TotalEnergies’ Venus 1-X discovery in Namibia announced in February 2022 kicked off a major deepwater exploration campaign not only by TotalEnergies, but attracted four additional operators drilling their own wells with more likely to come. Shell’s Graff-1X and Jonker-1X were also headline discoveries in late 2022/early 2023 and were followed by Galp’s Mopane discovery in early 2024. Chevron and Rhino/Azule have recently kicked off their own separate exploration wells in their respective blocks with two others likely to drill in 2025-2026. Successful deepwater exploration and appraisal has occurred in other regions of the world recently, although Namibia appears to have the greatest long-term potential.

This week Reuters reported Shell determined its discoveries in Namibia were not currently commercial. Shell came out the following day to note opportunities remain in Namibia but any potential project sanctioning appears less than likely and multiple years away, if ever.

I have spent much of 2024 researching deepwater E&P to model future drillship, semisub and OSV demand. My Base Case assumed Shell would not sanction its Namibia discoveries and accordingly have no rig demand tied to it this decade. Why? Shell had become quiet on Namibia in 2024 and in November noted the discoveries were “very challenging acreage” with low permeability. That’s not something a CEO typically says before a project is sanctioned. Shell’s announcement does not change much for me on the drillship and semisub demand outlook, but if TotalEnergies or Galp made a similar announcement it would be a different story.

TotalEnergies and Galp have made light oil discoveries that also have associated gas, although seems like less of an issue due to better geological characteristics. Galp’s recent Mopane-1A appraisal well confirmed “light oil with gas condensate in high quality reservoir-bearing sands once again indicating good porosities, high permeabilities and high pressures, as well as low oil viscosity characteristics with minimum CO2 and no hydrogen sulfide concentrations” on its primary target, AVO-1.

The Orange Basin is very large and stretches from Namibia to South Africa. Material exploration prospects remain well to the north (PEL 87) and south (South Africa) of the discoveries noted above.

Shell is a major international oil company also with attractive E&P prospects in USA. After selling its Permian assets to ConocoPhillips for $9.5B in 2021, Shell’s activities in USA are primarily deepwater in the US Gulf of Mexico. Shell utilizes some of the highest specification drillships in the world (mostly Transocean) with demonstrated success in US GoM.

The US Gulf of Mexico is a very different deepwater market than the Orange Basin in Namibia. The US GoM is mature and benefits from an existing infrastructure system with a lot of brownfield, subsea tieback capex potential. Namibia is very greenfield with an immature deepwater port (Walvis Bay) and no material domestic market for associated gas production. Potential free cash flow generation in Namibia is comparatively further out.

An impact of USA’s 2024 election results appears to be future Gulf of Mexico lease sales occurring as planned. Biden’s offshore drilling ban did not include the E&P relevant portions of the Gulf of Mexico where capex dollars flow. The outgoing administration was responsible for frustrating delays on the last lease sale (261). Shell is a big player in these US Gulf of Mexico lease sales and better visibility to lease sales occurring on time helps future planning.

Shell’s Option Value

A good CEO generates option value for its shareholders. Shell has a quality US Gulf of Mexico deepwater E&P business that includes production with lower cost subsea tieback potential, a numerous new projects along with its Whale project that produced its first barrel of oil this week. Separately, Shell sanctioned its Bonga North project in Nigeria in December 2024. Shell also significant shareholder returns programs exceeding $20B/year in 2022-2024.

Namibia is arguably the most exciting oil exploration market in the world currently, although there are many other countries across the globe at varying stages of exploration that also have potential.

Companies sometimes use the media strategically. Shell is not walking away from Namibia but has other options for its capital globally. This includes other prospects in the Orange Basin but in South Africa where they may drill 1-2 exploration wells in the next 12-18 months. There is also likely to be associated gas if discoveries are made in South Africa. If successful, longer-term Shell could potentially utilize option value in both countries for most attractive investment opportunities including how to handle associated gas.

Best “ZIP Code” in Namibia?

I initially became attracted to Galp because of comments I read from a former executive on earnings transcripts citing twice:

Galp 2Q22 Call (July 25, 2022): “We really like our ZIP code in Namibia. Good address, good location. The Galp team has been persistent in Namibia and have been there since 2014…next step for us to re-risk this further would be drilling a well. Our target is to drill an exploration well there during 2023 or 2024.” - Thore E. Kristiansen

Galp 4Q22 Call (February 13, 2023): “In my view, we may have the best ZIP code (in Namibia). We have around ~2,000 meter water depth, some of our colleagues in neighboring blocks operate at ~3,000 meters.” - Thore E. Kristiansen

In 2023, I was fortunate to have an opportunity to ask Filipe Silva (Galp’s former CEO) about their 80% interest in Namibia PEL 83 and its potential shortly after Galp contracted the Hercules semisub for Mopane-1X. I asked about the “ZIP code” comments and I quickly learned he was definitely not the person responsible for saying them. He did not care for these comments. In response, I was told about their previous failures in Namibia and how they “knew nothing” (at that time) about what eventually turned into the Mopane discoveries. Silva is conservative with his external communications, in my opinion.

Filipe Silva resigned as Galp’s CEO this week citing family reasons.

Silva was Galp’s CFO since 2012 before he became CEO in Jan 2023. Before that, he led Deutsche Bank’s investment banking business in Portugal. He’s not your typical E&P CEO, in my opinion. He’s an investment banker that understands capital returns — a financial type. I think he is very smart and a good businessman.

I often think of Galp as “Hess Jr.” due to Hess’ success in Guyana with Stabroek Block. Galp is much earlier stage in Namibia but some parallels exist. However, a big difference being cost. Stabroek Block began development in 2019 when offshore service costs were cheaper. John Hess was at the Goldman conference this week publicly bragging about his deepwater Guyana E&P assets and how Exxon is too conservative with its guidance. Silva was not the type of guy to do the same type of E&P marketing at Galp, in my opinion.

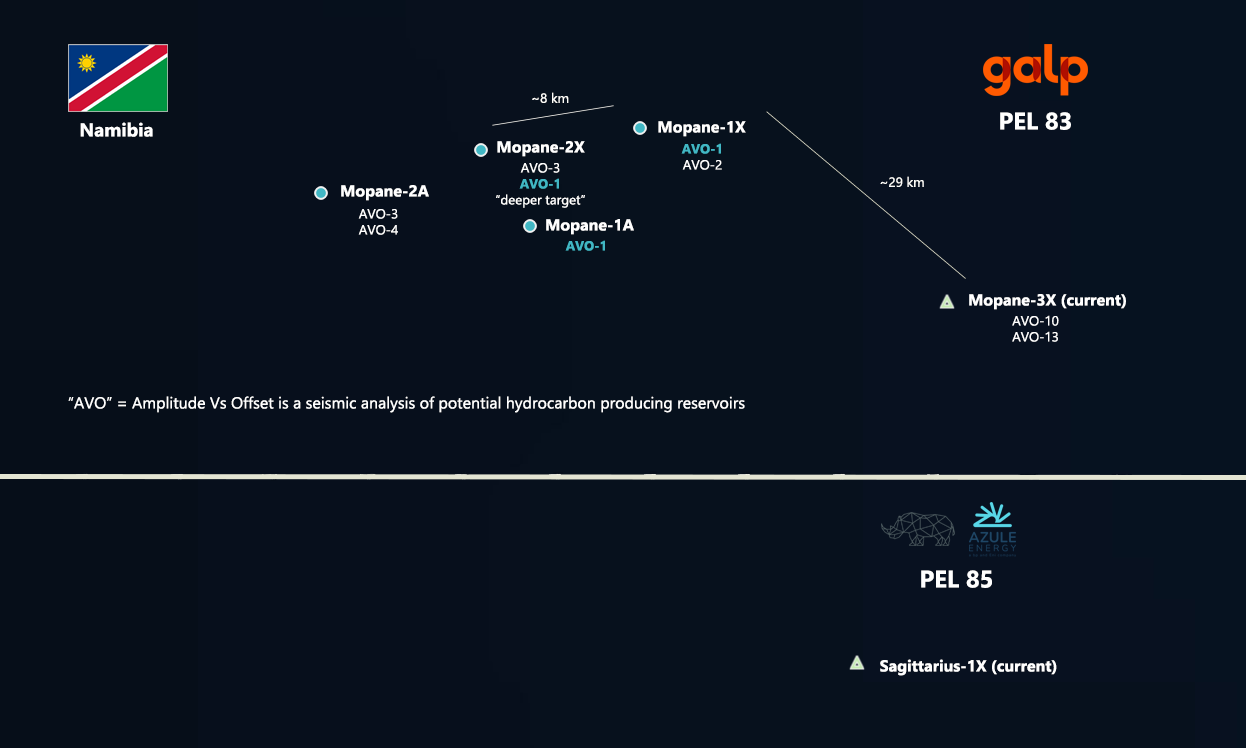

“AVO” = Amplitude vs Offset is a seismic analysis of potential hydrocarbon producing reservoirs

Galp’s Current Exploration Program in PEL 83

AVO-1 is light oil in high quality sands and has been confirmed with high permeability, good porosity and high pressures. We don’t know how thick AVO-1 is but its high quality and has been confirmed at Mopane-1X, Mopane-2X and Mopane-1A. AVO-2 and AVO-4 also appear to have light oil production potential but have only been found in one location thus far, and likely not as material as AVO-1.

The Mopane-2A results described AVO-3 as gas condensates, although high quality geological characteristics were also confirmed which has been consistent across the Mopane complex. While early, AVO-3 appears to be less of a priority to develop. We’re trying to find the oil window in Namibia for the earliest stage developments.

Mopane-3X would be a separate development if discoveries were found here. The targets are AVO-10 and AVO-13. These are not needed to justify a project but would potentially be a separate FPSO if a development were justified after further appraisal. A reminder that even Guyana’s Stabroek Block had early stage exploration misses (Skipjack-1X).

In April 2024, Galp communicated its upcoming (current) exploration and appraisal campaign of up to 4 wells would be designed to look at the reservoir extensions, and not necessarily target the “sweet spots”. Most wells thus far have targeted multiple AVO’s, including the current exploration well. Galp likely will have another well after Mopane to complete the 4 well campaign. Galp has also been shooting new 3D seismic with another exploration campaign appearing likely.

What to Watch

(1) Current exploration well results in Namibia including Chevron’s Kapana-1X, Rhino’s Sagittarius-1X as well as Galp’s Mopane-3X.

(2) TotalEnergies’ Tamboti-1X results should be provided by at least their upcoming earnings call on February 5, 2025. Total has already had success in Namibia with Venus and Mangetti, with Venus having potential to be the first FID in Namibia deepwater.

(3) Galp has an 80% interest in PEL 83. Galp is only a ~$3B EBITDA company with a modest balance sheet. It will need a larger partner to finance any potential development. Multiple suitors exist with Petrobras generating the most public interest. Galp is also going through a CEO transition while in this marketing phase.

(4) Galp has completed 2 appraisal wells and 2 exploration wells. They should eventually be able to provide guidance updates on resource size after original >10B boe in-place communicated in April 2024.

(5) TotalEnergies recently exercised an option to extend its use of Deepsea Mira and has a few Orange Basin prospects to the south, which also includes both Namibia and South Africa. Shell also has rumored interest in South Africa. I expect Galp to also potentially have another multi-well exploration program later in 2025.

To what extent does competition from batteries factor into these development decisions and affect demand forecasts? E.g. Gas peakers that help balance the power grid may face threat from grid scale batteries that can dispatch in milliseconds. Then on the transport side, EV growth may eventually hamper ICE sales. Or is there a sense that the uptake of clean tech is too small to materially affect development decisions?

How do you see Namibia’s deepwater exploration fitting into the bigger picture of how companies are allocating capital between greenfield and brownfield projects? With the challenges of limited infrastructure, no domestic gas market, and longer timelines for monetization, do you think Namibia can compete with more established basins like the Gulf of Mexico, where there’s existing infrastructure and quicker paybacks? Do you think what’s happening in Namibia signals a broader shift in how companies and governments think about developing frontier basins, especially given the technical challenges of appraisal and development, the financial risks of long lead times, and the uncertainty around building infrastructure in regions with limited existing capacity?

Cheers!