Stayin' Alive in '25

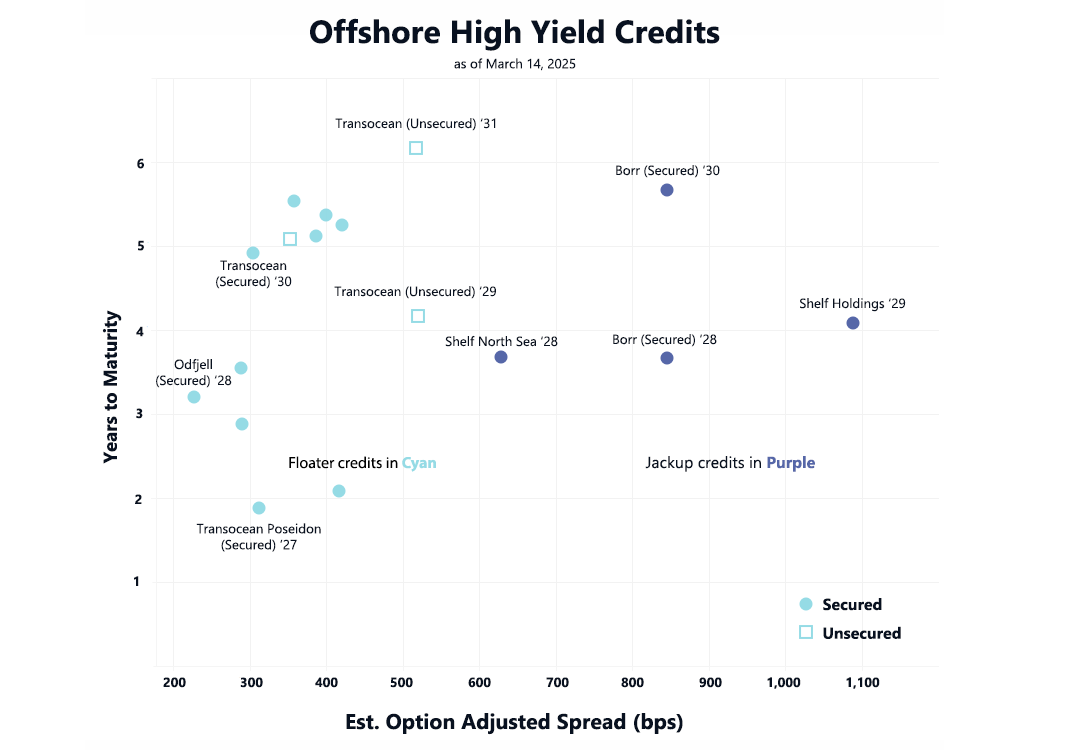

Offshore high yield markets are pricing the traditionally stable jackup rig issuers as riskier credits than deepwater floaters. Why?

Weakening risk asset sentiment and oil prices have contributed to credit spreads widening by 150-280 bps on some offshore high yield credits from levels seen two months ago, although there's no apparent solvency crisis for 2025. Shallow water jackup rigs are historically more stable rigs than deepwater floating rigs (“floaters”), although the high yield credit markets are pricing the traditionally more stable jackup rig issuers as riskier credits. Why? Specifics tied to the nature of rig demand matter. Approximately 9-10% of active jackup demand in 2023 was tied to Saudi Aramco’s 1 million bpd capacity expansion plan from shallow water, which is levered to meaningfully higher crude oil prices.

In the first half of 2022, when Brent crude oil prices exceeded $100 per barrel, Saudi Aramco initiated tenders for additional jackup rigs to support its capacity expansion from 12 million to 13 million barrels per day (bpd). Aramco had produced up to 11 million bpd that year. This expansion increased the shallow water jackup rig count from the low 50’s to approximately 90 rigs, representing 9–10% of total active supply. Coupled with rising global demand elsewhere, Aramco’s program significantly tightened the jackup market, driving dayrates from below $100,000 to the upper $100,000s by late 2023.

In response to weaker oil prices, during the first quarter of 2024 Saudi Arabia’s Minister of Energy directed Aramco to maintain capacity at 12 million bpd, effectively reversing the incremental demand for 9–10% of the global active jackup rig supply. Consequently, Aramco announced multiple rounds of jackup rig suspensions, expected to offset nearly all demand growth tied to the 13 million bpd expansion program. While most suspensions have been disclosed, a few additional rigs may still receive suspension notices. It’s unlikely this demand returns until crude oil prices are meaningfully higher given Saudi Arabia’s existing spare capacity appears more than adequate.

The jackup rig suspensions released a significant number of rigs into the market within a short period. While some have been re-contracted, many are still seeking work in various regions. Unlike the floater market, the jackup sector is more fragmented, with smaller players contributing to competitive bidding and potential dayrate pressure. The market is still absorbing this supply with further price discovery on dayrates and margins ahead.

Deepwater floater demand has experienced delays for multi-year development drilling projects, but no project cancellations or rig suspensions. Deepwater E&P capex tends to be longer-cycle with longer lead times than shorter-cycle projects demanding jackup rigs. Additionally, while all deepwater projects are unique, most of them work with Brent at $65 and futures curve hedging allows IOC’s to look in these prices.

The credit markets are demonstrating a more constructive on deepwater floater demand outlook. Idle time for 2025 is a reality but we’ve had positive news from Sub-Saharan Africa regarding future multi-year drillship demand from Cote d’Ivoire, Nigeria, and Mozambique in recent weeks. Slow emergence in West Africa has been a problem for 7G drillship demand in 2025 but recent weeks have provided “green shoots” of future demand in this important market.

Cote d’Ivoire: Some optimism exists that Deep Value Driller (7G drillship) may extend work in Cote d’Ivoire when its current program completes. In addition to Eni’s potential appraisal work on the Calao discovery of 2024 (and longer term Baleine Phase 3, Murphy has a three-well exploration program in the country to begin late 2025 and VAALCO has a development drilling program with 2026 commencement. Murphy’s upcoming exploration program will be a key follow.

Nigeria: TotalEnergies out with tender for work in Nigeria as soon as 1Q 2026. Other major IOC’s have development projects in Nigeria that likely have commencements in 2026-2027 although timing is uncertain.

Mozambique: This week TotalEnergies’ Mozambique LNG project received approval on external financing, an important step in a long-awaited potential FID. ExxonMobil’s Rovuma LNG project is also a potential FID in 2026. Security conditions have improved in the Cabo Delgado region. This is a potential multi-drillship market.

A key catalyst to watch for the drillship market will be potential project awards with multi-year terms, particularly in Africa, East Med and SE Asia. Dayrates are obviously a key follow, but contract term will be very important. While idle time is a problem in 2025, the delays are for multi-year drilling projects that should reduce future idle time concerns.

While we likely see more scrapping of floaters in 2025-2026, this is expected to be relevant to mostly lower tier rigs which is not expected to include warm 7G drillships. Not immune to idle time in 2025, 7G drillships are efficient offshore drilling rigs that remain in demand as evidenced by recent optimism tied to Deep Value Driller’s contracting outlook in Cote d’Ivoire along with Saipem’s potential purchase option of $300mm for the rig.

Saipem’s purchase option of $300mm will be a key watch for valuation purposes, although Saipem’s proposed merger with Subsea7 may complicate exercising this purchase option. Importantly, Deep Value Driller is a very similar 7G drillship to some 7G’s in Valaris and Noble’s drillship fleet.

The secured jackup bonds have meaningfully wider credit spreads than Transocean unsecured debt, mostly a reflection of (i) relative weakness and/or uncertainty in jackups tied to the Saudi rig suspensions, (ii) this 9-10% of total active supply’s leverage to sustained >$85 Brent prices if/when Saudi Aramco seeks to grow capacity, (iii) Transocean’s strong contract backlog that supports visible deleveraging through 2026 and (iv) concerns tied to Pemex and its jackup demand and payments. Further, Valaris, Noble and Seadrill bonds are all trading well showing support for deepwater floater outlook. Transocean’s secured bonds have traded resiliently thus far, although unsurprisingly the unsecured bonds have sold off a few points in recent weeks as PM’s de-risk on energy credits on recent oil price weakness especially considering Moody’s “Caa1” rating on RIG unsecured debt (whether you agree or not).

Jackups work on shorter cycle projects and while Borr has some rigs contracted into 2026, the driller’s 2026 contract book fairly open. Accordingly, Borr’s contracting for 2026 will be a key follow in coming quarters. On its 4Q24 conference call, Borr noted leading edge benign environment jackup dayrates were in the $120k-$130k range although also noted a recent $150k award in West Africa. Borr’s jackup fleet is high quality although the current market is competitive in benign jackups.

The chart above implies a linear relationship to Borr’s full year EBITDA based on market dayrates (EBITDA = 8.34*(dayrate) - 519.8) with an assumption of 95% utilization. Considering the amount of supply that has hit the jackup market from Saudi rig suspensions, an 85% utilization rate may be more appropriate to underwrite.

Borr’s fixed uses of cash include approximately $400mm/year of capex, cash interest and principal amortization. While an estimate subject to other variables, Borr needs dayrates of approximately $115k/day at 85% utilization to cover fixed cash uses in 2026 (~$400mm EBITDA). It may need higher dayrates to support its current dividend. This also assumes cash collections which have been a challenge recently with Pemex in Mexico. In its February 2025 fleet status report, Borr noted five of its jackup rigs were utilized by Pemex in Mexico making this a relevant watch item on Borr’s cash flows and liquidity (EBITDA does not equate to cash collections). Borr recently did a good job on a recent factoring arrangement to support cash collections from Pemex A/R. While the fallout from the Saudi jackup rig suspensions may be beyond its control, I believe Borr has a good management team. More work to be done.

Borr’s secured notes have structural protections, including but not limited to, a cash sweep and required ~7% annual amortization at par. Given the Borr secured bonds trade below par, the required semi-annual amortization at par is a nice protection for bond investors buying the debt below par (current dollar price is ~94). Borr also has a $150mm super senior revolving facility.

Shelf Drilling Holdings’ secured bonds traded at the widest credit spreads, likely due to its older jackup fleet. While Shelf has some good term on its jackup rigs (including its older rigs), it arguably has more exposure to higher crude oil prices longer-term given its fleet. The Shelf North Sea bonds are secured by premium harsh environment jackup rigs which are more immune from the Saudi rig suspensions.

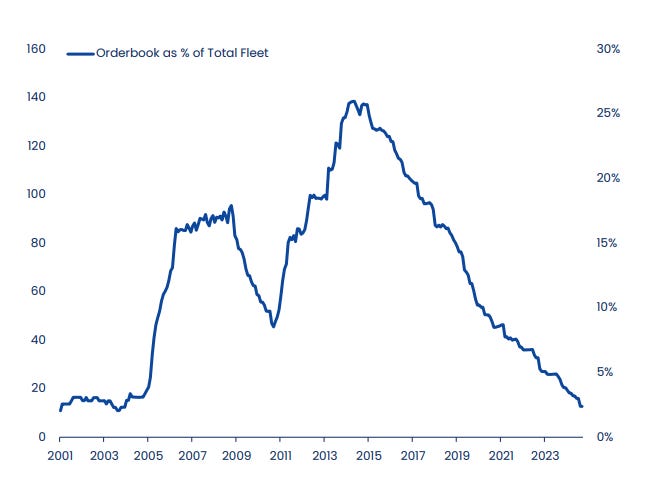

There is no denying offshore credit has a poor history. I’m very aware of it from my experience in 2015-2016. Some investors will never find this industry attractive and that is respectable. However, the major difference in today’s market vs. the peak distress in 2016 is the orderbook is substantially better than it was in the last cycle which should be supportive for quality assets. Buying offshore bonds at or near par exposes investors to downside risk in a volatile industry, although the lack of new supply entering the market will provide support unlike in the last cycle when the story was the exact opposite.

Good article. What can I say? If it was easy, anybody could do it…😎

Given recent volatility, if shit hits the fan and oil crashes, how secure are the backlogs?

Can the IOC's weasel out of the contracts ?

Also, people keep talking about expected scrapping in 2025 or 2026. So why were these not scrapped alredy? why pay for warm/cold stacked for several years, only to scrap them at the end?