The outlook for drillships in 2025 is influenced by the specifications of each rig and the regions of the world where its marketed.

The 7G+ Drillships are mostly in the US Gulf of Mexico (US GoM). These are generally the highest specification drillships and account for the >$500k dayrate awards announced in 2024. For simplicity, the 7G+ group also includes Titan and Atlas (8G). Transocean’s 7G+ drillship fleet has a 93% utilization at an average $482k dayrate contracted in 2025.

While the standard 7G drillship is still a quality asset, the 7G warm fleet faces modest idle time in 2025 partly due to its exposure to slower to materialize demand in West Africa. 7G drillships are mobile and can work in various markets across the world, although the 7G+ rigs benefit from marketing advantages in the higher spec US GoM and more stable infrastructure-led demand supporting high utilization.

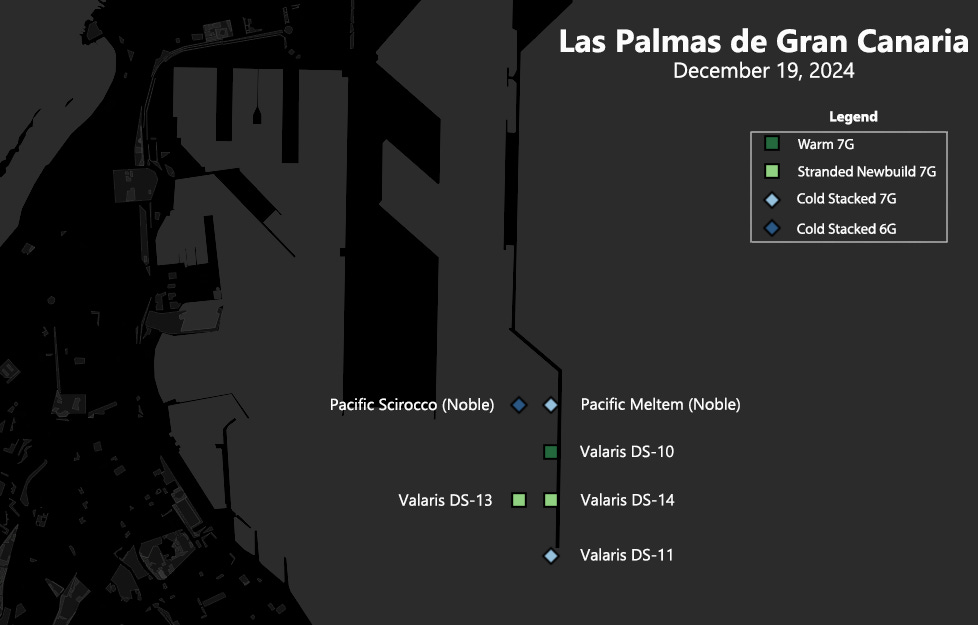

The standard 7G drillship announced various contract awards with clean dayrates in the mid-to-upper $400k’s in 2024. While dayrates have held in strong, the port of Las Palmas currently offers an illustration of challenges in the drillship market in 2024. The port currently hosts six (6) uncontracted drillships with varying levels of marketability, or two to three more than hoped twelve months ago. Specifically, these three are Valaris DS-10, DS-13 and DS-14.

In December 2023, Valaris exercised attractive purchase options on DS-13 and DS-14 for $337mm total, two stranded newbuild 7G drillships originally ordered a decade prior. While DS-13 and DS-14 wait on work with acceptable economics, they were joined in Las Palmas by DS-10 after the 7G drillship completed its work in Nigeria this summer.

DS-10 is most likely to be the first of the group to find work given its warm stacked status. DS-13 and DS-14 would be next to follow with the two coldstacked 7G’s (DS-11 and Meltem) unlikely to figure into any contract awards in 2025.

The market has cleared various stranded newbuild 7G drillships in recent years, most recently Tidal Action (fka West Libra) into Brazil. In 2023, Eldorado’s Zonda and Transocean’s Aquila were also awarded contracts into Brazil. However, Eldorado also has the Dorado and Draco 7G drillships looking for work.

Demand Delays: “Pushed to the Right”

The drillship market is waiting for development drilling opportunities with multi-year term. Stranded newbuild 7G drillships require meaningful activation costs (~$100mm) and will only be activated for multi-year term work. Those take longer to materialize. Delays on FPSO deliveries have contributed to slower contracting. FPSO’s can be multi-billion dollar vessels with multi-year construction lead times. Additional delays have been related to equipment supply chain challenges, as well as FPSO financing availability.

IOC’s are allocating more to shareholder returns than they did in the 2010-2014 upcycle. In many cases, Deepwater E&P capex is one of the highest returning investments IOC’s have on its capital budgeting menu although dividends are also expected by investors.

While Brent at $73/bbl is generally a good price for deepwater projects, the oil market has felt soft in 2H24. Uncertainty regarding global oil supply and demand has reduced the urgency for E&P projects, however we’re gradually seeing more deepwater projects sanctioned with a strong pipeline for years to come.

Further good news is a portion of the demand delay is attributable to the large dollar, multi-year nature of these deepwater projects with various partners. Approvals through multiple capital budgeting processes naturally take more time although these multi-year investments also demand multi-year drillship contracts.

Rig Supply and Demand in 2025-2026

The market currently has a couple warm, idle 7G drillships (DS-10, Noble Voyager) bidding for work, in addition to 4-5 stranded newbuild and 3-5 coldstacked 7G’s. My Outlook for 2024 stated this sidelined capacity needs to mostly clear before 7G dayrates can sustainably approach the $600k dayrates of the last upcycle. The market has not moved much closer to clearing this sidelined capacity over the past year.

Nigeria has numerous deepwater projects with major IOC sponsors that were slow to materialize in 2024, although this week Shell sanctioned Bonga North albeit with unclear timing. ExxonMobil’s $10B Owowo project made news in September and there are a couple other deepwater projects in Nigeria. Countries such as Suriname, India and others in SE Asia are likely to be sources of incremental floater demand in the next 12-24 months. However, FPSO and equipment delays will be an important watch.

The problem drillships have is the carry cost while idle. An offshore rig incurs warm stacking costs when idle with no revenue. While offshore rigs await production equipment delivery, they need to work or face warm stacking costs. The market has demonstrated price discipline thus far, although we may see an example or two testing it in 2025.

Various regions across the world have exploration programs for 2025 that can serve as bridges to longer-term work. However, some 6G rigs with fewer unique specifications may have difficulty finding work and face risk of cold-stacking. The very few rigs I view at greatest risk are all lower tier assets whereby the driller is arguably better off buying back shares at current valuations with cash flows they’d otherwise use to warm stack and maintain the rig with SPS.

Given modest warm supply availability, it’s more difficult making a case for higher drillship dayrates in 1H25 than it is lower. However this has previously been communicated as a lull in the market with project commencements pushed back until late 2025-2026. We recently saw healthy dayrates in the $400k’s on various drillship fixture announcements in mid-December. The trend toward increasing contract term is viewed positively as it relates to the longer-term trend toward higher dayrates from demand derived from new deepwater projects.

Contract Coverage in 2025-2026

All drillers brag about their assets and fleet quality. Rightfully so because all of them have good assets to varying degrees. However, differences in execution exist via each rig’s contracted cash flows.

The data points on the chart below plot the (y) average dayrate and (x) utilization on a 12 month average basis exclusively on contracts from January 2025 to December 2026. This depicts the strength of each driller’s forward contract book. Analyst adjustments were made as it relates to options, whereby only below market dayrate options were exercised.

The chart above includes only the warm fleet, excluding coldstacked rigs. The cost to warm stack is meaningfully higher than cold so it has a greater impact on 2025-2026 financial performance.

Transocean’s book of contracted cash flows through 2026 is industry leading by utilization and dayrates. It’s primarily due to their 7G+ drillships in US GoM and their harsh environment Semisubs (Norway eligible) having differentiated specs and capabilities for the most stable rig markets in the world.

While Transocean has a strong contract book, these cash flows will mostly go toward debt reduction until the driller reduces leverage enough to better enable shareholder returns. Transocean’s fleet and contract quality are further evidence concerns regarding its credit quality have been exaggerated, in my opinion.

Noble, Valaris and Seadrill all have shareholder rewards programs. While Noble has contracted at high dayrates for the next two years, its fleet utilization is lower primarily due to its 6G fleet. Valaris and Seadrill still have some legacy dayrates on 7G’s which are pulling its average forward dayrates lower. If Valaris and Seadrill price their 7G’s appropriately in future opportunities, they can gradually improve their realized dayrates and margins for even greater free cash flow growth for share repurchases.

Long-Term Rig Demand

There are at least 15 regions of the world with deepwater FID potential to support long-term rig demand. All have widely varying degrees of potential, risks and timelines. The Orange Basin in Namibia screens as potentially most impactful on rig demand after various discoveries in 2022-2024. TotalEnergies (Venus) and Galp Energia (Mopane) appear closest to potential project sanctions. Shell has also made various discoveries with others such as Chevron and Rhino/Azule recently embarking on their first exploration wells.

Namibia is not likely to produce its first barrel until 2029, although has potential to replicate and perhaps eclipse the success Guyana’s Stabroek Block. While early, little-known but respected Portuguese energy company Galp Energia’s PEL 83 block appears to have the most potential after its Mopane discoveries, along with other prospects in the block. I believe this because neighboring IOC’s in adjacent blocks have moved their exploration activity closer toward Mopane after Galp’s discovery in 1H24.

Watch Items: TotalEnergies has hinted toward potential Venus FID, which would be the first deepwater project sanction in Namibia. Galp Energia has an 80% interest in the >10B boe in-place estimate of Mopane discovery. It will need a partner to develop Mopane. Petrobras is a logical partner although other suitors are rumored to exist.

Geopolitics: I see demand emerging from various other regions but a real wild card on geopolitically-sensitive multiyear term demand for multiple rigs is Mozambique. Big LNG projects off coast of Cabo Delgado. Mozambique has not been smooth post election, particularly >2,000 km to the south in the capital of Maputo. I don’t think the drillship market needs Mozambique for growth but if the TotalEnergies and Exxon LNG projects go ahead this will be a call on multiple drillships.

About time this happened!! Thanks Tommy!!!

This is excellent work, Tommy. The dot chart really does show differentiated fleet and management for $RIG. Hopefully that argument has been put to bed - though obviously it has the leverage issues the others don't have. The softer market really seems to have made value of $RIG's efforts to high grade its fleet more visible.