Mid-Year 2025 Outlook

EBITDA Momentum, Operating Leverage, Mozambique and NCS Exploration

We’re finally through the first half of 2025. Thank God.

For those focused on the next 12 months, it’s starting to look better as we crawl toward increasingly visible mid-2026/2027 project commencements although we’re still not all the way there yet.

Equity markets are forward-looking. After concerns began emerging regarding deepwater project delays on 2Q24 driller conference calls, equity markets began to sell driller equities as they foresaw rig idle time in much of 2025 as multi-year projects were pushed into 2026. Then projects then began to leak into 2H26-2027, although commentary has been fairly consistent in recent months regarding multi-year drilling commencements still on track for 2H26-2027. While Noble and Valaris have been awarded some of these term contracts in the US Gulf, Suriname and West Africa, there are additional projects yet to be awarded in other regions of the world into 2027.

Drillships and semisubs have meaningful operating leverage from warm stacking costs that lead to negative rig-level EBITDA when idle. Warm stacking costs vary but I generally estimate as $50-$60k per day. Given project delays and related rig idle time for 2025, equity markets have been focused on the forward-looking negative earnings drag from idle time before multi-year project commencements begin in 2H26-2027. While 2025 is a year of negative operating leverage on EBITDA for most offshore drillers with idle time, transitioning idle rigs from warm stacking costs to positive cash flows while working at >$400k day is a meaningful boost to profitability. Note: Meaningful differences in specs exist among deepwater rigs — not all idle rigs will return to work.

Given offshore drilling’s long-cycle nature, earnings trajectories are often visible from 12-24 months away. The Aggregate Quarterly EBITDA chart below (NE+RIG+VAL+SDRL) reflects the anticipated EBITDA declines from 2025 into 1H2026, primarily due to rig idle time equity investors began to foresee in 2024. Earnings momentum investors focused on the next 12 months (full year) have likely appropriately viewed 2025 as a poor year by mid-2024, although visibility is improving for a 2H26-2027 recovery as of mid-2025.

Oilfield service stocks remain sensitive to oil price sentiment. In 2023, Brent above $80/bbl and OPEC+ market support drove positive investor sentiment. Since then, concerns have shifted to OPEC+ spare capacity, viewed as bearish for crude prices. As of mid-2025, OPEC+ is raising output by over 1 million bpd, with Brent holding in the mid-$60s—subdued, but better than feared. Importantly, spare capacity concerns are easing. While oil prices have been volatile in June, this is mostly in the spot market. Offshore drilling is more influenced by longer-dated futures, which remain relatively stable. Geopolitical developments have had little lasting impact on deepwater floater demand. Easing regional tensions may actually support rig demand in the Eastern Mediterranean, where Chevron is evaluating a potential expansion of its Leviathan deepwater gas project.

While oil prices have declined in the recent year, most deepwater projects are generally now lower cost compared to other sources and appear to be gaining share of IOC capex wallet. I expect this to continue for the next decade as US Shale matures. We have not seen deepwater project cancellations. We recently saw Suriname’s GranMorgu project eat up two deepwater rigs on multi-year contracts — there are more to come as deepwater has an impressive list of yet-to-be sanctioned FID’s with strong economics.

Light at the End of the Tunnel? As currently expected, if we continue to see multi-year project commencements in mid-2026 through 2027, the drag from negative operating leverage in 2025-early 2026 should abate and turn positive for 2H26-2027, as currently projected by consensus analyst estimates.

I believe the analysts are mostly accurate with their projections and we begin to see increased deepwater floater utilization into late 2026-2027…and beyond. Factors impacting the idle time in 2025 include delays in the FPSO supply chain, as well as other essential subsea equipment. FPSO’s (Floating Production, Storage and Offloading unit) are expensive, long-lead time infrastructure that are essential for development drilling campaigns. 7G drillships are mostly designed for development drilling and you cannot produce oil without FPSO’s and related infrastructure, so they have sat idle waiting for delivery. Reasons for FPSO delays are various and include financing availability, shipyard slot availability, equipment shipping delays and other factors. Further, the global offshore drilling supply chain was adversely impacted due to cost cuts in the painful downturn from 2015-2022 and ramping it back up has hit more than a few road bumps.

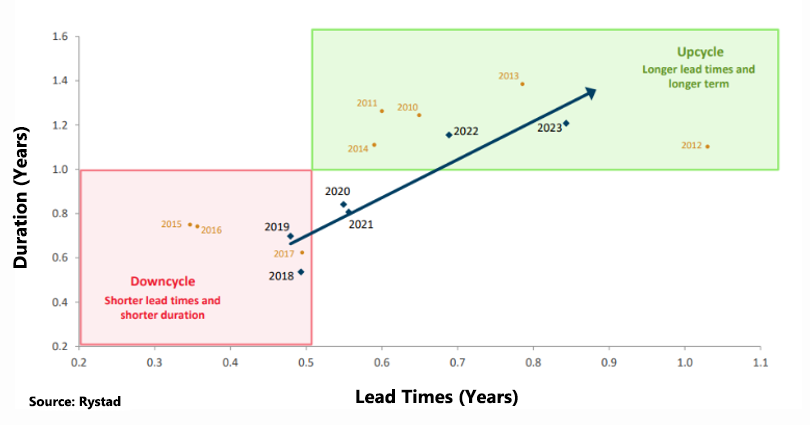

Longer-term contracts are a leading indicator of rising dayrates, as they reduce available supply of marketed high-spec floaters. While regional factors matter, continued multi-year awards should support future dayrate appreciation. Noble’s awards announced in April 2025 included four (4) separate floater contracts in the US Gulf and Suriname between 2.9 and 4 years each. Valaris also announced two separate 7G drillship contracts ranging from 11 months (w/ options) to 2 years in West Africa. While we will see some short-term contracts also announced in 2025, we should also expect to see more multi-year contract awards on larger projects which would be positive for market structure. Stay tuned.

An investor survey published in May 2025 by a well-respected Nordic capital markets and brokerage firm stated investors expected 7G drillship dayrates to be in the $250k-$350k range, with not a single vote for $400k and above! Considering all six (6) of the 7G drillship contracts inked in recent Noble and Valaris awards were comfortably above $400k, this was an example of excessive pessimism on the deepwater rig market.

Important to note these dayrates are for work commencing in mid-2026/early 2027. While rigs are idle in 2025, we are likely to see a couple contracts at weaker dayrates to keep rigs warm during in 2025, although are ultimately less relevant to market valuations given their shorter-term nature. Additionally, lower specification rigs facing risk of cold stacking (not 7G drillships) are likely to accept work at weaker dayrates in hope of finding more lucrative work on the following contract. Specifications are material to marketability on deepwater floaters and differences amongst them are material.

As noted in the chart below, consensus analyst estimate trailing twelve month (TTM) EBITDA levels expect to see anticipated declines in the next year, with an expected recovery if/when multi-year project commencements begin in 2H26/2027. Transocean (RIG) is the exception primarily due to their strong contract book supporting their EBITDA growth, primarily due to the Barents, Invictus, Conqueror and Atlas contracts at strong dayrates near ~$500k in the next 12-18 months (discussed in RIG Credit: Dayrate Duration, April 30th). I do not believe Transocean gets much credit from the equity market for its contract book, although some debt investors view it as a meaningful source of deleveraging. Transocean’s unsecured debt would trade at meaningfully worse levels if it had the same contract book as Noble, Valaris and Seadrill which sees meaningful idle time in 2025-early 2026. Good job by the Transocean contracting team.

Country to Watch: Mozambique.

In “Outlook 2025: Drillships” posted in December 2024, I noted Mozambique as a geopolitical wildcard that could be the source meaningful incremental drillship demand for multi-year work. Unlike some other countries where deepwater exploration and appraisal results are the primary driver of project sanctioning, Mozambique has already had major deepwater gas discoveries, it’s just a question of geopolitics if these projects are developed after TotalEnergies declared force majeure in 2021 due to a deadly insurgency.

Mozambique represents a significant wild card for global drillship demand growth beginning as soon as 2027-2028. If TotalEnergies’ Mozambique LNG and ExxonMobil’s Rovuma LNG projects are sanctioned, they could require multiple drillships on multiyear contracts, tightening a market with demand pull from other major deepwater projects around this time period. The resource base is large, with both development and possible concurrent exploration drilling needs, but timing remains uncertain due to persistent—albeit improving—security challenges in the Cabo Delgado region. The most immediate activity could stem from Eni’s Coral North FLNG project, potentially reaching FID in 2025, though it would demand only a single rig for a shorter term.

While Mozambique currently has no active offshore rigs, its long-term potential is notable—particularly if LNG projects proceed as planned. At peak activity, the country could account for meaningful portion of global 7G drillship demand. Recent affirmations of export credit agency financing, including from the U.S. Ex-Im Bank in March 2025, mark positive steps toward potential project sanctioning. If developed, these projects could contribute to tightening the global rig market and offer economic benefits to Mozambique. However, timelines remain uncertain and progress will depend on both security conditions and financial commitments aligning in the years ahead. TotalEnergies LNG project could be as large as $20B so this will be an important potential FID to watch in the next 12 months.

Semisubs in Norway

Transocean’s projected EBITDA growth has been supported by its seven-rig (7) harsh-environment semisub fleet, four (4) of which are active in Norway—a high-barrier to entry market inaccessible to the semisubs of Noble and Valaris, among others. While markets such as West Africa have been slower to develop, the Norwegian Continental Shelf (NCS) has remained resilient due to persistent capex from Norwegian E&P’s and others supported by strong in-place infrastructure, particularly in the North Sea, as well as supplying the European gas market.

Odfjell Drilling is a NCS semisubmersible pure-play and is the least speculative offshore contract driller given it’s positive near-term visibility to free cash flow growth in the next 24 months.

Odfjell’s free cash flow is expected to grow meaningfully through 2026, driven by (1) rising contracted EBITDA, (2) lower capex following completion of its 5-year SPS program, and (3) potential debt amortization relief if liability terms improve—which appears likely. While the market questions visibility into 2027, Equinor, Aker BP, and Vår Energi’s recent capital markets guidance suggests strong NCS E&P capex through decade-end. Norway’s tax regime further supports drilling activity by incentivizing capex even in weaker oil price environments. Given the quality of Odfjell’s UDW harsh-environment semisub fleet, its rigs are likely to be prioritized over competing units in Norway.

NCS Exploration: Aker BP’s highly anticipated Rondeslottet well, regarded as one of Norway’s highest-impact exploration prospects of 2025 with estimated in-place resources of ~800mmboe, delivered disappointing results last week and was deemed non-commercial. The well is among of a group of tight reservoir prospects in the NCS that likely require available technologies to overcome low-permeability challenges. The Norwegian Offshore Directorate views tight reservoirs as a source of long-term potential.

The volume of exploration wells on the NCS is ~20% higher than the 5-year average, although the success rate thus far in 2025 of 24% (YTD) is below the average of 48% since 2017. Given public commentary from NCS E&P’s, exploration activity is expected to remain elevated through the end of the decade. While exploration success is likely to gravitate higher toward long-term averages, the mature NCS may be experiencing increasing drilling intensity requiring more exploration and development drilling to maintain production levels particularly if producing more from more challenging reservoirs.

Rondeslottet was a high-risk, high-potential exploration well that would have been multiple years from FID if successful. The well’s failure has limited impact on the positive outlook through 2027+ on the NCS semisub market, although would have placed upward pressure on dayrates toward the end of the decade. Equinor, Aker BP, and Vår Energi plan elevated exploration activity in the coming years, supporting a pipeline of high-impact prospects, some of which likely involve tight reservoirs.

While the number of NCS discoveries remains encouraging, most have been smaller and only economic due to tiebacks—an area where Norwegian E&P excels. The NCS has recently lacked high-impact finds capable of supporting standalone developments, such as what Rondeslottet aimed to offer. Equinor’s Wisting project in the Barents Sea is the next major yet to be sanctioned project, although it is not likely to provide as strong of economic returns as Equinor’s Johan Castberg project also in the Barents Sea. Wisting does not appear to be a near-term project sanction in 2025 but is a source of potential future demand longer term.

Most of Norway’s E&P capex is directed to brownfield, infrastructure-led projects with high IRR’s and lower cash breakevens. On July 1, 2025, Equinor announced the $1.3B project sanction of Johan Sverdrup Phase 3 in the North Sea, a successful oil project with lower cost expansion capex leveraging existing infrastructure. The drilling contract associated is expected to be awarded later in 2025. Infrastructure-led expansion provides consistent demand with economic returns for the E&P, which have underpinned the recent strength of the Norwegian Continental Shelf.

OSV’s: I recommend reading Misadventures in Shipping for OSV coverage because Ed covers this opaque market very well, as well as other markets. My one take is OSV’s are demanded for many things, notably including PSV’s for multiyear development drilling campaigns. Drilling rigs and FPSO’s need supplies and it will be good for the PSV market as they transport essential supplies from shore when these projects commence beginning 2H26-2027.

Thanks Tommy. I always enjoy your pieces, learn a lot and appreciate your work. Cheers John

Somehow this got lost in my mailbox.