Outlook 2025: Offshore Credit

Floaters, Jackups and an E&P

“There’s no such thing as an investment grade offshore driller,” a major rating agency told me in 2015. This quote proved to be true for at least the next decade. In 2015 the offshore contract drilling industry was staring at a large new orderbook that would be delivering 7G drillships into a very poor demand environment for years to come. Many offshore drillers eventually filed for bankruptcy due to various factors including (i) IOC’s favoring short-cycle US shale capex that contributed to lower global oil prices, (ii) comparatively weaker demand for less flexible deepwater E&P capex as well as (iii) overleveraged balance sheets and an inability to fund newbuild deliveries from shipyards.

A lot of debt investors completely swore off financing offshore drilling rigs and OSV’s after the bankruptcies. The CLO market (~$1T in size) used to be involved >10 years ago, however now has nearly zero appetite and it will very likely stay that way. I get it — debt investors have limited upside and heavy downside. However, closed-mindedness of many may present some energy credit opportunities.

In 2025, the credit outlook is much better for offshore drillers than in 2015. Yes, the chapter 11 bankruptcies obviously reduced debt, but the lack of capital expenditure outlays tied to new rig deliveries materially helps future free cash flow profiles. While not immune from cyclical IOC capital spending trends, the absence of newbuild deliveries and relatively low levels of maintenance capex are supportive of free cash flow generation.

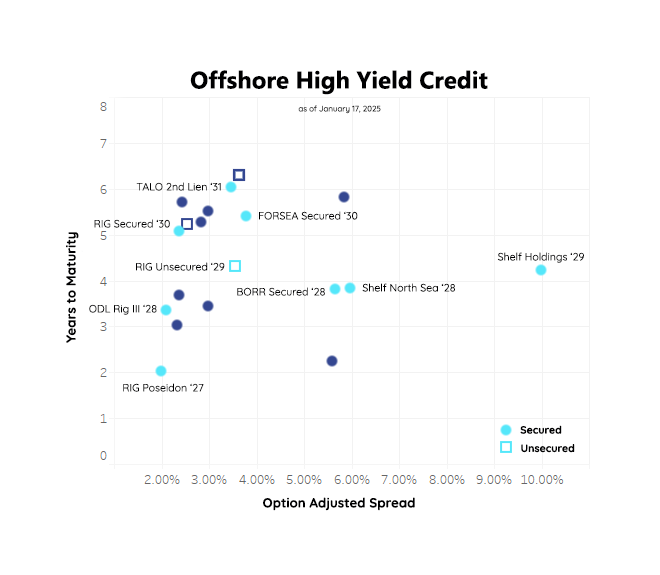

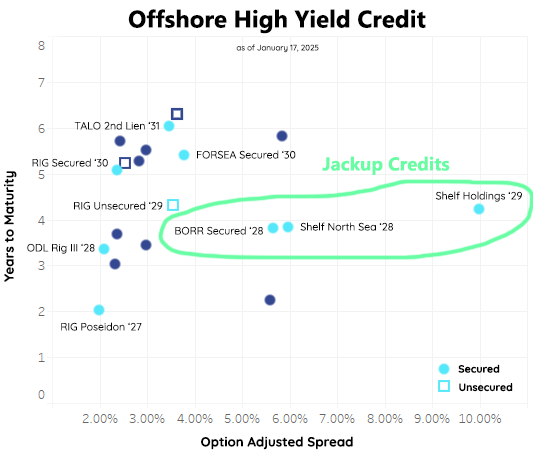

High yield is an expensive asset class as of January 2025. Offshore drillers may not currently offer credit some PM’s enough spread to get their attention, but some of the credits are strong.

If I had to bet my life on not losing principal my two favorites are:

Odfjell Rig III 2028s (1st lien): Very strong collateralization. The $330mm bond is secured by semisubs Deepsea Aberdeen and Deepsea Atlantic which have favorable long-term outlooks as top tier semisubs in the Norwegian Continental Shelf. Debt-to-EBITDA is ~2x.

Transocean Ltd 2030s (1st lien): Very strong collateralization. The ~$1B bond is collateralized by Thalassa, Proteus, Pontus, Enabler and Encourage. All five collateral rigs are high specification, modern rigs, although Enabler and Encourage are more niche midwater semisubs designed primarily for the NCS.

If you are open to emerging market borrowers, FORSEA 2030s (1st lien) offer more spread (~370 bps) but are collateralized by 6G rigs in Brazil. Transocean’s sale of idle rigs Inspiration ($147mm) and Development Driller III ($195mm) in summer 2024 was a positive readthrough given similar asset quality in Foresea’s five 6G rigs collateralizing the $300mm bond.

Transocean’s ~$6B of High Yield Bonds

Transocean’s debt includes ~$3.7B of unsecured (two different classes), ~$2B of secured (different rigs) and ~$550mm of convertible bonds. There’s a lot of unique credit risk to price in their capital structure. Given their contracted backlog, Transocean has a positive outlook on its credit. While Transocean is a 100% deepwater driller, it has a well diversified fleet of drillships and harsh environment semisubs operating in various regions across the world, notably including US GoM, Brazil and Norway. It also done a good job contracting its assets (see below):

While Transocean’s equity performed poorly in 2024 (as did other drillers), their unsecured debt traded well. Transocean raised $1.8B of unsecured debt in April 2024 and traded comfortably around par throughout the year. What accounts for the difference?

High yield investors underwrote the backlog (see chart above) with visible free cash flow growth from contracted assets.

Equity traded off more near-term industry outlook on next twelve month earnings, as well as oil price sentiment.

I believe Transocean is also more debtor-friendly at this time. Transocean’s debt structure requires between $420mm and $500mm of annual scheduled principal amortization. At current equity valuations, this would translate to an 11%-14% dividend yield if those cash flows were instead paid to equity but Transocean has more deleveraging to do to facilitate these shareholder returns. Acquiring Seadrill would accelerate this deleveraging. Odfjell Drilling was in a similar position two years ago but has since deleveraged enough to begin dividend payments and is currently reducing principal amortization in its debt.

Deepwater Dayrate Outlook: Expect variance by region and driller in 2025. I expect dayrates for the higher spec rigs in the US Gulf of Mexico and Norwegian markets to demonstrate better resiliency than in West Africa where competition appears greater. SE Asia is a growth region although may also be more competitive in the near-term. In 2024, price discipline held in well although 1-2 offshore drillers may seek to avoid idle time in 2025 and accept weaker economics that other drillers would not. Delays in the deepwater market have made idle time a reality for some rigs in 2025 but outlook appears positive with likely growth markets in Nigeria, Suriname, SE Asia, Namibia, Cote d’Ivoire and others.

Jackup Credit Underperformance in 2024

Saudi Aramco suspending the contracts of nearly 30 jackup rigs (under 10% of global supply) in 2024 weakened the shallow water jackup market. As these jackup rigs seek alternative work, there’s likely to be dayrate pressure which has contributed to weaker performance in jackup-focused credits.

Shelf Drilling’s debt currently offers the greatest upside with its 2029s trading in the mid-to-upper 80s. However, Shelf Drilling Holdings’ jackup rigs securing this bond are generally older rigs. Shelf Drilling North Sea’s collateral jackup rigs are higher value, although given the 2029s (different borrower and collateral) trading in distress, the company may be at greater risk of a liability management exercise and therefore indenture reviews are a critical part of the credit work. DYODD.

If the jackup supply pressure from Saudi Aramco rig cancellations persists, it is most likely to crowd out the oldest, least efficient rigs. If you’re bullish oil prices and expect Saudi Aramco to begin increasing oil production via shallow water, Shelf is a less risky credit.

Borr has ~$2B in debt, including its 2028s (secured) offering a YTW of ~9.7% and estimated OAS in the mid-500 bps. Borr’s debt trades cheaper than Transocean’s due to (i) rig availability in 2026 and beyond, (ii) dayrate pressure from suspended jackup rigs, (iii) recent challenges in Mexico with Pemex (follow the receivables) and (iv) a $180mm super senior revolver.

I don’t model E&P demand for shallow water jackup rigs because I think the long-term trend on deepwater FID’s from impact exploration success is more positive, although I believe Borr’s jackup rig fleet is the best in the industry.

Borr’s jackup fleet screens positively on paper. Borr’s fleet status report also notes meaningful availability in 2026 and beyond. I expect Borr’s future contracting opportunities to be better given its fleet quality, although execution in contracting is what generates the cash flows and remains to be seen for 2026 and beyond.

E&P High Yield: Talos Energy, a US Gulf of Mexico focused E&P with ~$1.2B of HY debt, announced successful drilling results at the Katmai West #2 well in the Ewing Bank area this week with Seadrill’s West Vela 7G drillship. Talos will next drill the Daenerys exploration well in the Walker Ridge area which has impact potential.

Great update. What do you think the odds are of RIG buying SDRL? What would SDRL want? Any other M&A bets this year before things pick up again in ‘26? Thanks