY_INC/5477107705/messages/228965#description

And their corporate presentation: https://sintanaenergy.com/wp-content/uploads/2025/01/sei_corp_presentation_jan24.pdf