As the 4Q24 earnings season approached, equity markets focused on offshore drillers' project commencement outlook for 2025 and 2026, with an emphasis on 2025. Noble summarized the near-term macro environment, noting a “mid-cycle lull” starting in 2H24 and continuing into 2025, reflecting global upstream capital discipline in a well-supplied oil market. This discipline contributes to the weak project commencement outlook for 2025.

Equity markets are wary of idle drilling rigs, seeing excess downtime in 2025 models. In contrast, credit markets remain stable, with deepwater drillers’ high-yield debt well bid due to a longer-term investor outlook. However, oilfield service equities, driven by earnings momentum, face consensus expectations of a soft 2025 for rigs rolling off contract.

While consensus seems to exist on a soft 2025, debate exists on how 2026/2027 is shaping up for demand. Outlooks for 2026 and beyond vary meaningfully by market across the globe.

US Gulf of Mexico: New project commencements will be very light in 2025, so drillships rolling off contract in 2025 face a high probability of idle time. However, this is an infrastructure-led capex market with good visibility into 2026 so this should not be persistent idle time unless a lower tier rig (i.e. Noble’s Globetrotter rigs).

Norway: This midwater/deepwater semisub market is doing just fine with very stable E&P demand from infrastructure led capex through the end of the decade. Equinor, Var Energi and Aker BP made this very clear a month ago. Odfjell has a great UDW HE Semisub niche in Norway.

West Africa: This is the market where demand has been slow to materialize. Nigeria has an inventory of multiple IOC projects with term in coming years, including Shell’s recently sanctioned Bonga SW. Exxon, Chevron and TotalEnergies also have projects with multiyear term potential. However, timing is uncertain on these projects. Côte d’Ivoire is country to watch with two projects likely in late 2025-2026 (Murphy, VAALCO/CNRL) along with long term potential with Eni’s Baleine (Phase 3 likely FID in 2025) and Calao (more prospective).

West Africa remains a wildcard, but subsea leader TechnipFMC stated this week it expects stronger-than-anticipated offshore demand in this region. This will be key for 7G drillship demand.

Geopolitics Matter in Offshore: In oilfield services, U.S. shale relies on short-cycle, price-sensitive capex, while deepwater operates on long-cycle capex with more influence from geopolitics due to its global nature.

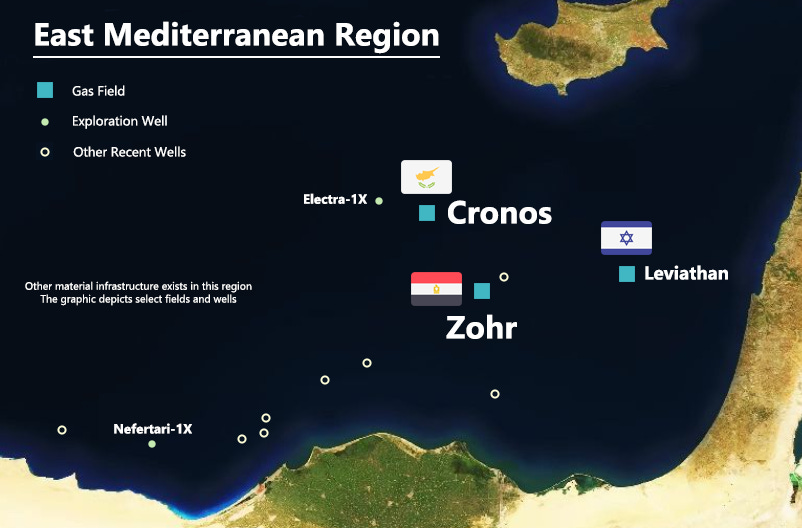

East Mediterranean coming back to life? This was a growth area for deepwater gas production but slowed down as war broke out in the region in late 2023. Importantly, this region has existing infrastructure to leverage with recent discoveries Deepwater drilling activity has increased in Egypt and Cyprus in 2H24 with five rigs working recently in the East Mediterranean region. Chevron’s Leviathan gas project in Israel has expansion prospects in a few years. Libya also has off potential as well. After a quiet first 2-3 quarters in 2024, the East Med region could be some demand to keep rigs in this region with term.

Indonesia’s Kutei Basin took a step forward this week as Eni and Petronas announced MOU for a partnership on developing recent gas discoveries (Geng North). Infrastructure led investment with meaningful exploration upside with apparent government support. There’s also been other discoveries in Indonesia’s Andaman Sea which would be more greenfield developments with longer time horizons but were impressive recent gas discoveries.

India: Activity has increased in recent quarters, as India seeks energy security from offshore sources to support its economy’s needs. ONGC, Reliance and Oil India have likely rig demand in this emerging region. After formally announcing E&P capex growth plans, BP may also have potential in the country.

Mozambique: The Cabo Delgado region has substantial deepwater LNG potential although instability in the region has slowed this development. The region has stabilized thanks to support from the Rwandan army. As geopolitical risks reduce in the region, FID potential increases after cautiously optimistic references on recent conference calls.

Colombia: The recent Sirius gas discovery highlights growing offshore potential, with Petrobras as a partner. Colombia's domestic production has declined due to unfavorable political conditions since 2022, although prospects appear likely to improve in the 2026 election. This is potentially late 2027-2028 demand.

Eni stated at its Capital Markets Day on Thursday the development of Cronos in Cyprus’ Block 6 will tie into Zohr’s existing infrastructure, which has additional capacity, enabling a fast-tracked, capital-efficient solution. An agreement between Cyprus and Egypt facilitates this development, initially addressing Egypt’s critical gas shortages while also supporting potential export opportunities to the European LNG market longer term. Egypt faced severe gas shortages in 2024 due to declining domestic production, leading to energy blackouts and reliance on costly LNG imports. Production at the Zohr gas field, which began in 2018, declined due to deferred reinvestment caused by delayed payments to IOCs. However, financial support from the IMF, EU, World Bank, and UAE in 2024 helped Egypt resume payments, revitalizing investment in gas production.

Cronos was a pleasant surprise of an announcement at Eni’s Capital Markets Day this week. In February 2024, the Cronos-2 appraisal well confirmed the lateral extension of the Cronos-1 discovery in August 2022. This has a net reservoir thickness of 115 meters and the production test “confirmed an excellent gas deliverability of the well.” Two additional discoveries, Calypso-1 (2018) and Zeus-1 (2022) were made on the same block. Cyprus is a high potential deepwater gas market and its access to Zohr infrastructure in Egypt helps accelerate its development.

Greenfield Demand for 2028 and Beyond: TotalEnergies’ Venus project in Namibia is a potential FID in 2026, but is not the only greenfield project in the country. Galp’s Mopane exploration and appraisal program is arguably the most exciting of its kind in the world. In 2022-2023, a former Galp executive described PEL 83 as “the best zip code” in offshore Namibia. After the first five wells, it has delivered.

Galp announced very good Mopane-3X results this week and a few days later announced a share buyback program. In April 2024, Galp announced 10B boe in-place estimate after its initial Mopane-1X and Mopane-2X wells. Distinct from other offshore discoveries in Namibia, Galp has consistently communicated the discoveries demonstrating high pressure, good porosity, good-to-high permeability. Permeability was a challenge with Shell’s write-down in 2H24.

Mopane-1A confirmed the extension and reservoir quality of AVO-1. This increased FID probability to high.

Mopane-2A tested primarily AVO-3 which was described as high quality reservoir characteristics but as “gas condensate”. We are trying to find the oil window so while this gave good info, not likely an early FID.

Mopane-3X tested a separate development area 18 km to the southeast. It tested two separate targets that yielded positive results. AVO-10 is significant column of light oil and gas condensate. AVO-13 is light oil but apparently smaller. The reservoir log measures confirm “good porosities, high pressures and high permeabilities”. This has good potential for being a second FPSO development although requires appraisal.

Galp seems to have focused its early exploration wells on targets with multiple AVO’s. It has not yet provided reservoir thickness in its public disclosures. Eni disclosed at its Capital Markets Day that Rhino’s Sagittarius-1X well was 90 meter gross thickness, a strong measure. Given its proximity to Galp’s block, it’s a potential read into Mopane but given the strong reservoir characteristics they don’t need to be as thick as 90 meters to justify development. Galp is focusing on testing extensions rather than targeting sweet spots, aiming to hit two AVOs per well to maximize seismic insights while maintaining capital efficiency.

Namibia is often compared to Guyana on its greenfield potential. Namibia has yet to have its first FID announcement, although is tracking positively on that with TotalEnergies (Venus) and Galp (Mopane). With Mopane-3X results, Galp may have found its second FPSO project within 14 months of initial discovery which is ahead of ExxonMobil’s schedule which took 18 months with its Payara discovery in Guyana. More appraisal drilling will be required.

Namibia is a greenfield deepwater market with meaningful sustained development drilling potential for multiple rigs, although potential project commencements would likely not occur until 2028. If they occur, the could really swing the rig market positively with demand. Until then, the Orange Basin is likely an exploration and appraisal market with shorter-term fixtures although there’s a lot of prospects to drill including potential work in South Africa for 2026.

Thanks Tommy. Your analysis is always extremely helpful. The beat-down in the Offshore sector during this earnings season has been brutal. The waterfall nature of the charts looks like capitulation. I know that VAL was Kuppy's Fund's largest position in his latest Investor Letter and given that he is so vocal on SM, I suspect a lot of others followed him in and are potentially regretting that decision / puking positions here. The news of NE and VAL scrapping stacked rigs dims the ST outlook but, longer term, tightens the supplyside further. Cheers John

Great piece, really been enjoying your stuff. I have zero experience with traded debt. How do you keep up with that side of everything?

Have always heard the debt guys were (or had to be) smarter than equity folks, and your piece on off shore debt really added another lens to double check things from. Appreciate that and all your other work