Mozambique has “giant” potential in deepwater gas and LNG although is a wild card on rig demand from 2027-2032. The country could reasonably demand anywhere from 0% to 6% of global 7G drillship supply at high utilization in 2028 and beyond. If Mozambique’s LNG projects are sanctioned, they likely require multiple rigs on multiyear contracts for development drilling as well as potential concurrent exploration demand. This potential demand could meaningfully tighten the drillship market at a time when other large projects potentially commence although is still years away. The risk is primarily geopolitical in Mozambique (more on this later).

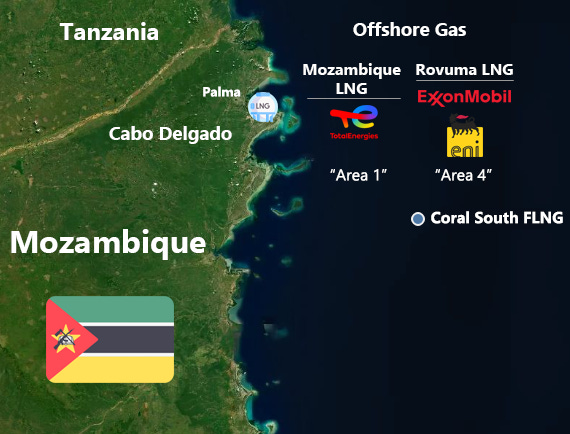

Anadarko’s Windjammer-1 offshore exploration well in 2010 was a play opening deepwater gas discovery in northern Mozambique’s Rovuma basin (Area 1). Eni also made various Rovuma discoveries to the east in “Area 4” from 2011-2014. The large scale LNG potential of these discoveries attracted major IOC’s. In 2017, ExxonMobil acquired a 25% interest in Area 4 (Rovuma LNG) from Eni for $2.8B in cash. In 2019, TotalEnergies acquired a 26.5% interest in Area 1 (Mozambique LNG) from Anadarko for $3.9B in cash. Both IOC’s communicated plans for 13-15 million tons per annum (“mtpa”) for each of their respective projects, with meaningful expansion potential beyond the initial phases.

As of March 2025, neither TotalEnergies (Area 1) nor ExxonMobil (Area 4) have yet to sanction either project primarily due to security issues in the area. Mozambique only produces 3.4 mtpa via Eni’s Coral South FLNG that produced its first LNG cargo in November 2022. Eni appears likely to FID Coral North FLNG later in 2025 which will produce an additional ~3.4 mtpa if sanctioned. The substantially larger land-based LNG projects would not produce its first LNG cargoes until 2029-2030 if sanctioned via current schedule.

IOC’s can benefit from globally diversified LNG businesses as they can react to changes in regional LNG supply and demand conditions. Mozambique is potentially an attractive LNG export hub as it is relatively well-placed to serve demand markets in Europe and Asia with comparable shipping distances. Additionally, the Rovuma basin’s gas composition is said to be “well adapted to liquefaction”. Both TotalEnergies and ExxonMobil have communicated potential development deepwater gas wells are expected to be highly productive. Gas produced by TotalEnergies and/or ExxonMobil would be piped to onshore liquefaction and export terminals, whereas Eni’s production will remain offshore via Floating LNG infrastructure.

Offshore Drilling Rig Market Impact

There’s currently no drillships, semisubs or jackups operating in Mozambique. The discoveries are deepwater and most likely to demand drillships although a semisub may also fit. Jackups are not likely relevant in Mozambique due to the water depth of the discoveries to date. The Saipem 12000 drillship was utilized by Eni on Coral South FLNG a few years ago. Eni’s Coral North FLNG is a potential FID in 2025 and would be the most near-term project commencement although would likely only be a single rig job with less than a two year term. The Mozambique LNG and Rovuma LNG projects are more significant sources of potential drillship demand.

TotalEnergies and ExxonMobil would likely demand 7G drillships for their efficient development drilling on multiyear contracts. While the development drilling is good work for drillships, the resource base is very rich and may limit the amount of development wells needed to be drilled although is still to be determined. As noted in the ExxonMobil presentation below (from 2019), they originally planned an exploration campaign in 2020 although was put on hold due to the global pandemic and the Cabo Delgado insurgency in 2021. As noted in both presentations below, the resource potential exceeds the first potential development phase so there may be potential concurrent exploration and appraisal demand. Development drilling may not commence until 2028 although potential exploration work could begin modestly sooner. Timing will remain sensitive to fragile conditions in the Cabo Delgado region.

Eni’s Coral North FLNG project is smaller in scale but closer to potential FID and commencement. It would be a carbon copy of its Coral South FLNG project that produced its first LNG in late 2022.

Geopolitical Risks in Cabo Delgado

Mozambique’s offshore gas discoveries are ~2,500 km north of the capital in Maputo. While the Cabo Delgado region in the north is resource-rich, this underdeveloped region has been exposed to a deadly insurgency since 2017 that has tragically killed thousands and displaced nearly one million people. The insurgency escalated in March 2021 when terrorists launched a large-scale attack on the coastal town of Palma, known for its proximity to the LNG construction site. Shortly afterward, TotalEnergies declared force majeure to suspend all activities on the project.

In July 2021, the Rwandan army was deployed the region and has played a critical role in stabilizing parts of the region, along with help from other nations. As of March 2025, security conditions in the region have improved and stabilized although remain fragile. Palma appears to be the primary beneficiary of the security protection due to the LNG projects, although other towns in the area are more fragile and a large amount of people remain displaced. There’s still a lot of human tragedy and poor living conditions in the Cabo Delgado region.

Export Credit Agency Financing

In March 2025, the US Ex-Im Bank affirmed its $4.7B financing package on the Mozambique LNG project after its original commitment made in 2019. This was an important step toward potential project sanctioning. Japan, South Korea, UK, Italy, Netherlands and Thailand are among countries with similar export credit agencies that originally committed to the project. The majority of these countries have allegedly affirmed their original commitments as well but there may be 1-2 that have not yet. TotalEnergies has communicated the Mozambique LNG FID is contingent upon export credit agency support which is why the US Ex-Im Bank affirmation was an important development.

While original offshore gas discoveries were made in 2010-2014, the benefits to Mozambique have been limited to date. The Mozambican government established a sovereign wealth fund in 2024 with a primary source of funding from Eni’s Coral South FLNG 3.4 mtpa project that began production in late-2022. The long cycle nature of both deepwater and LNG capital investment stipulates long-lead time positive cash flows. Mozambique and Rovuma LNG is are also true greenfield projects which require time. Eni’s potential Coral North FLNG project may begin production sooner, although the largest sources of production tax revenues for Mozambique would be beginning in 2029-2030 from onshore LNG export facilities (3-4x larger than Eni’s FLNG projects). An ideal long-term outcome would be materially improving living conditions living in the region funded via production taxes although remains to be determined.

Emerging/Frontier Market Credit

Mozambique’s (Caa2/CCC+) fiscal crisis stems from the Tuna Bonds scandal, where $2 billion in secret loans—partly embezzled—led to debt default, currency depreciation, and loss of investor confidence. The country remains heavily indebted, with much of its budget tied to debt repayment rather than development. Legal wins have helped recover some funds, but borrowing costs remain high, limiting economic growth. In December 2024, the country’s top court affirmed the victory of the ruling party (Frelimo) after its October elections. The capital city of Maputo experienced violent and deadly protests that lasted months after the election. As of March 2025, security conditions in Maputo have since improved although the protests are a reminder of the country’s lack of stability.

Mozambique’s sovereign bonds trade at levels that indicate distress. The 2031 maturity bonds have a 13.4% yield to maturity (March 2025) and demonstrate the high cost of funding. In addition to natural gas resources, Mozambique is also a meaningful miner of rubies. Due to the long-cycle nature of deepwater and LNG (and security challenges), Mozambique’s natural gas discoveries only produce over 3 million tons per annum of LNG export cargoes as of 2025. If the Mozambique LNG and Rovuma LNG projects are sanctioned, LNG production may increase by as much as 28 million tons per annum. While other factors will influence Mozambique’s sovereign debt valuations, improved security conditions and the sanctioning of these LNG projects in Cabo Delgado would be materially positive for the country’s economy.

In October 2024, TotalEnergies sanctioned the GranMorgu (Block 58) deepwater oil project in Suriname (Caa1/CCC+). Suriname’s 2051s are structured differently but rallied from the low-to-mid 80’s to above par points when confidence grew regarding the GranMorgu project sanction. As the result of a prior restructuring, the Suriname 2051s also include a value recovery instrument, or more of a direct claim on oil royalties so would be more sensitive to the project sanction than Mozambique’s sovereign bonds, all else equal.

Mozambique is an important follow for the deepwater rig, LNG and OSV markets. It’s potential impact is material although the range of potential outcomes are wide and include potential for further delays depending upon geopolitical developments. ExxonMobil has recently stated a potential FID on Rovuma LNG could be announced in 2026. TotalEnergies has noted sensitivity toward further export credit agency support and may have a similar timeline as Exxon regarding a potential project sanction.

Investing in the Deepwater sector is very similar to investing in the mining sector, a lot of research and a lot more waiting for results. Thanks for your research.

Difficult to understand why the UK and Netherlands would risk such political uncertainty operating off Mozambique while refusing to develop their own close to home nat gas resources, the ridiculous UK windfall profit tax and the Netherlands closing the Groningen fields are examples.