RIG Credit: June 2025 Update

Contracting Outlook, Credit Spreads and 20k psi Deepwater Oil

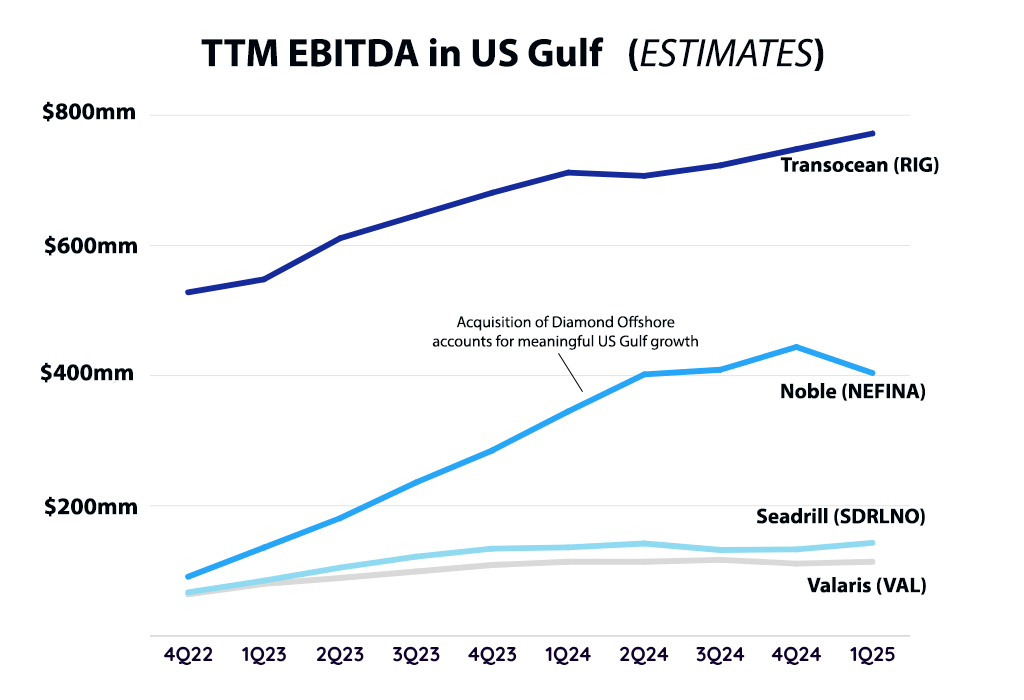

Since the April 30, 2025 article (“RIG Credit: Dayrate Duration”), risk assets have rallied, including Transocean’s publicly traded debt. As shown below, RIG’s priority guaranteed unsecured bonds tightened 185–220 bps in May. However, credit spreads remain wider than pre-Liberation Day levels, weighed down by oil price pressure from OPEC+ supply increases. My views on OPEC+ and its impact on the deepwater market are outlined at the end of this article.

Transocean’s debt has outperformed peers like Borr and Shelf, largely due to its stronger contract book, with 2023–2024 fixtures supporting cash flow and deleveraging through 2025–2026. The $655 million unsecured notes due February 2027 rallied ~220 bps in May and remain a key focus, though maturity is over 20 months out. Repayment options exist but may hinge on capital market conditions in 2025–2026.

Transocean has different classes of unsecured debt. In this article, I am only referencing the “priority guaranteed notes”. Transocean also has “legacy guaranteed notes” which are arguably one step further away from the cash flows of certain subsidiaries. Due you own due diligence on the structures.

Contracting Watch Items:

(1) As Transocean’s 7G Skyros (2013) concludes its work in Angola this September for TotalEnergies, it is one of a few warm drillships potentially available for two upcoming contracts in Cote d’Ivoire. (i) Murphy Oil’s three-well exploration campaign from 4Q25 to 2Q26 and (ii) VAALCO/CNRL’s Baobob Phase 5 program set to commence in mid-2026. The two jobs appear to have minimal downtime between them. VAALCO/CNRL is expected to award the rig contract in 2Q25. *EDIT on June 5, 2025* While not yet officially disclosed, Valaris’ recent DS-15 award in West Africa may have been this VAALCO/CNRL job. With most drillship demand expected to pick up in 2H26 and beyond, competition remains high for work commencing in the next 12 months. As a lower-spec 7G unit, Skyros is likely to be bid more aggressively (below $400k) than RIG’s premium fleet provided its eligible for work on these programs given Skyros has only 1 BOP.

(2) In the US Gulf, Transocean has 7G+ Proteus, 7G+ Asgard and 7G+ Conqueror with availability beginning from May 2026 through September 2026. Noble’s Voyager appears to have taken Shell’s work from Proteus, although the US Gulf is a large market with generally steady demand for high specification drillships. Transocean has a fleet of nine (9) high spec drillships in the US Gulf with a good operating history for major IOC’s and E&P’s. There may be some idle time in 2026, although these are marketable drillships that also likely have demand internationally for emerging ultra-deepwater projects. Venus?

(3) On its 1Q25 call, Transocean disclosed its harsh environment semisub Equinox (2016) had two of its options recently exercised at $540k for June 2026-August 2026, representing ~$23mm of EBITDA (estimate). Equinox has an additional dozen options at $540k through September 2027 for work in southern Australia. Transocean also noted 7G+ Asgard on its call regarding future work, although details were not clear.

(4) Future Contracting Watch Item: The proposed “One Big Beautiful Bill” would mandate at least 30 future lease sales in the U.S. Gulf through 2040, lower royalty rates, and streamline permitting. Under the prior administration, offshore lease sales in the US Gulf were frustratingly delayed due to a leasing pause, environmental reviews and legal challenges. While effects would be longer-term, the legislation represents a clear positive for offshore contract drilling, with Transocean poised to benefit most given its significant Gulf presence.

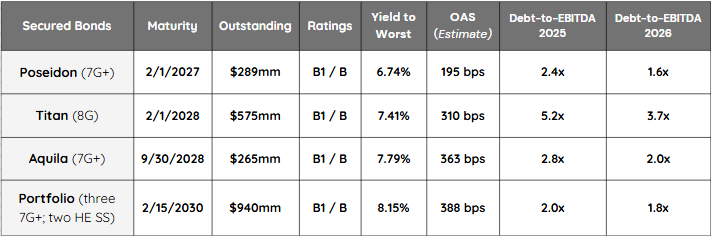

Secured Bonds: As of May 30, 2025, Transocean had $2.07B of secured bonds outstanding, including three single-asset bonds (Poseidon, Titan and Aquila) and one bond collateralized by a portfolio of five deepwater floaters (Pontus, Proteus, Thalassa, Enabler and Encourage). I believe these bonds have very low risk of impairment due to strong collateral and structure.

The rating agencies were lazy and assigned the same B1/B ratings to all four secured bonds, although I believe the 2030s are the strongest credit with a diversified portfolio of rigs in the US Gulf and Norwegian Continental Shelf (NCS).

Transocean’s scheduled debt reduction of $400-$500mm/year is heavily weighted toward paying down secured bonds via scheduled amortization. While the debt reduction is positive, the secured bonds are Transocean’s lowest cost of capital. At time of issuance, these secured bond investors required fairly aggressive amortization to support credit metrics such as Loan-to-Value and Debt-to-EBITDA on single asset bonds with naturally higher idiosyncratic risk.

Transocean has room to optimize the terms on its secured bonds, though meaningful refinancing optionality likely opens in February 2026, when the Titan notes' make-whole call steps down from 104.2 to 102.1. In future secured bond issuances, using multiple rigs as collateral rather than a single asset may be a way to reduce required principal amortization, which currently represents a significant use of cash.

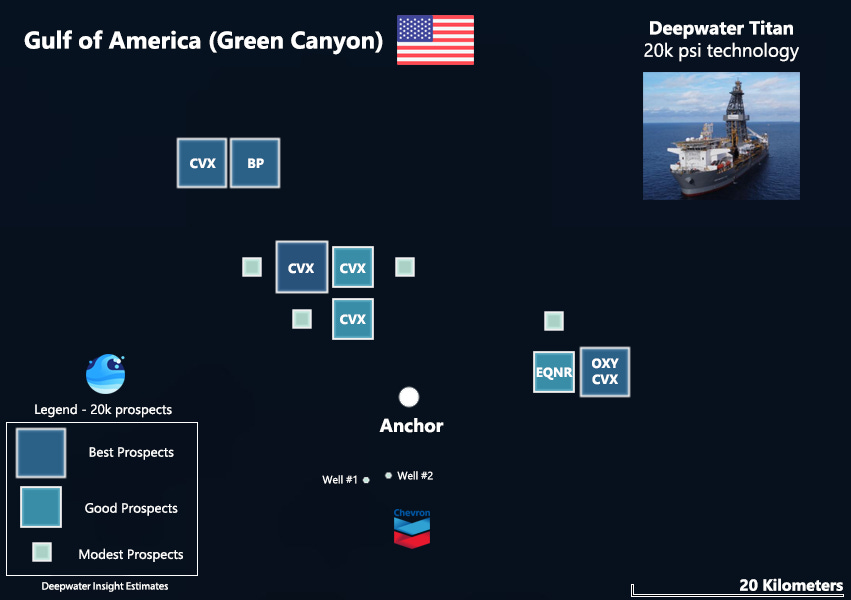

At >5x Debt-to-EBITDA, why are Transocean Titan notes rated B1/B? Titan is the highest-spec drillship globally, equipped with a 1,700 st hookload and dual 20k psi BOPs. With only 1–2 comparable rigs worldwide, it commands strong pricing power. Demand is supported by the growing adoption of 20k psi completions, with at least four operators reaching FID and additional interest emerging both in the U.S. Gulf and internationally.

Chevron’s Anchor project, the first to deploy 20k psi BOP technology, achieved first oil in August 2025 and is producing over 30,000 bpd from its initial wells. On its 1Q25 call, Chevron signaled potential for a Phase 2. Additional nearby prospects and other potential developments across the U.S. Gulf further underscore the area’s growth opportunity.

With few 20k psi-capable drillships and very high upgrade costs, this is not a shale-scale breakthrough in terms of production potential, but it remains a high-return investment for IOCs and E&Ps with strong future potential.

OPEC+ Supply Hike: On May 31, 2025, OPEC+ agreed to raise output by 411,000 bpd for July, totaling a 1.37 million bpd increase since April. While bearish for short-cycle non-OPEC+ supply, deepwater rig demand is generally more influenced by longer-dated futures pricing, given the long-cycle nature of E&P capex.

U.S. shale, with its short-cycle nature, is highly sensitive to spot pricing. As of May 30, 2025, WTI trades at a $2.70/bbl discount to Brent. While shale production can begin within months of investment, deepwater projects typically take several years from FID to first oil demonstrating more sensitivity to futures prices than spot.

The current contango in the Brent curve signals a smaller relative impact on the deepwater market, as longer-dated futures have held up better than spot. While this supports some resilience in deepwater capex, lower oil prices still reduce IOC and E&P cash flows and pressuring budgets. Despite recent oil price weakness, we have yet to see projects pushed back meaningfully as deepwater projects are less flexible than US Shale. We may see a greenfield project face delay depending on how oil trades in coming months, although project cancellations appear quite unlikely as they tend to be some of the highest returning projects to replace IOC’s reserves. Many deepwater projects are brownfield that leverage off existing infrastructure to reduce costs.

In April 2025, the oil market faced bearish pressure from rising OPEC+ supply and heightened recession risks tied to U.S. protectionist trade policies. Since then, while OPEC+ supply has continued to grow, demand concerns have eased as the U.S. has softened its trade stance and signaled willingness to run large fiscal deficits (>6% of GDP), supporting near-term economic growth and demand for crude oil.

Thanks Tommy. At market pricing currently are you a bigger fan of the debt or the stock itself at these levels?

Great piece as always, thanks Tommy.