Drillship Cannibalism

Alternative uses for coldstacked drillships

In early February, Noble announced it was retiring the Meltem (7G) and Scirocco (6G) drillships. One possible outcome from this action is cannibalizing them for parts. An additional benefit is rationalizing 7G supply, as Las Palmas is becoming crowded. Before 7G dayrates can hit the prior cycle’s peak of >$600k, the industry needs to clear the majority of sidelined capacity. This was slow to progress in 2024 but retiring Meltem is a positive step in this direction as it accounted for 8-10% of sidelined 7G capacity.

The valuation difference between a warm and cold drillship is substantial given cold reactivation costs of $125-$200mm and operator preference for warm rigs with track records (Meltem never drilled). Meltem’s value to Noble was mostly long-term option value, although cannibalizing her for parts has benefits. Large drillers like Noble can make use of Meltem’s parts and inventory, which has modest cost savings estimated between $15-$50mm but can also be leveraged to minimize warm fleet downtime by recertifying spare parts. Cannibalizing Meltem may also have benefits for the warm fleet’s 10 and 15 year special periodic surveys.

Noble’s 7G drillships Stanley Lafosse (fka Sharav) and Faye Kozack (fka Khamsin) share similar equipment and design with Meltem, as do four (4) other drillships with a similar design. Noble’s Scirocco is also similar to 6G drillship, Gerry de Souza (fka Santa Ana).

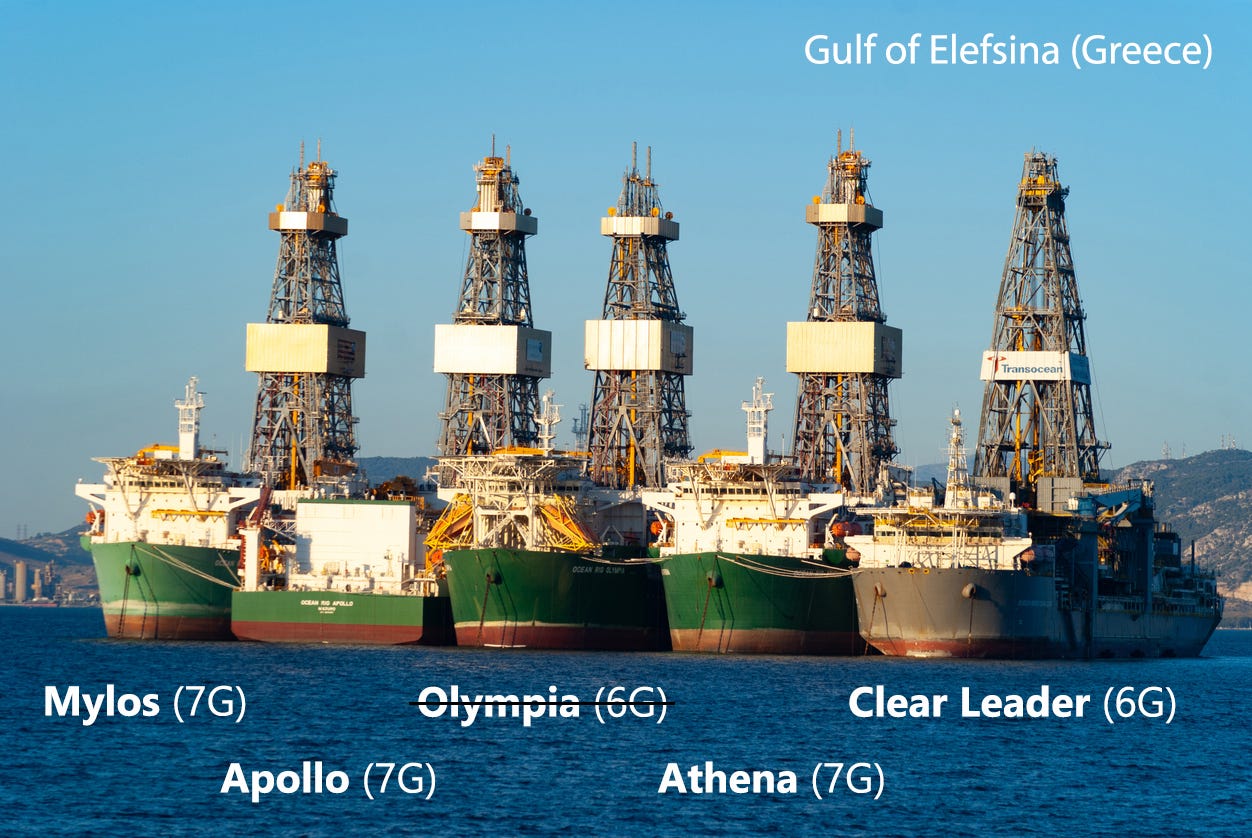

While Noble had one cold stacked 7G drillship, Transocean has three cold 7G’s in Greece today from its acquisition of Ocean Rig and its ~8 drillships in 2018. Today, four of these are operating in Brazil and Angola with three coldstacked 7G drillships in Greece since 2016-2017.

After inheriting a distressed loan portfolio of oilfield services borrowers 2015, I have taken a keen interest in following the former Ocean Rig drillships over the last decade. While Seadrill Partners and Pacific Drilling also had 1st lien loans in the broadly syndicated loan market at the time, the majority of my time was spent on the two Ocean Rig secured loans noted below.

Ocean Rig filed for Chapter 11 bankruptcy in 2017 and Transocean acquired the assets in 2018. Four of these drillships have worked in Brazil and Angola and three of the 7G drillships acquired have remained coldstacked into early 2025. These cold 7G drillships are Mylos, Athena and Apollo (collateral on a separate loan).

In 2016, I assumed these drillships could potentially reactivated by 2021-2022 with dayrates around $400k. In 2023, momentum was building toward reactivation however this began to die down in 2024 due to slower to materialize demand in West Africa and elevated reactivation costs. Full reactivation costs of a coldstacked drillship may be $125-$200mm when including important upgrades such as MPD ($30mm). IOC operators are unlikely to fund this out of their own pocket without taking a significant equity stake in the ship. Reactivation possibilities have gradually reduced, particularly as these drillships approach 10 years of ide time.

A meaningful difference also emerged in recent years. Compared to the environment when many 7G drillship orders were made in 2013-2014, major oil companies have reduced capital expenditures in favor of shareholder returns. Accordingly, the deepwater fleet was heavily rationalized in 2016-2020, although may have a few more to go given IOC/NOC shareholder return preferences.

Noble’s decision to retire Meltem is a signal that other coldstacked drillships may have more value to warm fleets through cannibalization and removing them from the drilling fleet (retiring supply). Cannibalizing cold stacked 7G drillships for spare parts and inventory for the warm fleet’s use can save money. Value can be realized by recycling parts and through more efficient recertification processes to limit downtime. Many of these drillships produce ~$250k/day in free cash flow so reducing downtime matters.

IOC’s have not been expanding their balance sheets to accommodate growth capex. While most of them have positive outlooks on future deepwater FID’s with growing capex allocations to deepwater, further fleet rationalization on higher cost, coldstacked 7G’s would be beneficial to the drillship market long-term.

Potential remains for Transocean reactivating at least one of its coldstacked 7G’s, however there’s 4-5 drillships that would be activated before Mylos, Athena or Apollo which is years away. Reactivating any of these cold drillships also introduces more supply to a market placing pressure on dayrates. Retiring the cold 7G fleet constrains future supply and benefits long-term dayrates and utilization.

While a Transocean/Seadrill merger is only a RUMOR, Transocean’s cold 7G drillship fleet arguably has unique value to Seadrill. Mylos, Athena and Apollo have the same Samsung 12000 design as Seadrill’s seven 7G drillships along with having very similar NOV equipment. As Seadrill’s fleet approaches various 10 and 15 year SPS’s, cannibalizing Transocean’s cold 7G’s could reduce capex, reduce downtime and extend the lives of the Seadrill 7G drillships. Transocean’s fleet has limited matches beyond Skyros.

While cannibalizing at least a portion of Transocean’s cold 7G fleet does not provide the attractive, direct returns as reactivation, the potential benefits to Seadrill’s fleet may help facilitate a merger that would bring (i) $75-$100mm of annual synergies, (ii) accelerate Transocean’s deleveraging and potential shareholder returns and (iii) improve LT cash flows of Seadrill’s 7G fleet.

Why would Seadrill shareholders accept a merger proposal from Transocean? The benefits of scale and fleet diversification are good places to start, although Transocean has three separate classes of deepwater floating rigs that have earned >$500k dayrate awards in 2024 of which Seadrill has no comparable assets. The 8G drillships capable of the 20k psi completions in the US GoM are very unique, high specification assets that have been awarded >$600k dayrates. Transocean’s 7G+ drillships and Norway eligible harsh environment semisubs all have strong utilization rates.

While Seadrill does not have any warm comparable assets to the Transocean floaters noted above (after cold stacking West Phoenix), Valaris and Noble do not have any 8G, 7G+ or Norway eligible harsh environment semisubmersible rigs either. Transocean also does not have much standard 7G drillship (1,250 st hookload capacity) presence in Brazil and West Africa, which Seadrill’s existing warm fleet would provide in any potential merger.

I honestly think it wouldn't be a bad move. Like you said it removes some long-term upside if demand strongly increases but the near-term cost benefits and constraining of supply is probably better. If dayrates continue to climb there will be plenty of shareholder returns anyways.

Does it make any sense to convert drillships into something else after cannibalization in order to avoid scraping? Or their hulls and superstructures are too specific for such conversion?